Overview:

Delays are a common mishap in traveling, therefore it is a good move to have yourself insured to get a reimbursement when unexpected setbacks happen— mostly in these situations:

- Natural Disasters occurring at the planned destination

- Strike, Civil Unrest, Riot or Commotion resulting in cancellation of scheduled Common Carrier services

- Inclement weather condition

- Actual or suspected mechanical breakdown/derangement and structural defect of the air conveyance

- strike or other industrial action being taken by employees of the public transport provider;

Notes:

The period of delay is calculated from the scheduled departure time given by the carrier in the original itinerary to the actual scheduled departure time of the replacement flight.

Important Common Conditions:

- You must have checked in on time for the scheduled public transportation you have booked in your original itinerary

- Must have written proof of the delay from the public transport provider or handling agent. The document needs to show the number of hours you were delayed, and the reason for the delay.

- The delay must be usually be according to the full stated hours, with no fault on your end.

Here’s the Best Travel Insurance for Travel Delays:

Sublimit | |||

Entry | Savvy | Luxury | |

S$300 | S$300 | S$500 | |

Delay While Overseas: S$50 for every 3 hours Delay while in Singapore: Max S$50 for the first 3 hours | Delay while in Singapore: Max S$50 for the first 3 hours Delay While Overseas: S$50 for every 3 hours | ||

Sublimit | |||

Premium | Business | First | |

S$300 | S$500 | S$500 | |

Delay While Overseas: S$50 for every 3 hours Delay while in Singapore: Max S$50 for the first 3 hours | Delay While Overseas: S$100 for each full 6 hours, up to the maximum indicated limit depending on the premium Delay while in Singapore:S$100 for the first 6 hours | ||

Sublimit | |||

Plan 1 | Plan 2 | Plan 3 | |

S$1,000 | S$1,000 | S$1,000 | |

Delay While Overseas: S$50 for every 3 hours Delay while in Singapore: Max S$50 for the first 3 hours | Delay While Overseas: S$100 for first full 6 hours; for each additional hour of the delay, you will receive $20 thereafter, up to the limit Delay while in Singapore: S$100 for the first 6 hours | ||

Sublimit | ||

Classic | Premier | |

S$1,200 | S$1,200 | |

Delay While Overseas: S$100 for each full 6 hours, up to the maximum indicated limit depending on the premium Delay while in Singapore: S$100 for the first 6 hours | ||

Sublimit | Sublimit | |||

Basic | Standard | Enhanced | Supreme | |

S$200 | S$1,000 | S$2,000 | S$3,000 | |

Delay While Overseas: S$100 for each full 6 hours, up to the maximum indicated limit depending on the premium Delay While in Singapore: Not Specified | ||||

Sublimit | ||

Essential | Superior | |

S$800 | S$1,200 | |

Delay While Overseas: Adult: S$100 for each full 6 hours, up to the maximum indicated limit depending on the premium Child: S$50 for each full 6 hours, up to the maximum indicated limit depending on the premium Delay while in Singapore: Child: S$50 after 6 hours Adult: S$150 after 6 hours | ||

Sublimit | Sublimit | |||

DA150 | DA200 | DA500 | DA1000 | |

S$1,000 | S$1,000 | S$1,500 | S$2,000 | |

Delay While Overseas: S$100 for each full 6 hours, up to the maximum indicated limit depending on the premium Delay While in Singapore: S$100 after 6 hours | ||||

Sublimit | |||

Basic | Classic | Elite | |

S$1,000 | S$1,200 | S$1,200 | |

Delay While Overseas: S$50 for every 3 hours Delay while in Singapore: Max S$50 for the first 3 hours | Delay While Overseas: S$50 per every 6-hour for the Basic plan, up to S$1,000 S$100 for each full 6 hours for Classic and Elite plan up to the maximum indicated limit depending on the premium Delay while in Singapore: S$50 per every 6-hour for the Basic plan, up to S$500 | ||

Sublimit | |||

Standard | Elite | Premium | |

S$500 | S$1,000 | S$1,500 | |

Delay While Overseas: S$50 for every 3 hours Delay while in Singapore: Max S$50 for the first 3 hours | Delay While Overseas: S$100 for each full 6 hours of delay while you are overseas up to the maximum indicated limit depending on the premium Delay while in Singapore: Not specified | ||

Sublimit | |||

Lite | Plus | Prestige | |

S$500 | S$1,000 | S$1,200 | |

Delay While Overseas: S$50 for every 3 hours Delay while in Singapore: Max S$50 for the first 3 hours | Delay While Overseas: S$100 for each full 6 hours of delay while you are overseas up to the maximum indicated limit depending on the premium Delay while in Singapore: Not specified | ||

Special Conditions:

Singlife

- you will only be reimbursed on the following scenarios:

- The public transport you have booked on your trip is delayed than expected; or

- Due to overbooking, you are not permitted to board the public transportation for which a confirmed reservation has been obtained from the travel agency or operator(s) of the intended public transportation; or

- You are unable to proceed with the trip as planned and experience a delay in reaching your destination because the public transportation that you were supposed to take is diverted.

What is not covered:

- Any claim resulting from something that happened, was planned, or existed prior to the time you purchased your insurance or made your travel arrangements, whichever came first. This includes catastrophic events, strikes, riots, and civil disturbances.

- Your failure to check in for the public transport according to the original itinerary.

- Any claim for management fees, maintenance costs or exchange fees associated with timeshares and similar arrangements.

- Any claim if you don’t adhere to the revised departure schedule provided by the respective carrier.

- Where a claim under Section 15 – Trip Interruption and Section 16 – Travel Delay arises from the same event, they will pay the claim under one of the sections only. This includes Trip interruption due to COVID-19 under the summary of cover, Free Extensions (h) – COVID-19 Cover.

- Where a claim under Section 16 – Travel delay and Section 23 – Hijack, Hostage and Mugging, arises from the same event, they will pay the claim under one of the sections only.

- Anything mentioned in the General Exceptions.

Sompo:

- One claim per delay: You can only make a claim for a travel delay under one specific section (1-8) of the insurance policy, even if the delay falls under multiple sections.

Conclusion:

If you would like to receive claims for delays as early as 3 hours, then Etiqa TIQ would be the best option. Not all insurance covers travel delay while in Singapore, however, I noticed that Sompo gives the highest claim amount of S$150 after the first 6 hours of travel delay while in Singapore (after you have checked in). The highest claim limit for travel delay would be AIG Supreme, allowing you to claim up to S$3000 on travel delay.

How to ensure you receive your rewards after sign up?

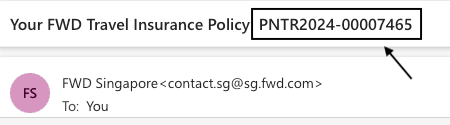

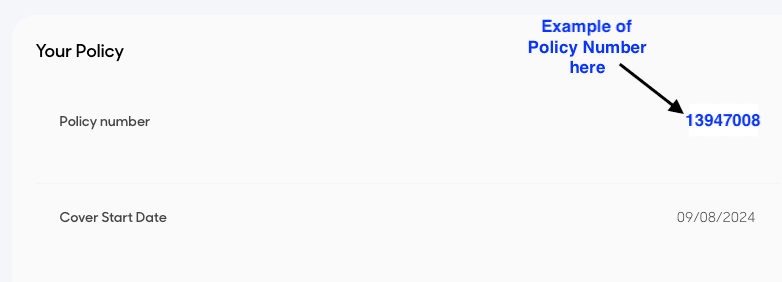

Step 1: After you have purchased your travel insurance, you should receive your policy number which could look something like this:

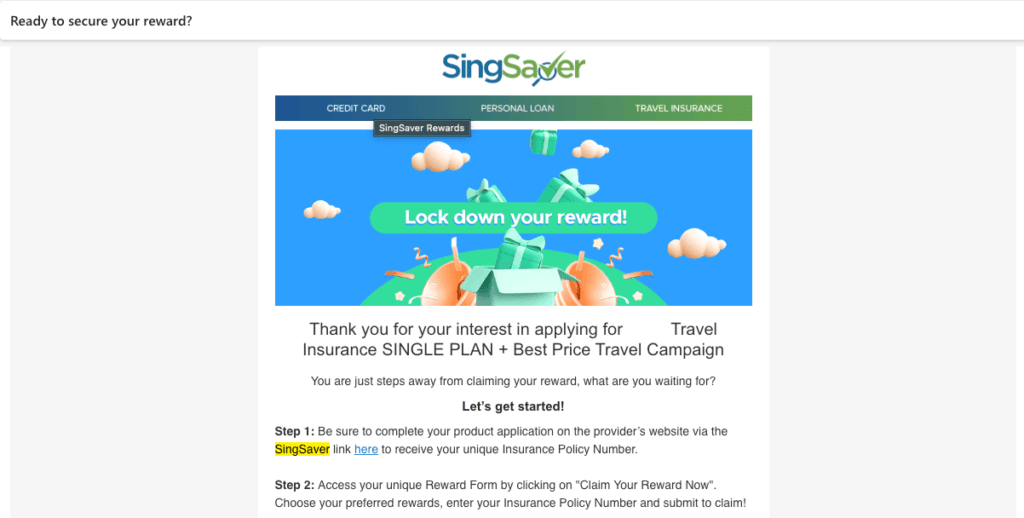

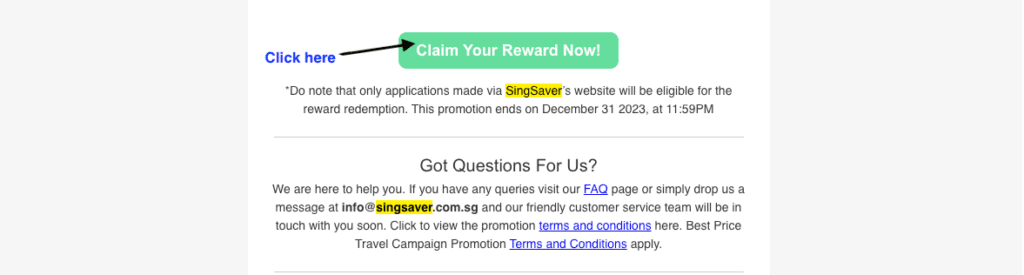

Step 2: You should have received the below email titled “Ready to Secure Your Reward?” from no-reply@singsaver.com.sg. Proceed to click “Claim Your Reward Now“:

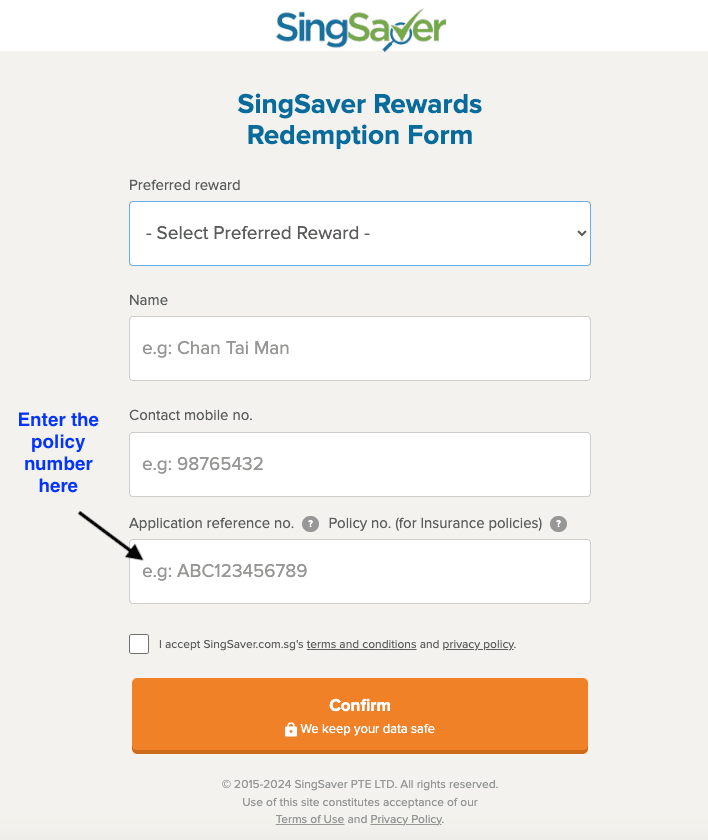

Step 3: Fill up your details with your policy number and click “Confirm“. And you are good to go.

If you fulfill the conditions set forth for the rewards, you can expect your rewards redemption notification to be sent to your email once the terms are fulfilled

💳 Credit cards change their T&Cs every so often and it is difficult to stay updated. That’s why I created a Telegram Broadcast where you can receive timely bite-sized updates to get the most out of your spending.

💡 We believe in always paying our credit card bills on time and in full. It is only by doing that, can we fully maximise our credit card benefits.