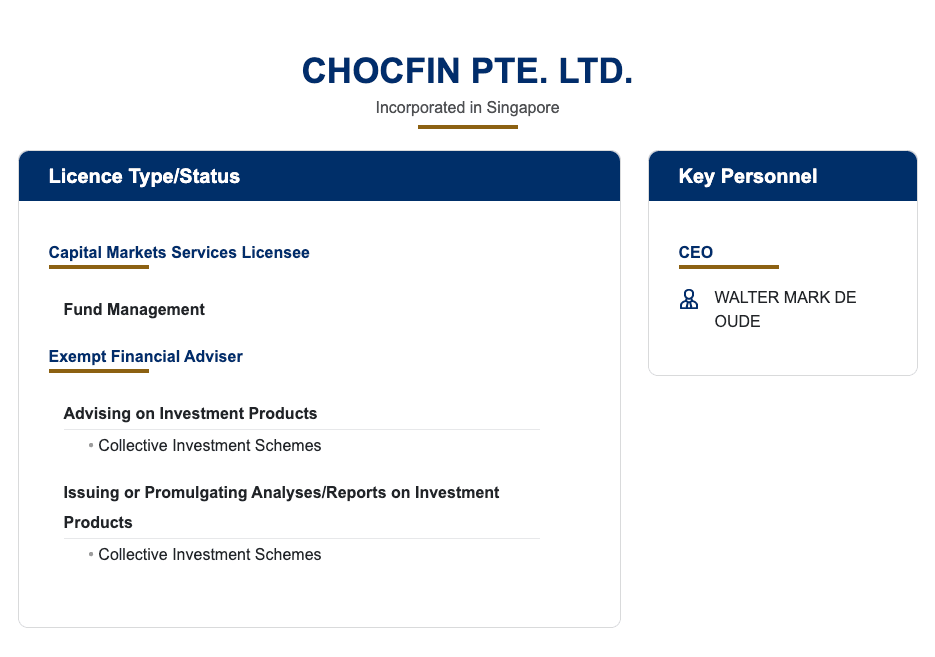

Chocolate Finance came burst into the scene with a radical 4.2% p.a interest for your first S$20K deposit over the past year. I waited for them to have their MAS license before I covered it in my TikTok and blog.

What is the current program?

- For the promotional period, you can receive a guaranteed* 4.2% p.a. return on your first S$20K, regardless of how the underlying investments perform. *This is because Chocolate Finance will “top up” the difference if the underlying funds perform below 4.2% p.a return.

- This promotion was supposed to last till either 31 December 2024, or when the assets under management reaches S$500M, whichever comes first.

- Beyond S$20,000 deposit, you will receive a target 3.5% p.a return (no top-ups). There’s no guarantees here, so the returns will depend on the performance of the portfolio.

- Therefore, i had only deposited slightly under S$20K so that my total balance is covered under the top up program.

What is the upcoming change?

From the 1st of November, you will enjoy 4.2% 3.6% p.a. on balances up to S$20k and 3.2% p.a. on your next S$30k. This is covered under their Top-up programme where if they don’t make the target on your first S$50k, the difference will be topped up during the Qualifying Period (which has been extended to the 31st March 2025 or until we reach S$1 billion AUM).

Recap: what are they investing in?

- Mostly short-term, investment-grade bond funds.

- These are generally considered low-risk investments due to the short loan terms and the creditworthiness of the borrowers.

- The Chocolate Finance managed account is a new portfolio of fixed-income securities comprising of a collection of funds. The portfolio is currently made up of:

- Dimensional STIG SGD

- UOBAM United SGD Fund

- Fullerton Short Term interest rate fund (SGD)

- Lion Global

- These funds from Chocolate Finance’s portfolio are relatively safe and unlikely to default – You can do your own research to find out more.

- These may change at the sole discretion of the portfolio manager. In your app you will be able to see the information on each fund and the percentage of money allocated to them.

Why this is good:

- No lock-in period.

- No hoops to jump through. Just put your money in and start seeing daily returns on your first S$50k the very next day.

- No minimum deposit required.

How fast is withdrawals?

Withdrawals up to S$20,000 are instant, while larger amounts take 1-5 business days.

Risk you must know:

Company Risk: Chocolate Finance is MAS-licensed and client assets are held separately. In the unlikely event that the company shuts down, you would not lose the underlying investments themselves (held by HSBC and State Street). Instead your assets held under custody will be returned to you.

This is not financial advice.

A gentle reminder that this is an investment, not a savings account. Even though it is not capital guaranteed with no SDIC insurance, but the risks are relatively low to me.

My Personal Strategy:

Previously, I have parked S$20K for my mom and I each in our own accounts as it helps me get some extra interest without needing to jump through hoops. For someone like my mom, who is unable to fulfill the minimum spending of S$500 for a UOB One Account, I evaluated that this is a good place for me to park her excess cash.

Will anything change for me?

Nothing. I will still maintain funds slightly under 3.2% p.a as the interest given for the next S$30K is not as attractive to me. There are other ways to earn higher returns at the moment. This might change tho.

If you would like to sign up, free free my referral link below to download the app then sign up and paste this link https://share.chocolate.app/nxW9/opwqalo6 if a code is required.

💳 Credit cards change their T&Cs every so often and it is difficult to stay updated. That’s why I created a Telegram Broadcast where you can receive timely bite-sized updates to get the most out of your spending.

💡 We believe in always paying our credit card bills on time and in full. It is only by doing that, can we fully maximise our credit card benefits.