Overview:

When you use frequent flyer points to purchase an airline ticket or other travel or accommodation expense, and unanticipated events occur that result in the cancellation of the trip, they will reimburse you for the full retail price of that purchase at the time it was made, up to the maximum amount shown in the table below—if the purchase is subsequently canceled for a specific reason and the points are lost and cannot be regained from any other source.

- Loyalty or reward points must be the points allocated to you as a registered customer/member of a frequent flyer program or similar reward program by any commercial airline company. This means if you redeem for a family member as a nominee and they cannot make it for valid reasons, the loss of frequent flyer points will not be covered even if they got any of these insurance policies.

Here are the 4 options you can choose from:

Lite | Plus | Prestige | |

Yes | Yes | Yes | |

Add New | Add New | Read Policy Here | |

Classic | Deluxe | Suite | |

S$100 | S$500 | S$750 | |

Add New | Read Policy Here | ||

Add New | Add New | Add New | |

Standard | Enhanced | Supreme | |

N/A | S$500 | S$750 | |

Add New | Add New | Read Policy Here | |

Add New | |||

Classic | Premier | ||

S$100 | S$300 | ||

Read Policy Here | |||

Classic | Deluxe | Platinum | |

S$10,000 | S$15,000 | S$15,000 | |

Family Limit: | S$25,000 | S$37,500 | S$37,500 |

Limited ONLY to these situations:

- Do note that you can only be compensated if the miles or points cannot be recovered, meaning, if recovering them is possible by paying a cancellation fee, the value of the miles or points cannot be claimed under your travel insurance. Also, it must be cancelled due to these reasons:

- Death, injury or illness of the Insured Person or his spouse, child, parent, parent-in-law, grandparent, grandchild, brother, sister or travel companion

- Major unexpected event which prevents the insured person from travelling to his main destination-

- Strike, riot or civil commotion, natural disaster, or events arising out of circumstances beyond your control

- Serious damage to the insured person’s permanent place of residence

- Called as a witness in the Court of Law in Singapore or the compulsory quarantine of the insured Person or his travel companion or his relative.

- Closure of airspace or airport closure which prevents you from commencing or continuing Your scheduled trip

Conclusion:

In conclusion, Singlife appears to be the only travel insurance provider that reimburses the full retail price of your ticket, if the ticket, purchased with points, cannot be recovered. For example, if you redeem a S$4,000 business class ticket using points, Singlife would cover the entire amount, whereas other insurers might only reimburse up to the sum insured (eg. S$750 for Etiqa Travel Infinite Suite). On the other hand, Direct Asia is the only one that specified inclusion of Family Plan.

How to ensure you receive your rewards after sign up?

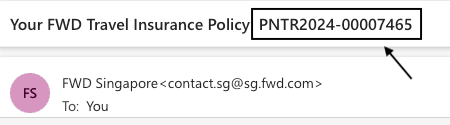

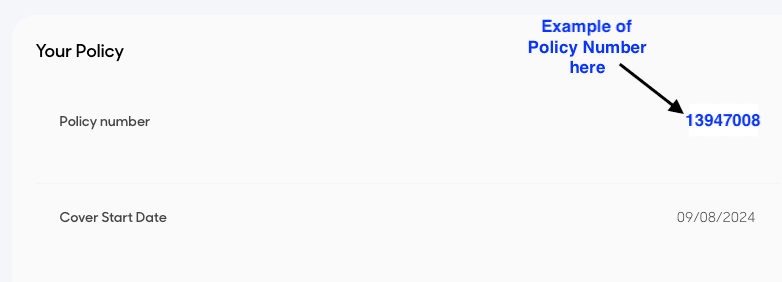

Step 1: After you have purchased your travel insurance, you should receive your policy number which could look something like this:

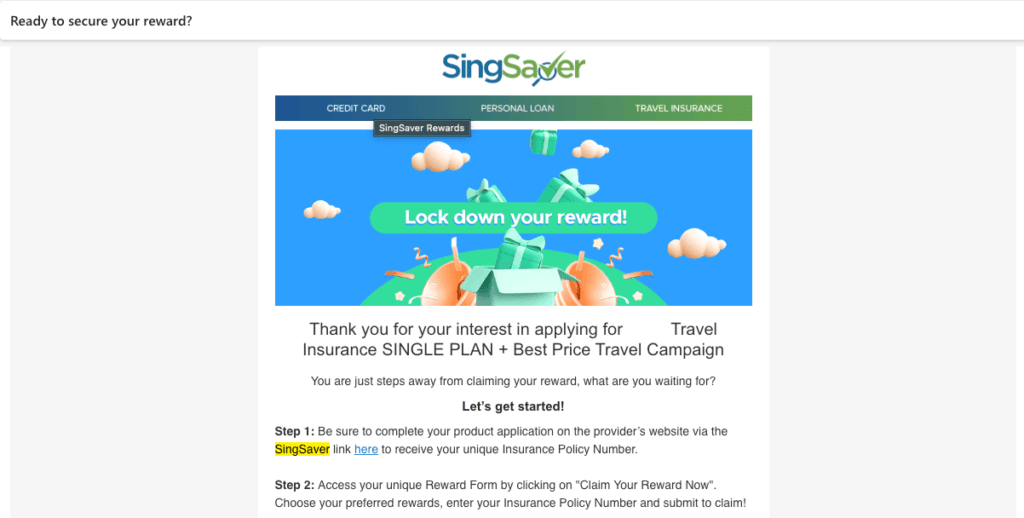

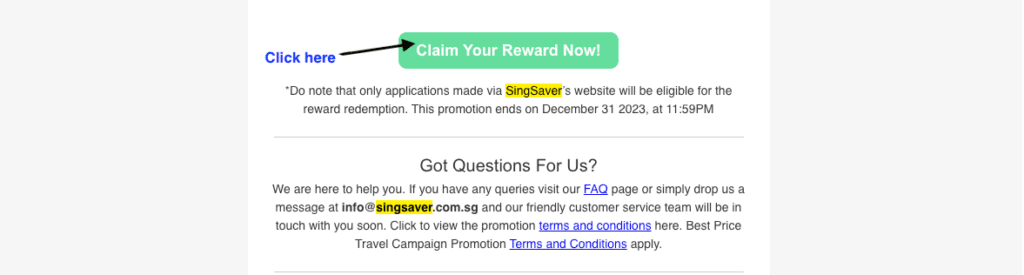

Step 2: You should have received the below email titled “Ready to Secure Your Reward?” from no-reply@singsaver.com.sg. Proceed to click “Claim Your Reward Now“:

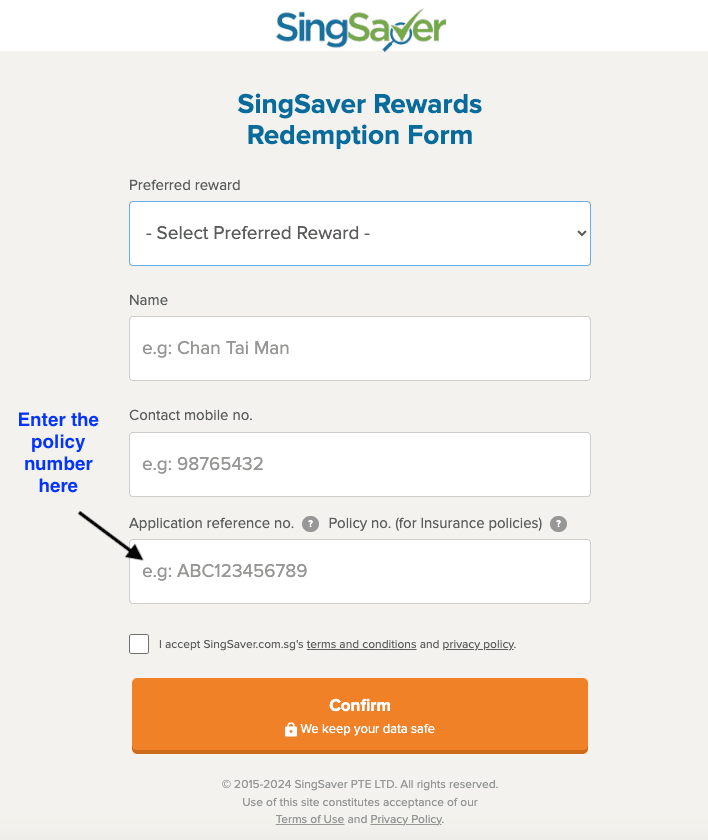

Step 3: Fill up your details with your policy number and click “Confirm“. And you are good to go.

If you fulfill the conditions set forth for the rewards, you can expect your rewards redemption notification to be sent to your email once the terms are fulfilled

💳 Credit cards change their T&Cs every so often and it is difficult to stay updated. That’s why I created a Telegram Broadcast where you can receive timely bite-sized updates to get the most out of your spending.

💡 We believe in always paying our credit card bills on time and in full. It is only by doing that, can we fully maximise our credit card benefits.