Overview:

Having the appropriate travel insurance is essential whether you’re exploring dangerous terrain, plunging into the ocean’s depths, or soaring through the skies.

This guide will assist you in navigating the world of travel insurance, with a particular emphasis on plans created with extreme sports enthusiasts in mind. We’ll go over the essential coverages, evaluate various options, and offer tips on selecting the ideal policy for your upcoming trip.

Why is Travel Insurance a MUST when engaging in extreme sports/activities?

Although extreme sports are often associated with excitement and adrenaline, there are always risks involved. Accidents can occur, and they may have terrible consequences. At this point, having travel insurance is essential. Extreme sports are frequently played in areas with limited medical resources and a severe injury could require costly medical care or perhaps evacuation. These expenses may be covered by travel insurance, saving you from spending heavy expenses.

What are the usual activities included (must be guided by licensed professionals)

- Bungee Jumping

- Skydiving

- Jet Skiing

- Tobogganing

- Hot Air Ballooning

- Snowboarding

- Rock Climbing

- Paragliding

- Hiking

- Golf

Sports included but with limitations:

- Trekking – usually until 4,000 meters only

- Scuba Diving – until 30 meters deep

- Skiing – must be within the designated boundaries

- Canoeing/White water rafting – up to class 3 rapids

General Exclusions for all Insurance:

- Activity/Sports is a paid form of professional competitions wherein you receive sponsorship or some kind of monetary reward

- Drag racing

- Exploration on inaccessible locations

- Extreme sports which involve speed, height, danger, a high level of physical exertion, highly specialised gear or special stunts

Here’s the Best Travel Insurance for Extreme Sports:

Standard | Elite | Premier | |

Accidental Death and Permanent Total Disability | |||

Adult below 70 years old | NA | S$200,000 | S$500,000 |

Adult above 70 years old | NA | S$75,000 | S$100,000 |

Child | NA | S$75,000 | S$100,000 |

Overseas Medical Expenses | |||

Adult below 70 years old | NA | S$500,000 | S$1,000,000 |

Adult above 70 years old | NA | S$75,000 | S$100,000 |

Child | NA | S$200,000 | S$300,000 |

Sports Covered: Land and Air Activities – zip-lining, zip-riding, bungee jumping, parasailing, tandem sky diving, tandem paragliding, tandem hang gliding – sightseeing on hot-air balloon, helicopter, airplane; – hiking, trekking or mountaineering (up to 3,000m above sea level – marathon (up to 42.195km) Water Activities/Sports: – canoeing or white-water rafting (with a qualified guide and up to Grade 3 of internation of river difficulty) – jet skiing, helmet diving; – scuba diving up to qualified depth of insured person’s diving certification (must be accompanied by dive instructor or dive master and does not exceed depth of 30 metres Winter Activities/Sports: – ice skating, tobogganing, sledging; snow tube sliding, dog sledding, snow rafting, skiing or snowboarding, snowmobiling(provided theses activities are not done in off piste, ungroomed, unpatrolled, areas, or placesnot recommended for beginner to intermediate users) | Sports Covered: Land and Air Activities – zip-lining, zip-riding, bungee jumping, parasailing, tandem sky diving, tandem paragliding, tandem hang gliding – sightseeing on hot-air balloon, helicopter, airplane; – hiking, trekking or mountaineering (up to 3,000m above sea level – marathon (up to 42.195km) Water Activities/Sports: – canoeing or white-water rafting (with a qualified guide and up to Grade 3 of internation of river difficulty) – jet skiing, helmet diving; – scuba diving up to qualified depth of insured person’s diving certification (must be accompanied by dive instructor or dive master and does not exceed depth of 30 metres Winter Activities/Sports: – ice skating, tobogganing, sledging; snow tube sliding, dog sledding, snow rafting, skiing or snowboarding, snowmobiling(provided theses activities are not done in off piste, ungroomed, unpatrolled, areas, or placesnot recommended for beginner to intermediate users) | ||

Conditions the insured person suffers accidental death or injury as a result of taking part in or practising for the following activities for leisure and non-competitive purpose, with a licensed operator and provided the insured person follows all safety and health instructions, guidelines or regulations | |||

Coverage | Maximum Amount Payable per Insured per trip | |

Optional Cover: Winter Sports | Accidental Death and Permanent Disablement | S$50,000 |

Emergency Medical Cover (Aggregate) | S$250,000 | |

Personal Liability Extension | up to selected plan’s limit | |

Loss of Winter Sports Equipment | S$3,000 (up to S$1,000 for any one article or set of article if grouped together; excess payable: S$250 | |

Hire of Winter Sports Equipment | S$500 (up to S$500 per day) | |

Loss of Deposit due to Ski Track/Piste Closure | S$1,000 | |

Ski Pass and Ski Lift Pass | S$500 | |

Delay due to Avalanche | S$200 | |

Optional Cover: Water Sports | Emergency Medical Cover (Aggregate) | S$250,000 |

Accidental Death and Permanent Disablement | S$50,000 | |

Personal Liability Extension up to selected plan’s limit | up to selected plan’s limit | |

Loss of Water Sports Equipment (including while in use) | S$3,000 (up to S$1,000 for any one article or set of article if grouped together; excess payable: S$250) | |

Hire of Water Sports Equipment | S$500 (Up to S$100 per day) | |

Sports Covered: Winter Sports/Activities: – skiing, snowboarding, snow tubing, snow rafting, toboganning, snow shoeing, sleigh rides, sledging, snow mobiling, glacier walking (must be organised by licensed operator and accompanied by a qualified guide at all times) Water Sports/Activities: – diving with the use of artificial breathing apparatus, white and black water refting, canoeing/kayaking, cave/river tubing, dinghy sailing, yachting, jet boating/kite boating, jet skiing, sea walking, sailboarding/wake boarding/body boarding/kite boarding/paddle boarding, wind surfing/water surfing/flow riding, water skiing, dragon boating, deep sea fishing (if you do no hold a diving qualification, they will only cover you to dive to a maximum depth of 30 metres when accompanied by and under the direct supervision of a qualified diving instructor as paprt of an accredited course) | ||

Winter Sports/Activities: | ||

Classic | Deluxe | Preferred | |

Personal Accident | |||

Adult above 70 years old | S$100,000 | S$125,000 | S$200,000 |

Adult below 70 years old | S$150,000 | S$200,000 | S$500,000 |

Child | S$75,000 | S$100,000 | S$125,000 |

Medical Expenses incurred Overseas | |||

Adult above 70 years old | S$300,000 | S$300,000 | S$350,000 |

Adult below 70 years old | S$250,000 | S$500,000 | S$1,000,000 |

Child | S$150,000 | S$200,000 | S$300,000 |

It covers the following activities: hiking, bungee jumping, parasailing, paragliding, parachuting, hang-gliding, skydiving, abseiling, skiing, snowboarding, canoeing, kayaking, white water rafting, dragon boating, paddleboarding, marathon, ultramarathon, biathlon, triathlon, surfing, snorkelling, trekking (up to 4,000 metres) | |||

Conditions: – is undertaken while complying with all safety procedures, such as wearing safety equipment and following rules and regulations; whether specifically advised or generally expected of a reasonable person, – must be under the supervision of licensed guides or instructors – is not excluded under the general exclusions | |||

Classic | Superior | Premier | |

Accidental Death and Permanent Disablement | |||

Adult below 70 years | S$100,000 | S$200,000 | S$300,000 |

Adult above 70 years | S$50,000 | S$100,000 | S$150,000 |

Child | S$50,000 | S$100,000 | S$100,000 |

Medical Expenses Incurred Overseas | |||

Adult below 70 years | S$200,000 | S$1,000,000 | S$2,000,000 |

Adult above 70 years | S$50,000 | S$75,000 | S$200,000 |

Child | S$200,000 | S$200,000 | S$300,000 |

Conditions: Activities must be: organized harnessed outdoor rock climbing, harnessed abseiling trekking (including mountain trekking Exclusions but with conditions: – Adventure climbing including outdoor rock climbing or abseiling; High altitude activity or any activity above 6,000 metres or trekking (including mountain trekking) above 3,000 meters Criteria: – The activity must be accessible to anyone, without any specific restrictions other than general health and fitness warnings. – The activity must be provided by a recognized local commercial tour operator or activity provider. – The activity must be conducted under the guidance and supervision of qualified guides or instructors from the tour operator or activity provider. – Participants must also follow the advice and instructions given by these professionals. | |||

Conclusion:

There are big differences in coverage between insurers when it comes to travel insurance for extreme sports. The most comprehensive choice is MSIG, which provides an adequate protection for general adventurous activities. While NTUC Income offers adequate coverage for hikers up to 4,000 meters, it may not cover as much extreme sports as MSIG does overall. AIG can also be a good option as it can cover activities up to 6,000 meters but with limitations. On the other hand, Singlife provides the coverage for water and winter sports as an optional add-on. I would encourage you to use the above as a guide to see if it covers your activity, then look at the policy for future details to ensure that you have adequate coverage.

How to ensure you receive your rewards after sign up?

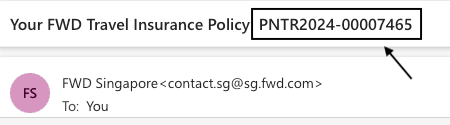

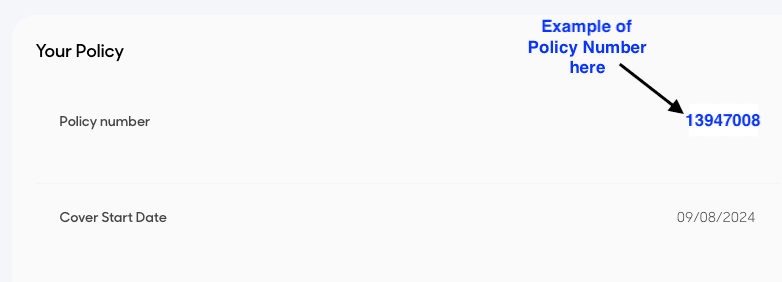

Step 1: After you have purchased your travel insurance, you should receive your policy number which could look something like this:

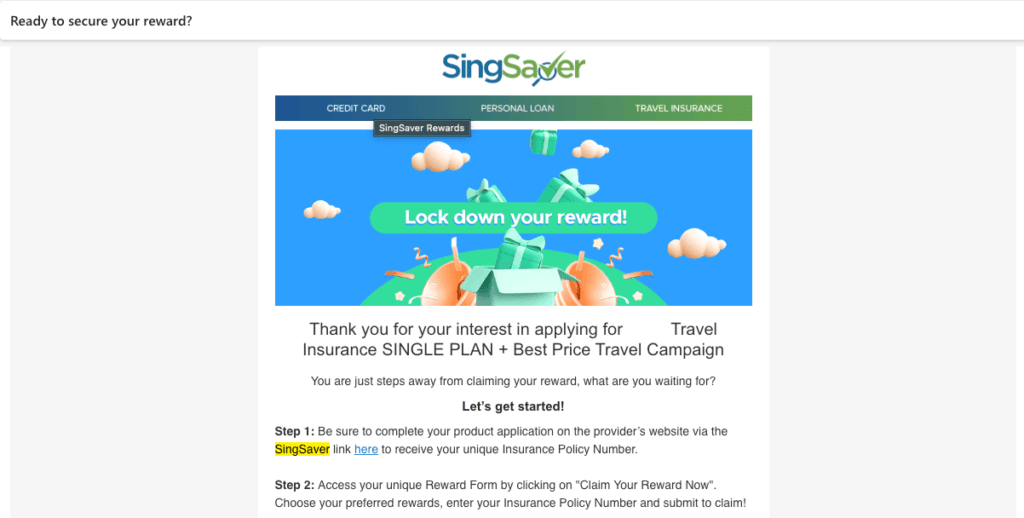

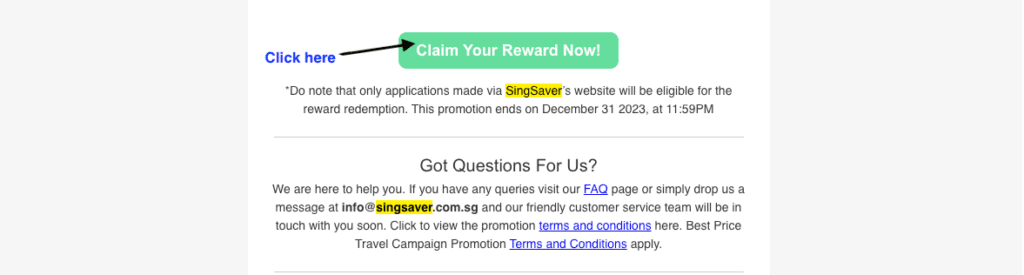

Step 2: You should have received the below email titled “Ready to Secure Your Reward?” from no-reply@singsaver.com.sg. Proceed to click “Claim Your Reward Now“:

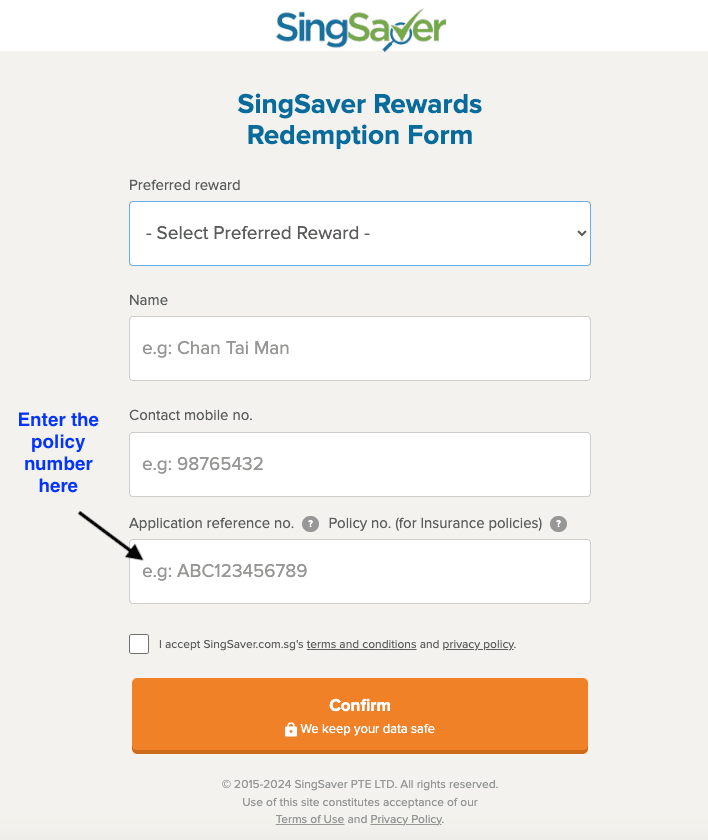

Step 3: Fill up your details with your policy number and click “Confirm“. And you are good to go.

If you fulfill the conditions set forth for the rewards, you can expect your rewards redemption notification to be sent to your email once the terms are fulfilled

💳 Credit cards change their T&Cs every so often and it is difficult to stay updated. That’s why I created a Telegram Broadcast where you can receive timely bite-sized updates to get the most out of your spending.

💡 We believe in always paying our credit card bills on time and in full. It is only by doing that, can we fully maximise our credit card benefits.

One Response