UOB One Card Overview:

The UOB One Credit Card offers up to 10% cashback on your daily favourites, such as McDonald’s, Grab, Shopee, SimplyGo and the newset category which is Grocery! You can also enjoy fuel savings of up to 22.66% at Shell and SPC. Plus, you can earn 5% p.a. interest on your savings account when you pair your UOB One Credit Card with a UOB One Account.

Eligibility & Fees:

- Minimum Age: 21 years old

- Minimum Annual Income: S$30,000 (locals/PRs); S$40,000 (Foreigners)

- Applicants who do not meet the minimum income requirement can submit a minimum Fixed Deposit Collateral of S$10,000.

- Annual Fee: S$196.20, waived for the first year

Key Benefits:

- Tier 1 & 2: Spend either S$600 or S$1,000/month for 3 consecutive months, with at least 10 eligible transactions each month:

- Base cashback:

- S$600/S$1,000: 3.33% cashback (capped at S$60/100 per quarter)

- Additional cashback (capped at S$120 per statement month):

- Selected Partners: 5%

- Grocery (MCC 5411): 2.67% – only for Tier 2

- Base cashback:

- Tier 3: Earn up to 10% Total Cashback: Spend S$2,000/month for 3 consecutive months, with at least 10 eligible transactions each month:

- Base cashback: 3.33% cashback (capped at S$200 per quarter)

- Additional cashback (capped at S$120 per statement month):

- Selected Partners: 6.67%

- Grocery (MCC 5411): 4.67%

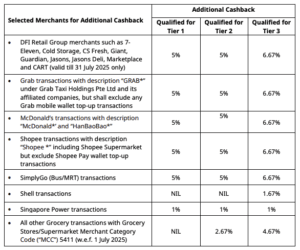

Tier 1 | Tier 2 | Tier 3 | |

Minimum Spend | S$600 | S$1,000 | S$2,000 |

Minimum Transaction Count | 10 | 10 | 10 |

Base Cashback per quarter | 3.33% (S$60 cashback) | 3.33% (S$100 cashback) | 3.33% (S$200 cashback) |

Additional Cashback on Selected Spends | 5% | 5% | 6.67% |

Additional Cashback on Grocery Spend New | – | 2.67% | 4.67% |

Total | up to 8.33% | up to 8.33% | up to 10% |

These changes will be effective from your next qualifying quarter (as of writing – 1 July 2025) | |||

- Earn up to 22.66% fuel savings at Shell and SPC

- Earn 4.33% cashback on Singapore Power utilities bills

How to Best Optimise it:

Good Use For Regular Consistent Spending With Some Level Of Tracking:

- You will minimally get 3.33% cashback. The only part that you need to take note is that it needs to be consecutive monthly spending. This means, if you spend S$1,000 in month 1, you would need to spend S$1,000 in month 2 and 3 to qualify for Tier 2 quarterly cashback (i.e. S$100). If you spend S$1,000 in month 1, then S$600 in month 2 and 3, then you will only qualify for Tier 1 quarterly cashback (i.e S$60). Do note that everyone’s quarter is different and it is dependent on your card opening month. (See “How to Earn the Quarterly Cashback” below)

Best Use for These Eligible Merchants For Additional Cashback On Top of 3.33%:

-

Do note that DFI Retail Group and UOB Travel will no longer be eligible for bonus cashback from 1 August 2025. On the bright side, a new Grocery category (MCC 5411) has been added, covering a wide range of supermarkets — a valuable inclusion for many cardholders. However, this only applies to Tier 1 and Tier 2. Also, the cashback cap for “Additional Cashback” is increased from S$100 to S$120, giving you more room to earn.

How to Earn the Quarterly Cashback?

- Spend According To Your Card’s Quarterly Cycle, Not The Calendar Quarterly Cycle:

-

- Note that the monthly spend is based on your statement period:

- Example 1: If your statement is generated on 30th, your monthly spend for January will be from 1 January to 30 January

- Example 2: If your statement is generated on 15th, your monthly spend for January will be from 16 December – 15 January

- The spend quarter is a 3-month period base on your first 3 statements, if your card is issued in February, these are your spend quarters:

- Spend quarter #1: Feb, Mar, Apr

- Spend quarter #2: May, Jun, Jul

- Spend quarter #3: Aug, Sep, Oct

- Spend quarter #4: Nov, Dec, Jan

- Note that the monthly spend is based on your statement period:

- To find out when is your card issued, you can refer to the physical card for your anniversary month as a reference.

Avoid Squeezing Your Spending To The Last Few Days Of The Month:

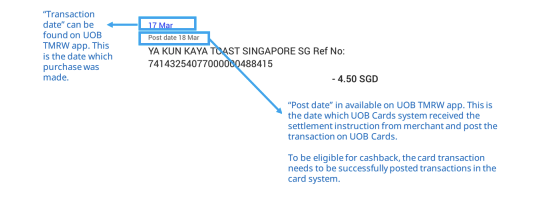

- Your spending is calculated and counted into the spend conditions for the month when your transaction is successfully charged AND posted on the Bank’s systems (See below picture). This means that if you spend on 31st Jan, it will likely not get posted on the same day, even for contactless spending. It usually take a few days. So technically, it’s best to hit your minimum spending a few days before the end of the month as it takes time for the transaction to get posted.

What to Avoid:

Exclusion List:

(a) any cash advances;

(b) any interest, fees and charges (including without limitation, late payment charges or interest charges, annual or monthly fees or charges) imposed by the Bank;

(c) balance and/or funds transfers to or from the Card Account;

(d) any credit card transaction that was subsequently cancelled, voided or reversed for any reason;

(e) monthly instalments under 0% Instalment Payment Plan and SmartPay;

(f) amounts approved under the UOB Payment Facility and any associated fees or charges

(g) any Grab mobile wallet top-up transactions;

(h) any Shopee Pay wallet top-up transactions;

(i) any payment made with the following Merchant Category Codes (“MCC”);

MCC | Description |

4829 | Wire Transfer/Remittance |

5199 | Nondurable Goods |

5960 | Direct Marketing – Insurance Services |

5965 | Direct marketing –Combination Catalog and Retail Merchants (wef 1 October 2024) |

5993 | Cigar Stores and Stands (wef 1 October 2024) |

6012 | Member Financial Institution–Merchandise and Services |

6050 | Quasi Cash–Financial Institutions, Merchandise and Services |

6051 | Quasi Cash–Merchant (Non-Financial Institutions – Foreign Currency, Non-Fiat Currency, Cryptocurrency) |

6211 | Securities–Brokers and Dealers |

6300 | Insurance Sales/Underwrite |

6513 | Real Estate Agents & Managers – Rentals |

6529 | Quasi Cash-Remote Stored Value Load-Financial Institute Rentals |

6530 | Quasi Cash-Remote Stored Value Load-Merchant Rentals |

6534 | Quasi Cash-Remote Money Transfers |

6540 | Stored Value Card Purchase/Load |

7349 | Clean/Maint/Janitorial Serv aka Property Management |

7511 | Quasi Cash – Truck Stop Trxns |

7523 | Automobile Parking Lots and Garages |

7995 | Gambling – Betting, including Lottery Tickets, Casino Gaming Chips, Off-Track Betting, and Wagers at Race Tracks |

8062 | Hospitals |

8211 | Schools, Elementary and Secondary |

8220 | Colleges, Universities, Professional Schools and Junior Colleges |

8241 | Schools, Correspondence |

8244 | Schools, Business and Secretarial |

8249 | Schools, Trade and Vocational |

8299 | Schools and Educational Services–Not Elsewhere Classified |

8398 | Charitable and Social Service Organizations |

8661 | Religious Organizations |

8651 | Political Organizations |

8699 | Membership Organizations (Not Elsewhere Classified) (wef 1 October 2024) |

8999 | Professional Services (Not Elsewhere Classified) (wef 1 October 2024) |

9211 | Court Costs including Alimony and Child Support |

9222 | Fines |

9223 | Bail and Bond Payments |

9311 | Tax Payment |

9402 | Postal Services—Government Only |

9405 | Intra-Government Purchases—Government Only |

9399 | Government Services—not elsewhere classified |

AXS* | PLUS500UK LIMITED |

AMAZE* (wef 1 October 2024) | Saxo Cap Mkts Pte Ltd |

AMAZE* TRANSIT* (wef 1 March 2022) | SKR*PLUS500CY LTD |

EZ Link* | SKR*SKRILL.COM |

EZLINK* | TRANSIT* |

EZ-LINK* | WWW.IGMARKETS.COM.SG |

EZLINKs* | WWW.MYEZLINK.COM.SG |

FlashPay* | WWW.PLUS500.CO |

NETFLASHPAY* | IPAYMY* (wef 1 August 2022) |

MB * MONEYBOOKERS.COM | RWS-LEVY* (wef 1 August 2022) |

OANDA ASIA PAC* | SMOOVE PAY* (wef 1 August 2022) |

OANDAASIAPA | SINGPOST-SAM* (wef 1 August 2022) |

PAYPAL* PLUS500 | RazerPay* (wef 1 August 2022) |

PAYPAL* PLUS500.COM | NORWDS* (w.e.f. 21 Jul 2024) |

PAYPAL * BIZCONSULTA | CardUp* |

PAYPAL * OANDAASIAPA | |

PAYPAL * CAPITALROYA | |

PLUS500 |

Past Buffs/Nerfs:

Buffs:

- Effective 1 July 2025:

- the additional cashback cap is increased from S$100 to S$120 monthly

- an added additional cashback category: Groceries (MCC 5411) for Tier 2 & 3

Nerfs:

- Effective 1 July 2025 (by the next qualifying quarter for existing):

- the minimum spend for Tier 1 will be increased to S$600, capped at S$60.

- transaction count is increased from 5 to 10 per month

- Effective 1 August 2025:

- UOB Travel and DFI Retail Group (7- Eleven, Cold Storage, CS Fresh, Giant, Guardian, Jasons, Jasons Deli, Marketplace and CART) will no longer earn cashback.

Is it Worth it:

Advantages:

- 3.33% base cashback on all qualifying retail spend – so you know minimally, you will get 3.33% cashback without tracking

quite easy requirements of 5 transactions per month – just take bus/mrt rides 5 times!- can double dip on UOB One Account interest with one spending

- Great for petrol savings with SPC

Disadvantages:

- need three months of consistent spending to get quarterly cashback

- after the update, must perform 10 transactions

- AXS payments are excluded from all rewards

- Cashback is based on S$600, S$1000 and S$2000. Even if you spend S$800, you will only get cashback based on S$600 tier.

Frequently Asked Questions:

- Does utility bills qualify for cashback and UOB One account interest minimum spend: Yes if you do not pay via AXS. Download SP App and pay via the app directly.

- Are insurance eligible for cashback and does it count into the min spend for cashback on UOB One Credit Card?: No, transactions tagged under MCC 6300 (Insurance Sales/Underwrite) are not considered as purchases, hence, they are not eligible for cashback and will not count into the minimum spend accumulation for cashback. You may refer to uob.com.sg/onetncs for the full list of exclusions. However, card spend tagged under insurance are eligible to earn bonus interest for UOB One Account.

Final Thoughts:

This card is a perfect complementary credit card to UOB One account holders who may just want to hit the lowest minimum spend requirement to get the highest interest on their savings account. After hitting the minimum spend requirement, you can move on to using your other credit cards for higher cashback.

💳 Credit cards change their T&Cs every so often and it is difficult to stay updated. That’s why I created a Telegram Broadcast where you can receive timely bite-sized updates to get the most out of your spending.

💡 We believe in always paying our credit card bills on time and in full. It is only by doing that, can we fully maximise our credit card benefits.