Overview:

Pre-existing medical conditions refer to illnesses or injuries that people had know of prior to travel, for which they have medical records, a diagnosis, and treatment for. This covers conditions like diabetes, epilepsy, asthma, heart disease, and high blood pressure. This is mostly included in the general exclusions list of most insurances, so it is vital to spot which insurance has a coverage for this.

Pre-Ex plans covers only for:

- single return trip with duration up to 30 days coverage.

- not available for Family Plan.

For any claim, the insured person or their representative must contact insurer company as soon as the situation allows.

What is usually defined as Pre-Existing Condition:

Etiqa:

- any medical condition for which:

(a) The Insured Person(s) received medical treatment, diagnosis, consultation or prescribed drugs within a twelve (12) month period immediately prior to the Effective Date of Insurance; or

(b) Medical advice or treatment was recommended by a Medical Practitioner within a twelve (12) month period immediately prior to the Effective Date of Insurance; or

(c) A reasonable person in the circumstances would be expected to be aware of within a twelve (12) month period immediately prior to the Effective Date of Insurance.

MSIG:

Under TravelEasy® Pre-Ex cover, it means:

Any pre-existing medical or physical conditions of any insured person which have needed consultation or treatment including any recurring, chronic or continuing illness or condition before the start of the journey.

FWD:

This is available as optional cover which refers to a medical condition that:

- the insured person were aware of (or should reasonably be aware of)

- the insured person has received medical advice, treatment, diagnosis or prescription drugs up to 12 months before the start of the trip

- To claim the benefit of Emergency medical evacuation & repatriation, you (or someone on your behalf) must call their Emergency Assistance line at +65 6322 2072.

Sublimit | Sublimit | ||

Pre-Ex Standard | Pre-Ex Elite | Pre-Ex Premier | |

Medical Expenses Incurred Overseas (in-patient hospital charges) | |||

Below 70 years old | S$75,000 | S$100,000 | S$150,000 |

Above 70 years old & Children | S$50,000 | S$75,000 | S$100,000 |

Emergency Medical Evacuation and Repatriation | S$100,000 | S$150,000 | S$200,000 |

Pre-Ex Entry | Pre-Ex Savvy | Pre-Ex Luxury | |

Medical Expenses Incurred Overseas (in-patient hospital charges) | |||

Below 70 years old | S$75,000 | S$125,000 | S$150,000 |

Above 70 years old | S$20,000 | S$40,000 | S$50,000 |

Child | S$50,000 | S$75,000 | S$100,000 |

Overseas Hospital Income | S$5,000 ($200 per 24 hrs) | S$10,000 ($200 per 24 hrs) | S$20,000 ($200 per 24 hrs) |

Emergency Medical Evacuation | S$150,000 | S$200,000 | S$250,000 |

Repatriation of Mortal Remains to Singapore | |||

Premium | Business | First | |

Medical expenses incurred overseas | S$50,000 | S$100,000 | S$150,000 |

Emergency medical evacuation & repatriation | |||

Trip cancellation and loss of deposit (50% co-payment) | S$7,500 | S$10,000 | S$15,000 |

Trip postponement (50% co-payment) | S$500 | S$1,000 | S$1,500 |

Trip cut short (50% co-payment) | S$5,000 | S$10,000 | S$15,000 |

Trip disruption (50% co-payment) | S$1,000 | S$2,000 | S$3,000 |

These are standard conditions for all insurers that the insured person must meet to be eligible for Pre-Ex cover:

1. The insured person is following their treating doctor’s advice for all their pre-existing medical condition. This includes not refusing or delaying any monitoring, medical appointment, medical test, medication, treatment or surgery.

2. The insured person does not have any medical condition or symptom which they have not consulted a doctor for or for which they are waiting for medical test, medical result, diagnosis, treatment or surgery.

3. In the last 12 months, the insured person does not have any pre-existing medical condition which has required them to:

a) receive treatment at a hospital’s Accident and Emergency Department more than once;

b) stay in a hospital as an inpatient for more than three days in a row; and

c) stay in a hospital as an inpatient for more than once.

What is not covered for all insurers:

In addition to the exclusions, this section does not cover any claims resulting from:

1. any pre-existing medical condition that worsens within the 30 days before the start of the trip for which a doctor has advised to see a medical specialist, undergo investigative test, surgery, or change in treatment, prescribed medication or dosage. This does not include changes to prescribed medication or dosage for lowering blood cholesterol;

2. terminal illness regardless of whether diagnosis was received before or after this insurance was purchased;

3. outpatient medical treatment; or

4. medical expenses incurred in Singapore

5. For FWD, the insured person have been given a terminal illness diagnosis with a life expectancy of less than 12 months

Conclusion:

- All policies cover Medical Expenses incurred overseas and Emergency Medical Evacuation. MSIG and Etiqa have the policies with a Pre-Ex label, while FWD offers it as an optional cover to the normal policy. However, Etiqa includes Overseas Hospital Income and FWD covers 50% if trip is postponed, cut short, disrupted, cancelled due to the acute on-set of the pre-existing condition. However, for those above 70 years old, the coverage medical expenses incurred overseas is higher for MSIG and FWD. MSIG is the only one that covers any injuries arising from adventurous activities if your trip itinerary includes adventurous sports.

- There are exclusions across the board that limits the benefits for pre-existing conditions. Eg. It cannot be a terminal illness or outpatient medical treatment or treatment in Singapore.

- All policies for pre-existing conditions will only cover cost incurred by the insured person up to thirty (30) days from the date the insured person first suffers the acute onset of a pre-existing medical condition during the trip.

(Make sure to choose Pre-Existing Plan)

How to ensure you receive your rewards after sign up?

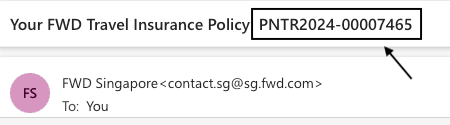

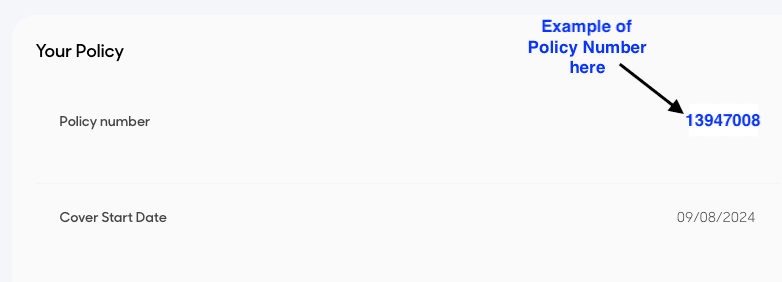

Step 1: After you have purchased your travel insurance, you should receive your policy number which could look something like this:

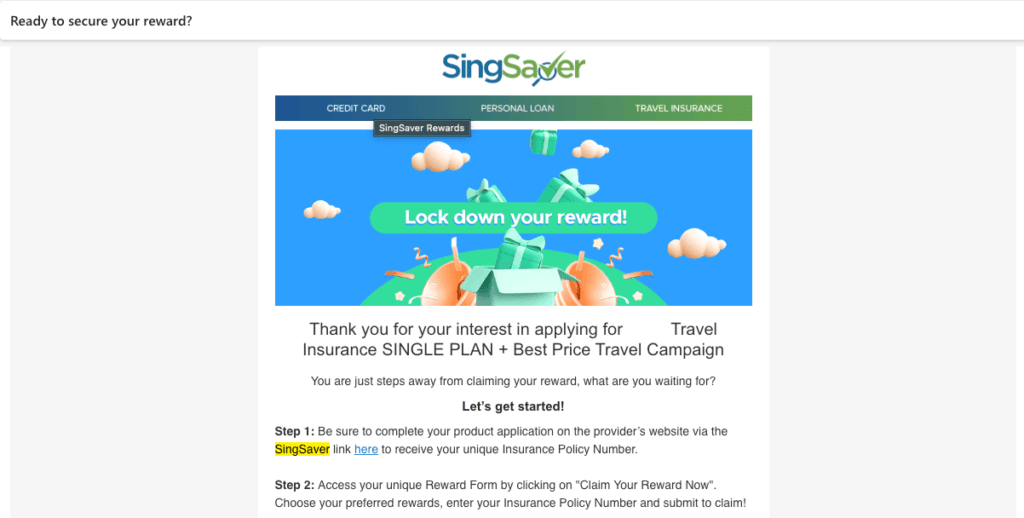

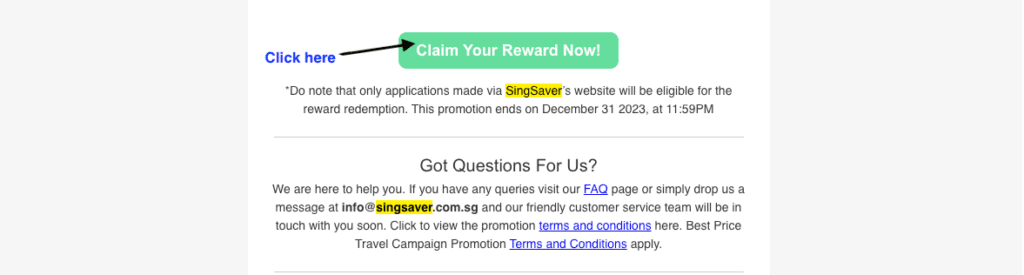

Step 2: You should have received the below email titled “Ready to Secure Your Reward?” from no-reply@singsaver.com.sg. Proceed to click “Claim Your Reward Now“:

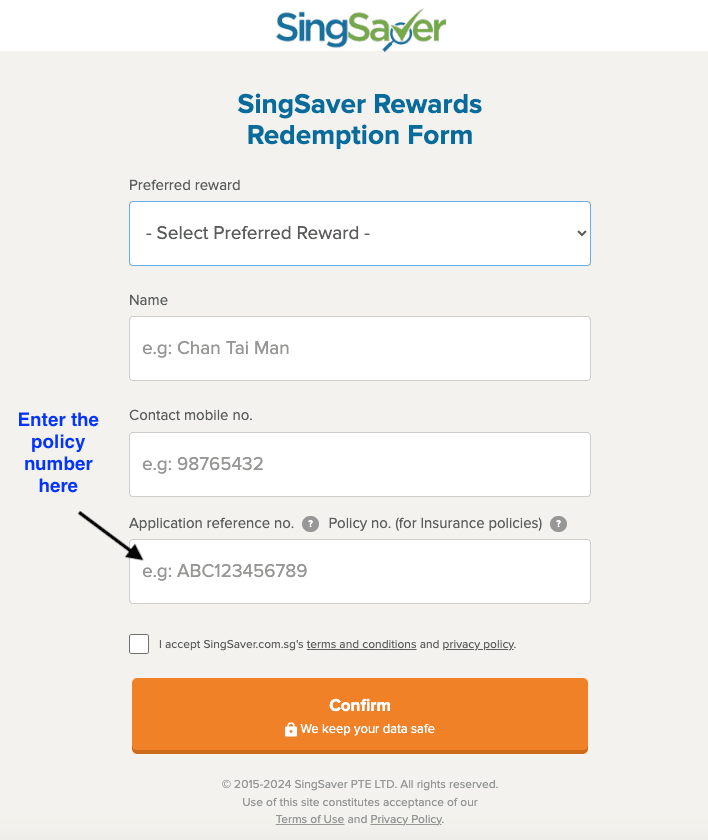

Step 3: Fill up your details with your policy number and click “Confirm“. And you are good to go.

If you fulfill the conditions set forth for the rewards, you can expect your rewards redemption notification to be sent to your email once the terms are fulfilled

💳 Credit cards change their T&Cs every so often and it is difficult to stay updated. That’s why I created a Telegram Broadcast where you can receive timely bite-sized updates to get the most out of your spending.

💡 We believe in always paying our credit card bills on time and in full. It is only by doing that, can we fully maximise our credit card benefits.

One Response