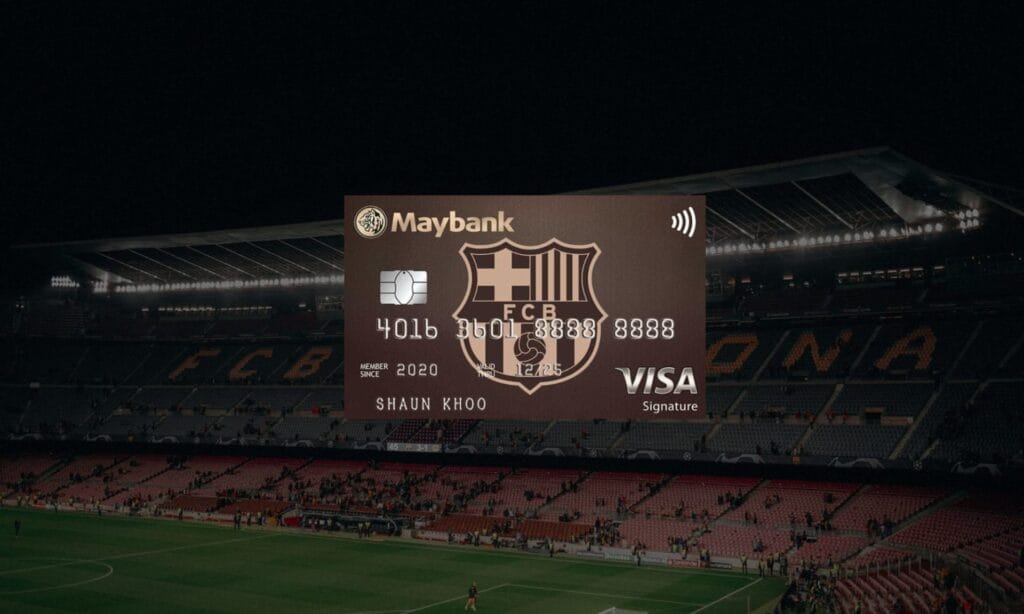

Maybank FC Barcelona Card

Earn 1.6% unlimited cashback on local purchases

Maybank FC Barcelona Card Overview:

Maybank FC Barcelona Visa Signature card is a good option even if you are not a FC Barcelona fan. This is a great card with a unique proposition if you do most of their spending locally. You can earn 1.6% unlimited cashback with no minimum spend on local purchases, 2x TREATS points for overseas spends, also, you can get a chance to win a trip for 2 to catch FC Barcelona LIVE every football season!

Eligibility & Fees:

- Minimum Age: 21 years old

- Minimum Annual Income: S$30,000 (locals/PRs); S$60,000 (foreigners)

- Annual Fee: S$120, 2 years waived (subsequent annual fee will be waived if you spend S$10,000 annually)

Key Benefits:

- Earn 1.6% unlimited cashback on local and overseas purchases

- No minimum monthly spending required

- No maximum spending cap

- 5% Discount at the FCBotiga official store in Camp Nou.

- Complimentary travel insurance coverage of up to S$300,000 when air tickets or travel packages are charged in full to the card.

- Earn 0.3% Cashback on selected categories:

Categories | MCC |

Real Estate Agents and Managers – Rentals | 6513 |

Educational Institutions / Schools | 8211, 8220, 8241, 8244, 8249, 8299

|

Hospitals / Medical / Pharmacy | 8062, 4119, 5047, 5122, 5912, 5975, 5976, 8011, 8021, 8031, 8041, 8042, 8043, 8049, 8050,8071, 8099

|

Business Services (Not elsewhere classified) | 7399

|

Utilities | 4900 |

How to Best Optimise it:

Best Used on General Local and Overseas Purchases

- If you want a single card that can reward both local and overseas transactions, this card is a simple and hassle-free option to use. Especially that there’s no spending requirement and cap and minimal exclusions.

Rare Use Case For School Fees

- While most credit cards exclude educational institutions, Maybank cards doesn’t exclude Education Fees. Therefore, you can use this card for your school fees to earn 0.3% cashback. While it was nerfed from 1.6% cashback, it is worthy to note that this is one of the few cards that rewards on educational fees. Refer to Best Credit Card For Education to check on eligibility and conditions relating to the educational institution.

What to Avoid:

Exclusion List:

- Payments made to government institutions and services (court cases, fines, bail and bonds, tax payment, postal services, parking lots and garages, intra-government purchases and any other government services not classified here)

- Betting or gambling transactions

- Brokerage/securities transactions

- Payment to insurance

- Transactions classified under the following Merchant Category Codes(“MCC”):

- Financial Institutions – Merchandise, Services, and Debt Repayment (MCC 6012)

- Non-Financial Institutions – Foreign Currency, Non-Fiat Currency (for example: Cryptocurrency), Money Orders (Not Money Transfer), Account Funding (not Stored Value Load), Travelers Cheques, and Debt Repayment (MCC 6051)

- Non-Financial Institutions – Stored Value Card Purchase/Load (MCC6540)

- Transactions made via AXS and SAM

- FlexiCash, FlexiPay, 0% Interest Instalment Plans, funds transfers, cash advances, finance charges, late payment charges, annual fees, reversals, Interest charges, any other miscellaneous charges charged by the Cardmember, or payment of funds to prepaid accounts listed below.

- Effective 1 July 2025, these will be excluded:

-

- MCC 7523 – Automobile Parking Lots & Garage

- MCC 8651 – Political Organisations

- MCC 8661 – Religious Organisations

- MCC 8398 – Charitable and Social Services Organisations

Past Buffs/Nerfs:

Buffs:

- Instead of earning TREATS Points, you can now earn 1.6% cashback on overseas purchases effective 1 July 2025

Nerfs:

- Effective 1 July 2025, you can only earn 0.3% cashback on selected categories:

Categories | MCC |

Real Estate Agents and Managers – Rentals | 6513 |

Educational Institutions / Schools | 8211, 8220, 8241, 8244, 8249, 8299

|

Hospitals / Medical / Pharmacy | 8062, 4119, 5047, 5122, 5912, 5975, 5976, 8011, 8021, 8031, 8041, 8042, 8043, 8049, 8050,8071, 8099

|

Business Services (Not elsewhere classified) | 7399

|

Utilities | 4900 |

- These MCCs are added to the exclusion list:

- MCC 7523 – Automobile Parking Lots & Garage

- MCC 8651 – Political Organisations

- MCC 8661 – Religious Organisations

- MCC 8398 – Charitable and Social Services Organisations

Is it Worth it:

Advantages:

- High cashback for local spending

- Able to pay for education institution fees and earn unlimited cashback

- Special FC Barcelona perks

- Complimentary travel insurance coverage

Disadvantages:

- Low miles (with fx fee) for overseas spend

- FC Barcelona specific perks might not be relevant for everyone

Frequently Asked Questions:

How do I redeem my TREATS: Simply download the Maybank TREATS SG app and login with your Online Banking Username and Password to view or redeem your TREATS Points.

Final Thoughts:

Overall, the Maybank FC Barcelona Visa Signature card is a solid choice for those who want a straightforward cashback card and spend a lot locally without the pressure to hit a minimum monthly spend requirement. It caught my attention where I saw that it does not have any exclusions for school fee payments, allowing you to earn unlimited cashback on your school fees. This card will be ideal for those who want to earn some cashback on education fees, and even after you pay off your education fee, it still makes a great general spending card with VERY minimal exclusions. Definitely a rare gem.

If this has benefitted you, without any cost to you, feel free to use my referral link and fill out the google form to help me sustain this blog and create more independent reviews like that so that we can huat together. Alternatively, use your friend’s referral code.

💳 Credit cards change their T&Cs every so often and it is difficult to stay updated. That’s why I created a Telegram Broadcast where you can receive timely bite-sized updates to get the most out of your spending.

💡 We believe in always paying our credit card bills on time and in full. It is only by doing that, can we fully maximise our credit card benefits.