Choosing the right savings account is key to managing your money, especially if you want something fuss-free and flexible. The best accounts are easy to use, with no salary crediting, card spend, or other hoops to earn interest, and many Singapore banks now offer options that are quick to open, have minimal requirements, and allow easy withdrawals. Digital banks make it even easier to manage multiple savings pockets for different goals without lock-ins. Accounts like GXS and Mari are SDIC-insured, providing protection under the Singapore Deposit Insurance Corporation scheme, while Chocolate Finance is not insured since it is not a bank.

1. GXS Savings Account

Key Features:

- Interest Rates (daily credited):

- Main Account: 1.08% p.a.

- Saving Pockets: 1.18% p.a.

- Boost Pockets: ~1.30% p.a. (1.08% base + bonus at maturity)

- Flexible Account Structure:

- Main Account for daily use

- Up to 8 Saving Pockets for goals

- Boost Pockets for short-term deposits with bonus interest

- Deposits are limited only up to S$95,000

- No Fees / Minimums: No monthly fees, no minimum balance required

- Withdrawal Flexibility:

- Saving Pockets: withdraw anytime

- Boost Pockets: early withdrawal keeps base interest, forfeits bonus

Eligibility:

Age: 16 years old and above

Citizenship: Must have a residential address in Singapore, be a Singapore citizen, Singapore Permanent Resident or have a valid visa e.g. Dependant’s Pass (DP), Employment Pass (EP), Work Permit

How to Open a GXS Savings Account:

- Simply download the GXS Bank app from Apple Store or Google Play store

- Launch the app, and tap on GXS Savings Account ‘Sign up now’— there will be instructions on the process

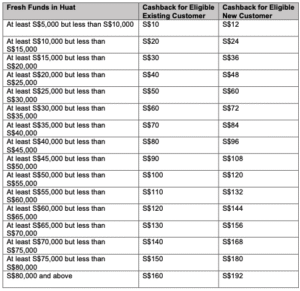

- Get up to S$192 cashback (Limited to first 1,000 customers). Plus, an additional S$8 cashback when you sign up using the code AUDR190.

- Following review and approval of your documentation, your GXS Savings Account will be activated and ready to use.

GXS Savings Account

Promo Code: AUDR190

Get up to 1.30% p.a on Boost Pockets

2. Maribank Savings Account

Key Features:

- Earn up to 0.88% p.a.

- Interest credited daily, based on previous day’s balance

- No minimum balance required to earn interest

- No minimum deposit

- No salary crediting

- No minimum spending

- Instant transfers via PayNow and FAST

- Overseas remittances available (fees and limits vary)

- NETS QR integration for in-store payments

Eligibility:

Age: 16 years old and above

Citizenship: Singaporean, Permanent Resident or foreigner with a valid pass

How to Open a Mari Savings Account

Download the MariBank app from the Apple App Store or Google Play Store

Key in the promo code: 2OJA50ZV

Register for a MariBank account with a valid Singapore mobile number.

Open a Mari Savings Account digitally with Singpass.

- Applications will be processed either immediately or over the course of one to two days. Depending on your selected communication method, they will inform you via email, SMS, and/or push notification on the MariBank app about the status of your application

Mari Savings Account

Promo code: 2OJA50ZV

Earn up to 0.88% p.a.

3. Chocolate Finance

Key Features:

- Earn 2% p.a. on first S$20,000 and 1.8% p.a. on your next S$30k (under Top-Up Programme)

- This means that when the portfolio underperforms, Chocolate tops up the difference to ensure you earn the current promotional rate.

- Valid until 30 June 2026 or until assets under management reach S$1.5 billion, whichever comes first

- Earn up to 1.8% p.a. on any amount above the first S$50K (not under Top-Up Programme)

- No lock-ins — free to withdraw your money anytime. Typically, it takes up to 3 business days to reach your bank account.

- No minimums — you can start with any amount.

- No complex criteria — no hoops or complex conditions to meet for returns.

- The only drawback is that Chocolate is NOT SDIC-insured because it’s not a bank; funds are invested via bonds and principal isn’t guaranteed. The returns are solid and it could still do well as a temporary holding place for a goal like travel fund.

- You can request a withdrawal anytime in the app by tapping “Withdraw”, entering the amount, and confirming — there are no minimum or maximum limits.

Eligibility:

Age: 18 years old and above

Citizenship: Residents of Singapore only — currently Chocolate Finance only accepts Singapore residents when opening an account

How to Open a Chocolate Finance Account:

Download the Chocolate Finance app from the App Store or Google Play via this link

Sign up and verify your identity using Singpass MyInfo

Once verified, add money to your account using bank FAST transfer, eGIRO or PayNow QR.

Chocolate Finance Account

Earn 2% p.a. on first S$20,000 and 1.8% p.a. on your next S$30k (under Top-Up Programme)