Ever wondered how much your overseas transactions really cost? Starting March 2025, the MariBank app will show you—instantly. You can now track FX fees and cashback in real time, so you always know what you’re paying and earning.

Unlimited Cashback, No Fuss

With the Mari Credit Card¹, you enjoy:

✔ unlimited 1.7% cashback on local purchases⁴

✔ unlimited 3% cashback in the form of Shopee coins²

✔ unlimited 3% cashback on foreign currency spending³ (valid until 31 December 2025)

But let’s be real—if there’s a 3% foreign currency fee, does the cashback actually cancel it out?

Understanding the 3% Foreign Exchange Fee:

The Mari Credit Card applies a 3% fee on foreign transactions, but this is lower than the market average of 3.25%, making it one of the more competitive choices for credit cards in Singapore.

Here’s the best part: MariBank is absorbing the 3% FX fee and giving it back to you as cashback. That means every dollar you spend overseas comes with no extra cost.

New Feature: See FX Fees & Cashback in Real Time

With the new MariBank app update, you’ll now see exactly how your cashback offsets the FX fee—right after your transaction is processed.

Every overseas transaction will display:

✔ Original transaction amount in foreign currency

✔ Converted amount in SGD using Mastercard’s exchange rate

✔ Foreign currency fee

✔ Cashback earned—directly offsetting the 3% foreign exchange fee

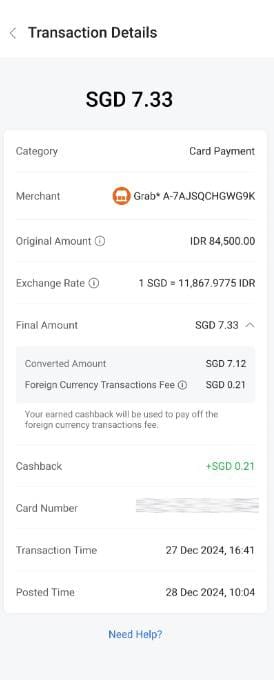

As seen in below example:

Transaction Detail | Amount |

Original amount (IDR) | IDR 84,500 |

Converted to SGD (Mastercard rate) | SGD 7.12 |

Foreign currency fee (3%) | SGD 0.21 |

Cashback earned (3%) | SGD 0.21 |

Final cost after cashback | SGD 7.12 (No extra fees!) |

This means your final cost is exactly what you spent—no extra charges, no hidden fees.

Enjoy up to 4.5% Cashback on eligible overseas spend

From 1 Mar 2025 to 30 Jun 2025, use your Mari Credit Card on overseas transactions and enjoy $0 foreign currency fees* PLUS up to +1.5% Bonus Cashback

Get more rewards based on your total eligible overseas spend per month, up to the first S$1,500.

*3% unlimited cashback on overseas card spend fully offsets foreign currency fees of 3%

This promotion is available to all new and existing Mari Credit Card users.

Final Verdict: Is the Mari Credit Card Worth Using Overseas?

With no annual fees, unlimited cashback, and real-time tracking, the Mari Credit Card is a straightforward option for everyday spending, whether at home or abroad. Now that you can see exactly how FX fees and cashback balance out, it’s easier to track your overseas spending—with no unexpected costs.

So would you use this card for your next overseas trip? Comment below!

Want to Sign-up for a Mari Credit Card?

- Get up to 13% Welcome Cashback when you spend S$300 on Eligible Transaction(s) within 30 days of card approval

- You must be among the first 50,000 New Mari Credit Card Holders

- Must be a new-to-bank customer

- Valid until 30 April 2025

- For more information on the promotion, please refer to: https://www.maribank.sg/promo

- Note: Shopee purchases via Mari Credit Card Instant Checkout is not eligible for the reward

Mari Credit Card

Use Code: 2OJA50ZV

Earn 3% Unlimited Shopee Coins with Mari Credit Card Instant Checkout (until 31 December 2025 only) and 1.7% Unlimited Cashback on eligible card spend

So would you use this card for your next overseas trip? Comment below!

Terms and Conditions:

1.7% Unlimited Cashback (Local Spend)

3% Unlimited Cashback (Overseas Spend)

3% Shopee Coins on Shopee Spend with Mari Credit Card

MariBank Cardmembers’ Agreement

Disclaimers:

¹The only credit card in Singapore offering the highest unlimited Shopee Coins on Shopee spend via Mari Credit Card Instant Checkout and the highest unlimited cashback rates with no cashback cap or minimum spend requirements for eligible card spend (excludes promotional rates that other banks may offer from time to time). Information is correct as at May 2024. For full Mari Credit Card Terms and Conditions, please visit our website.

²Awarded in Shopee Coins for eligible transactions using the Mari Credit Card Instant Checkout payment method on Shopee. Promotion will end on 31 Dec 2025.

³Only applicable for eligible card spend in foreign currencies (non-Singapore Dollars), less any applicable interest, fees, and charges such as foreign currency transaction fees. For more information, please refer to Mari Credit Card Foreign Currency Spend 3% Unlimited Cashback Promotion Terms and Conditions.

⁴Only applicable for eligible card spend in Singapore Dollars. Please refer to the Terms and Conditions Governing Cashback For Mari Credit Card for transactions that are not eligible for Cashback.