CardUp just launched a new promotional offer specifically for Mastercard users. This promo significantly lowers the service fees you’d typically pay, bringing them down to an attractive range of just 1.67% from the usual 2.6%.

Why is this a big deal? Well, CardUp recently had a promotion for Visa cards with a 1.75% fee. This new Mastercard offer undercuts that, meaning if you’re a Mastercard holder, you could be paying less to get rewards with using your card for things like rent, taxes, etc through CardUp

Maximise Your New User Benefits First On Cardup or iPayMy

If you’re new to these platforms, use these codes on other payments (e.g. insurance, rent, education) to maximise your first-timer discount before using the tax promo codes:

- New Users:

- CardUp: Use code PINING,AGNESN515 (including the comma “,”) to get $30 off your first payment (sweet spot payment amount: $1,154).

- iPayMy: Sign up via this link to get $30 off (sweet spot payment amount: $1,250).

Then after which, you can use this code to take advantage of the Mastercard tax promotion.

- Existing Users:

- Use MCTAX25 and get 1.67% fee

- Valid for Mastercard cards

- No minimum payment required

- Only for the first 1,500 users— the code will be invalid if it already reached 1,500, you’ll see before payment confirmation

- Up to S$5,000 only, after which, 2.6% fee applies

- Schedule by 31 August 2025, 6PM

- Payment due date must be on or before 25 March 2026

- T&Cs here

- Use MCTAX25 and get 1.67% fee

How To Calculate Cost Per Mile:

For an admin fee for CardUp is 1.67%, with a 1.4 miles per dollar card and a tax amounting to S$1,000, here is the calculation:

Amount x Admin fee = Service Fee

S$1,000 x 0.0167 = S$16.7 service fee

Amount x (1 + Admin Fee) x Earn Rate = Miles Earned

S$1,000 x (1+0.0167) x 1.4 miles per dollar = 1,424 Miles

Service Fee / Miles Earned = Cost per Mile

S$16.7 / S$1,424 = 1.17¢ cost per mile

Here are the credit cards that can earn you either miles or cashback via Cardup:

Tip: Make Monthly Recurring Income Tax Payments over 12 months To Maximise Cashflow

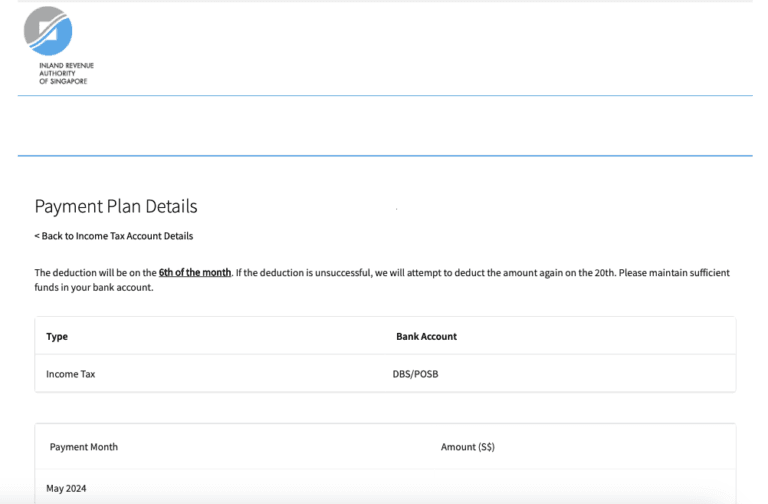

Step 1: Make a GIRO arrangement with IRAS first.

As you can see the deduction from your bank account will be on the 6th of the month, so you just need to arrange for Cardup to make payments before the deduction happens.

Step 2: Follow the steps above and schedule the monthly recurring payments a week BEFORE the deduction date (in my case, 6th of every month)

Below will be the step-by-step guide for Cardup and iPayMy:

How to pay income tax with credit card using CardUp:

Sign Up for an account

2. Schedule a payment by selecting Income Tax payment type under the Taxes payment category

3. Select the recipient

4.Fill out details such as payment amount, choose the card and select “Standard payment“

5. Schedule a monthly recurring payment (more on that later)

6. Key in your IC Number, enter promo code below and click “Continue”:

- For new users, use code PINING,AGNESN515 (including the comma “,”) for S$30 off your first payment to maximise your rewards

7. Submit your documents

- Statement of Account showing your Name, NRIC, Outstanding balance and Date of outstanding balance

After all that, you’re good to go!

- Some photos and Information are from cardup.co

Your dashboard will show the scheduled payments like this:

How to pay income tax with credit card using iPayMy:

Sign Up for an account on iPayMy to get S$30 off

On the dashboard’s upper right, click “Make a Payment”, then select “Tax”

3. Enter the details for your tax bill

4. Choose the Schedule Type whether One-Time or Recurring

- For recurring payment, you need to set up a GIRO arrangement and schedule your payments at least 7 working days before the IRAS debit date each month. If you pay early, IRAS won’t take the payment, as it sees your account is up to date. But you must keep the GIRO arrangement active, or IRAS will ask for the full tax payment.

5. Choose your Payment Date, but note that your card will be charged a few days earlier

6. On the Payment Details screen, you’ll choose the saved credit card you’d like to use, and the standard ipaymy fee of 2.4% will be shown.

7. If you signed up via my referral link, you should have an email (check spam/junk mail) that looks like this, with the promo code that you should enter.

8. Once you applied the code, you should see S$30 deducted off the service fee.

💳 Credit cards change their T&Cs every so often and it is difficult to stay updated. That’s why I created a Telegram Broadcast where you can receive timely bite-sized updates to get the most out of your spending.

💡 We believe in always paying our credit card bills on time and in full. It is only by doing that, can we fully maximise our credit card benefits.