Effective March 10th, 2025, Instarem Amaze will implement key changes that reduce its benefits. Notably, a 1% fee will now be imposed on all SGD linked card transactions and Instapoints will no longer be convertible to cashback.

In case you are new to this, let us do a small recap:

Recap: What Is Amaze Card

Instead of managing multiple credit cards, the Instarem Amaze card simplifies your payments by acting as a single payment processor that allows you to convert your offline spends into online. It comes with an Amaze Wallet which serves as a digital wallet for cashless transactions, and it also comes with a Linked Card feature which allows you to link up to 5 Mastercard debit or credit cards.

Two Main Reasons Why We Use Amaze:

(1) Convert Offline to Online Transactions

We pair the Instarem Amaze Card with the Citi Rewards Card to convert local offline dining & retail into online transactions. This strategy allows us to maximise miles, as Citi Rewards grants 4 miles per dollar on online transactions but not on offline spending. By routing payments through Amaze, which processes transactions as online purchases, we can still get the same miles that Citi Rewards earn.

(2) Use on Overseas Spending for lowered foreign currency fees

Pairing the Instarem Amaze Card with miles or cashback credit cards converts offline overseas transactions into online ones, helping you earn the same credit card rewards while reducing costs.

There are two cards that are suitable for this:

- OCBC Rewards – overseas department store categories

- Maybank Family and Friends Card – your 5 chosen categories

Amaze lowers the usual 3.25% FCY fee to a 2% FX spread by converting overseas transactions into SGD and charges the bank in SGD.

All Changes At A Glance:

AMAZE WALLET | BEFORE MARCH 10 | AFTER MARCH 10 |

Benefits | • Overseas ATM Withdrawals • Exchange and hold 11 currencies: SGD, MYR, THB, USD, EUR, CHF, NZD, CAD, AUD, GBP, JPY • Wallet limit of S$3,000 per transaction, up to S$20,000 in a calendar year | • BUFF: Wallet limit of S$15,000 per transaction, up to S$75,000 in calendar year • NEW! Transfer balance from amaze wallet directly to bank account • NEW! Set spend limits by daily or per-transaction for security |

Rewards | Earn 0.5 Instapoints per dollar on overseas spend, capped at 500 Instapoints per month | BUFF: Earn 0.5 Instapoints per dollar on local or overseas spend, no cap |

Fees | • Fee-free on currency exchanges in wallet • 2% ATM withdrawal fee | • Fee-free on currency exchanges in wallet • 2% ATM withdrawal fee |

AMAZE LINKED CARD | BEFORE MARCH 10 | AFTER MARCH 10 |

Benefits | • Earn card reward points with Citi Rewards, Maybank F&F, OCBC Rewards (must use correctly) • Get lowered fx spread of 2+% instead of usual bank card’s FX markup of 3.25% to 3.75% | No changes |

Rewards | Earn 0.5 Instapoints per dollar on overseas spend, capped at 500 Instapoints per month | NERF: No Instapoints issued |

Fees | • 1% fee on SGD spends >S$1,000 (first S$1,000 free) • 1% fee on spends on MCC 6540 (eg. Grab topups, e-wallet topups) | NERF: 1% fee on all SGD spends |

Let’s Dive Deeper Into the Changes…

(1) 1% Fee on All SGD Transactions – Nerf

The most notable nerf is the introduction of a 1% fee on transactions made in Singapore Dollars when you are using Amaze Linked Card. Previously, this fee applied but was waived for the first S$1,000 in SGD transactions. Now, with the update, there is no longer a “first S$1,000 free”, and all SGD transactions are automatically subject to the 1% fee! Boo! This change will have a significant impact for those who have been using their Amaze Wallet with a credit card like Amaze with Citi Rewards for local offline transactions, like dental clinics, restaurants, shopping, and even the Kris+ app, where it is essential to use with amaze card to qualify for 4 miles per dollar. However, it should not affect you if you are using this for online transactions in SGD, as you can use the Citi Rewards card directly.

(2) Transfer Amaze Wallet Balance to Bank Account – Yay

In my recent video, I talked about how I was hesitant to put money into my Amaze Wallet because it doesn’t let you withdraw money from the wallet and that it cannot be very helpful for when I need a cash— this has also been a major pain point for some users. However, with the new feature, you can now transfer funds directly from their Amaze Wallet to their bank account!

(3) Instapoints (IP) Can No Longer Be Converted To Cashback – Nerf

After March 10th, you’ll lose the ability to turn Instapoints (IP) into cashback at the previous rate of 1,000 IP for S$5. Now, your only option is to convert them to KrisFlyer miles, and the rate is pretty disappointing: 1,200 IP for just 400 miles. This makes your cost per mile 3 cents per mile which is really expensive. In addition, without the cashback option, this forces everyone to convert it to miles, even if you are a cashback person.

I’d suggest that you convert your IP points before 10 March and cash it out after 10 March, when the bank transfer function is made available.

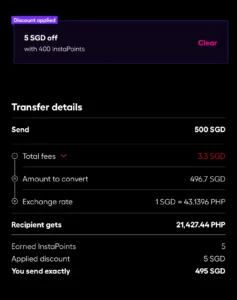

After 10 March, you can still use your IP to reduce the cost of remittance transactions through Amaze. Specifically, you can use a maximum of 400 IP to get S$5 off each remittance transfer, provided the transfer is at least S$500. If you regularly send money overseas, whether for domestic helpers or business, this could be a useful alternative.

(4) Earn Instapoints with No Cap on Amaze Wallet – Maybe Not

Previously, Instapoints were capped at 500 per month on foreign currency spend. Now, you can earn 0.5 Instapoints per dollar on both local and overseas transactions with no cap. While this is an improvement from before, it only translates to approximately 0.25% cashback—significantly lower than many other credit cards. While it’s a general upgrade for the Amaze card itself, it still ranks at the bottom of my list compared to other available options.

(5) No More Instapoints for Linked Card Transactions – Nerf

Previously, linking your selected credit cards to the Amaze card allowed you to earn Instapoints on every transaction. Unfortunately, that benefit is no longer available. This change might make it slightly more expensive for those who use the Amaze linked card to rack up rewards in foreign currency spend, but it’s not too bad and does not affect the overall value of using the card with selected credit cards for foreign currency spend.

Common Questions:

Is it still worth using your Citi Rewards + Amaze on local offline spend?

Well, yes, but at a higher cost, which means for every 400 miles earned, you pay S$1 more, making your cost per mile 0.25 cents per mile, which is still quite cheap. Effectively, instead of earning a 4 miles per dollar, you are earning 3.96 miles per dollar on local spending for a 4 miles per dollar credit card.

Would I still use this?

Likely yes, after I have maxed out other 4 miles per dollar cards. For two reasons:

(1) Able To Transfer To Infinity Mileagelands For Better Miles Value

Citi cards are one of the three banks cards (besides HSBC and AMEX) that allows transfer to Infinity Mileagelands and Infinity Mileagelands miles have some sweet spot for miles redemptions, even on Singapore Airlines.

(2) Continue to Stock Up On Existing Points in Citi Rewards

As of time of writing, I have around 235,000 points, and it would be a waste to stop the accumulation. At a 3.96 miles per dollar earn rate, it is still not too bad in my opinion and the cost per mile is still within my acceptable range.

Final Thoughts:

Instarem Amaze has rolled out a significant number of updates, with a mix of positive and negative changes. On the positive side, Instarem now allows you to transfer funds directly from your Amaze Wallet to your bank account. However, there are notable drawbacks. Instarem has introduced a 1% fee on all your Singapore Dollar transactions made with the linked card. Furthermore, they have discontinued Instapoint earning on your linked card transactions, be it local or foreign transactions. While Instarem Amaze remains useful for overseas spending with linked card function, it is less beneficial for your local offline spending in Singapore when using the linked card method. Therefore, you may want to consider alternative credit cards for your offline purchases in SGD, specifically for Citi Rewards & Amaze pairing.

One Response

hi sis, is there any exclusion for using instarem wallet to pay to get instapoint?