Overview:

Usually an optional add-on benefit for travel insurance— Cancel for Any Reason (CFAR). If for any reason you must cancel your trip, even one that isn’t covered by standard travel insurance, you can get reimbursed for a portion of your prepaid, non-refundable trip costs. Listed here are some of the Best Travel Insurance you can consider for Cancel for Any Reason Benefit!

I was curious about Travel Insurance with Cancel For Any Reason coverage and I wanted to find out how do they differ in coverage.

Here are two brand options for ‘Cancel For Any Reason’ with different plans:

Premium | Business | First | |

(Optional Add-On) | S$1,000 | S$3,000 | S$6,000 |

Lite | Plus | Prestige | |

Lite – None; Included from Plus onwards | Not Covered | S$5,000 | S$5,000 |

*These 2 travel insurances will reimburse up to 50% for all covered travel costs charged by the licensed provider such as transport provider, accommodation provider, tour operator or travel agent where You have paid or legally have to pay for Your Trip and which You cannot get back

- capped at the respective maximum amount above

SUPER important note:

Based on my understanding for the terms and conditions, for this clause to apply, you have to buy your travel policy before or within 7 days of the date on which you paid the initial payment or deposit for your trip. This is not the date the payment transaction is completed, but rather the date you give your payment information to the licensed travel provider.

Diving deeper into the components:

Premium | Business | First | |

*Trip Cancellation for any reason | S$1,000 | S$3,000 | S$6,000 |

^Trip postponement for any reason (Rebooking fees coverage is only applicable under Trip Postponement for any reason) | S$1,000 | S$3,000 | S$6,000 |

~Trip cut short for any reason | S$1,000 | S$3,000 | S$6,000 |

Lite | Plus | Prestige | |

*Trip Cancellation for any reason | Not Covered | S$5,000 | S$5,000 |

^Trip postponement for any reason | Not Covered | S$2,000 | S$3,000 |

~Trip cut short for any reason | – | – | – |

Change of Travelling Date or Time For Any Reason | – | S$2,000 | S$3,000 |

* Any unused accommodation and transport expenses (air, sea or land travel) that you have paid in advance and cannot get back from any other source, as well as cancellation fees

^Any rebooking fees so that you can reorganise the trip (to the same destination as the original trip) to such later date within 180 days from your original scheduled departure date

~if your trip has commenced for a period of 48 hours or more, and you have had to incur a covered travel cost as a result of you having to return to Singapore before your scheduled return date for any reason. Any unused accommodation and transport expenses (air, sea or land travel) that you have paid in advance and cannot get back from any other source, as well as cancellation fees

What is not Covered in Both Travel Insurance:

- FWD

- any amount, regardless of form, that is reimbursed or received as compensation. Examples are: cash, voucher, credit, points, or miles received as a return or compensation.

- Singlife

- Any request for a reimbursement of any expenses for individuals who are not included on the policy.

- Any claim pertaining to multiple incidents throughout an insurance period.

Conditions to both:

- If you would like to modify your policy, you must do so no later than seven days from the date of your original trip payment or deposit.

- If it turns out that you need to cancel, postpone, or abandon the travel plan, you have to let the relevant service providers know as soon as you can.

- They will reduce your claim by the amount of refund you have obtained regardless of the form of refund. Examples of form of refund are cash, credit, points or vouchers. Proof of compensation or denial received from the relevant service provider must be provided when a claim is made

- Regardless of the type of refund, they will deduct your claim by the total amount you have already received. Refunds can take the form of cash, credit, points, or vouchers. When a claim is filed, proof of the payment or denial obtained from the applicable service provider is required.

You may refer to my excel sheet HERE where you can see the medical coverage.

Conclusion:

“Cancel for any reason” cover is useful for coverage for reasons not listed in a general travel insurance. However, for it to be in effect, one has to buy the policy before or within 7 days of first trip booking!

FWD is a great hassle-free travel insurance with a low cost premium that gives you the choice to add on this coverage to any plan. This is a value for money option for those who are going on a general trip with some optional covers like home contents, domestic pet care.

Singlife is definitely a go-to with an affordable if you are:

How to ensure you receive your rewards after sign up?

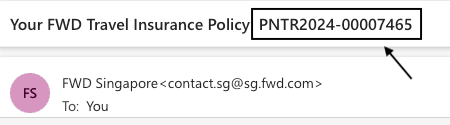

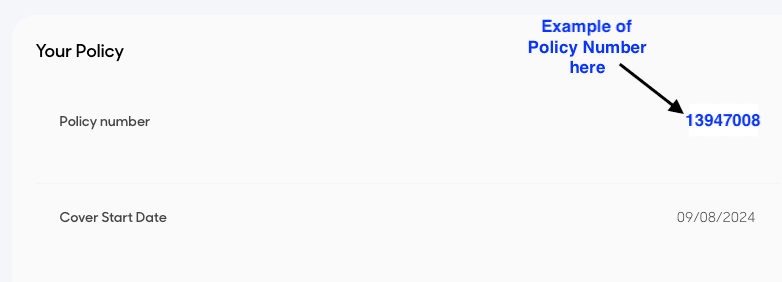

Step 1: After you have purchased your travel insurance, you should receive your policy number which could look something like this:

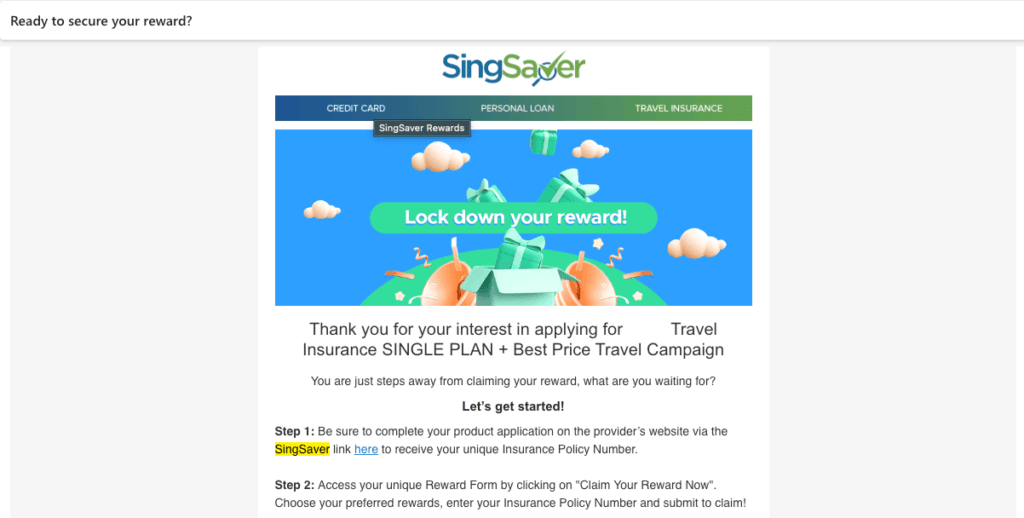

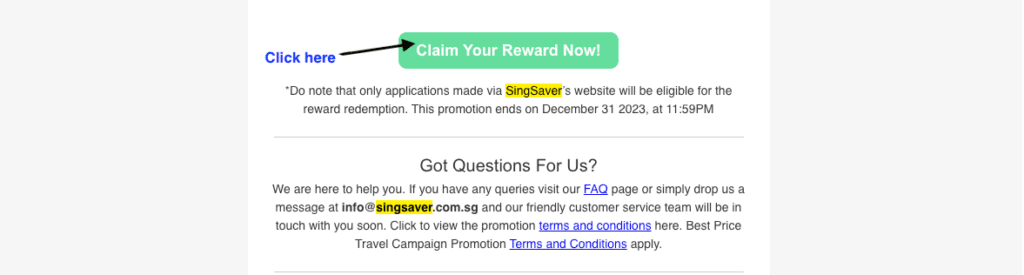

Step 2: You should have received the below email titled “Ready to Secure Your Reward?” from no-reply@singsaver.com.sg. Proceed to click “Claim Your Reward Now“:

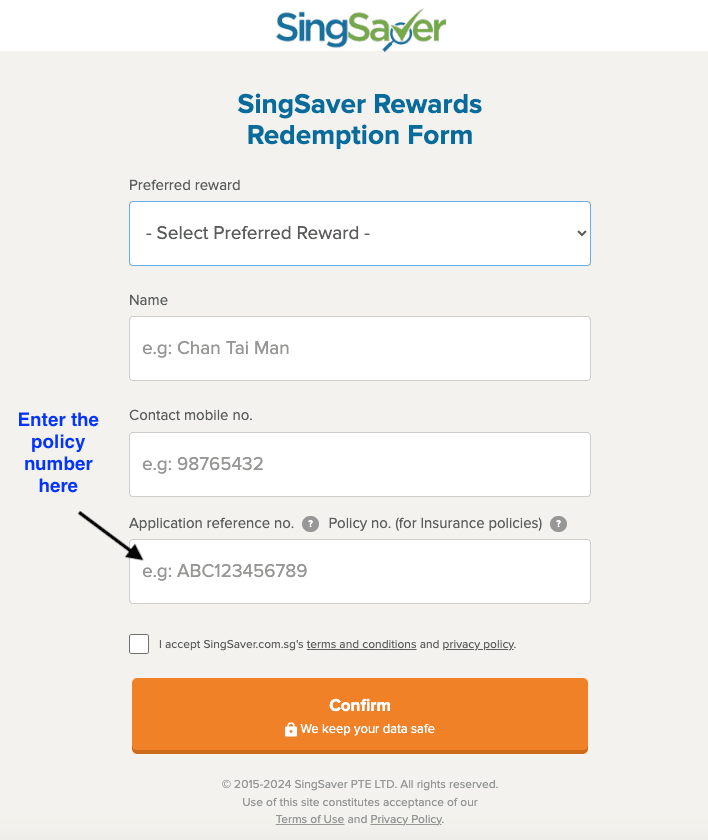

Step 3: Fill up your details with your policy number and click “Confirm“. And you are good to go.

If you fulfill the conditions set forth for the rewards, you can expect your rewards redemption notification to be sent to your email once the terms are fulfilled

💳 Credit cards change their T&Cs every so often and it is difficult to stay updated. That’s why I created a Telegram Broadcast where you can receive timely bite-sized updates to get the most out of your spending.

💡 We believe in always paying our credit card bills on time and in full. It is only by doing that, can we fully maximise our credit card benefits.