Overview:

Taking your sporting equipment out on the road (or to the beach)? Avoid losing out on safety!

You should have peace of mind knowing that your expensive sports equipment are covered whether you’re riding through incredible landscapes, surfing big waves, or teeing off on a top-notch golf course. Travel insurance for sports equipment can help in such a scenario. It serves as a safety net against unforeseen damage, loss, or theft, guaranteeing that your sporting experiences will be thrilling rather than stressful financially.

Here’s the Best Travel Insurance for Sports Equipment:

FWD:

Sublimit | |||

Premium | Business | First | |

Cover for sports equipment in the event of damage or theft, including up to S$100 per day for rentals | S$2,000 | S$2,000 | S$2,000 |

Condition: - sports equipment is stolen or accidentally damaged; - sports equipment is lost or stolen while in the custody and care of any airline operator, transport or accommodation provider | |||

Sports Equipments covered: - golf clubs, diving gear, skis (boards and poles), snowboards, wakeboards, bicycles, specialist apparel for diving, skiing and snowboarding, fishing tackle equipment | |||

Etiqa:

Sublimit | |||

Entry | Savvy | Luxury | |

S$500 | S$2,000 | S$4,000 | |

Condition: - sports equipment is stolen or accidentally damaged; - When using sports equipment for play, practice, or play, they will not be responsible for any loss, damage, or destruction. | |||

Sports Equipments covered: - golf clubs, diving gear, ski equipment, snowboards, bicycles, climbing gear, fishing equipment | |||

Conclusion:

FWD’s travel insurance with optional sports equipment coverage can be a lifesaver for adventurous travelers who are carrying expensive sports equipment. It offers financial protection against loss, theft, or damage to your equipment, giving you peace of mind while traveling. Even though other insurers might provide comparable coverage, FWD stands out for its affordability, ease in adding coverage, and comprehensive protection.

How to ensure you receive your rewards after sign up?

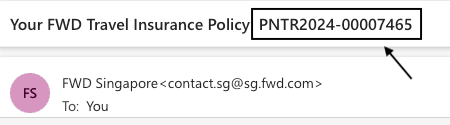

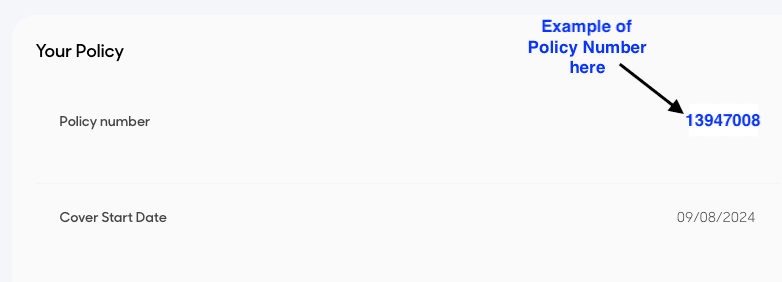

Step 1: After you have purchased your travel insurance, you should receive your policy number which could look something like this:

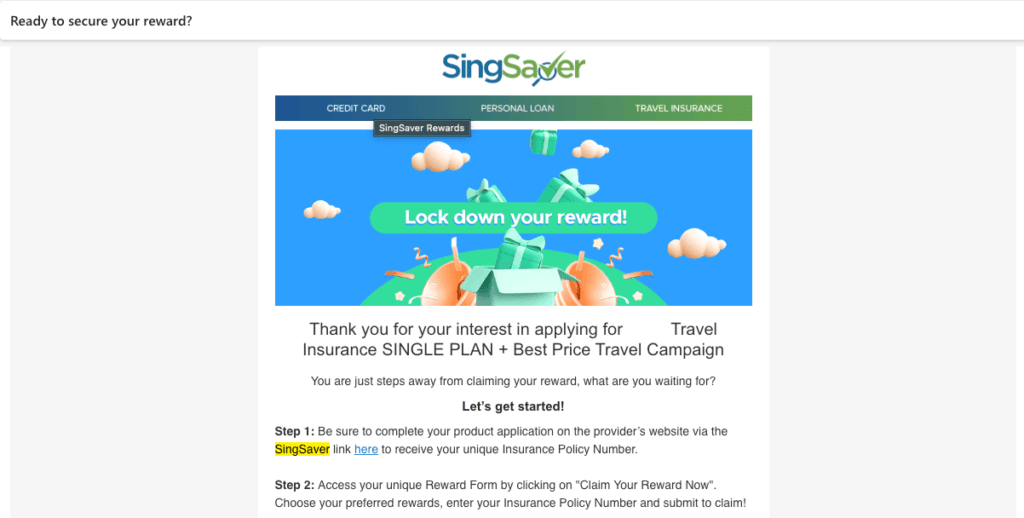

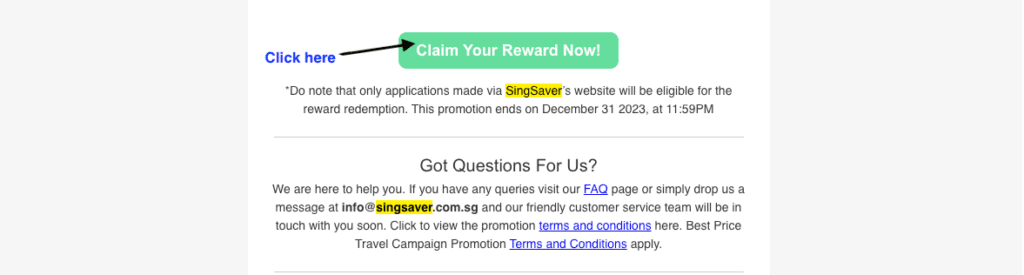

Step 2: You should have received the below email titled “Ready to Secure Your Reward?” from no-reply@singsaver.com.sg. Proceed to click “Claim Your Reward Now“:

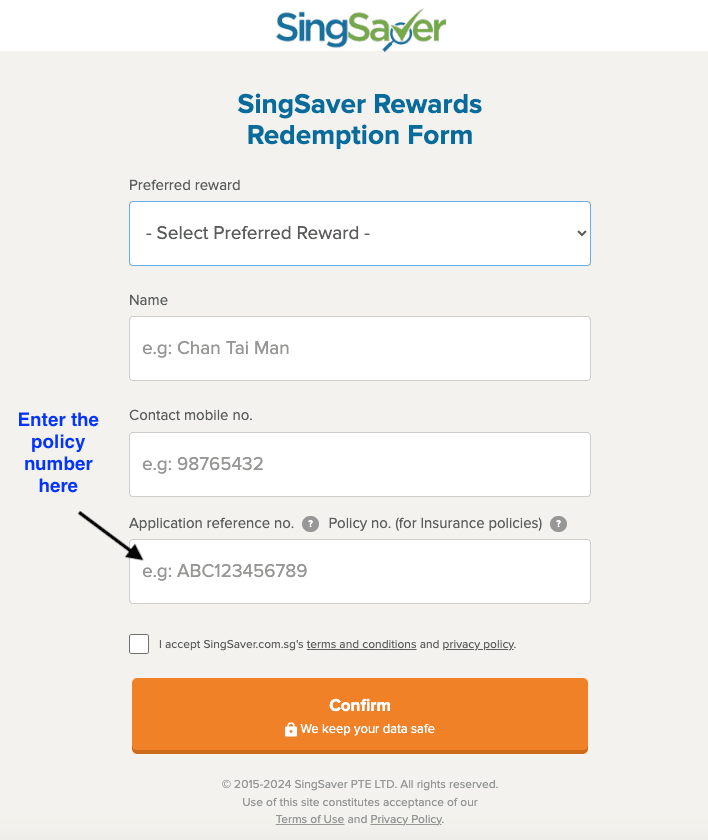

Step 3: Fill up your details with your policy number and click “Confirm“. And you are good to go.

If you fulfill the conditions set forth for the rewards, you can expect your rewards redemption notification to be sent to your email once the terms are fulfilled

💳 Credit cards change their T&Cs every so often and it is difficult to stay updated. That’s why I created a Telegram Broadcast where you can receive timely bite-sized updates to get the most out of your spending.

💡 We believe in always paying our credit card bills on time and in full. It is only by doing that, can we fully maximise our credit card benefits.

One Response