From 11 February 2025, you can earn 2 miles for every S$1 spent on almost anything, anywhere, with your Chocolate Visa Debit Card. You’ll earn 2 miles per dollar on your first S$1,000 of monthly spend, and after that, continue earning 0.4 miles per S$1. Whether you’re shopping locally or traveling abroad, your Chocolate Visa Debit Card rewards you on every transaction. But as of 1 July 2025, this will be reduced to 1 mile per dollar and bill payments are capped at 100 miles per month

Even better, you can earn miles on payments for things typically excluded from most rewards programs, like insurance, charity donations, utilities, education fees, and AXS Bills. Chocolate Visa Debit Card brings you closer to your rewards, whether it’s for everyday purchases or bigger bills.

Since this is a debit card, almost everyone can apply and start collecting miles right away.

Key Benefits of the Chocolate Visa Debit Card:

- 1 Max Mile per dollar on the first S$1,000 spent each month

- 0.4 Max Miles per S$1 after S$1,000 spend

- Earn miles on insurance payments, charity donations, utilities, education fees, and AXS Bill payments

- Bill Payments refer to the following MCCs (capped at 100 miles per month):

- 80 Medical & Health (MCC 8011–8099)

- 93 Government Services (MCC 9311–9399)

- 49 Utilities (MCC 4900–4999)

- 65 Real Estate & Property Management (MCC 6513, 6531)

- 63 Insurance (MCC 6300–6399)

- 73 Business Services (MCC 7311–7399)

- Bill Payments refer to the following MCCs (capped at 100 miles per month):

- Zero foreign exchange fees — Visa’s exchange rates are passed directly to you with no hidden fees or markups

Plus, Earn Up To 5 Miles Per Dollar On SimplyGo

HeyMax often runs limited-time promotions that help you rack up even more miles. For example, there’s currently an offer where you can earn an extra 3 miles per dollar on bus and MRT rides when using any Visa debit or credit card. The campaign will conclude on 28 February 2025 or once a total of 1 million Max Miles have been accumulated by all HeyMax users through the campaign, whichever occurs first. Combine this with the Chocolate Visa Debit Card, and you can earn a total of 5 miles per dollar on your rides! Stay updated with the latest deals and rewards by subscribing to my Telegram channel.

What is HeyMax?

If you’re new, HeyMax is a miles rewards platform similar to Shopback, but instead of cashback, you earn Max Miles on your spending. These Max Miles never expire, and you can transfer them to over 28+ partners at a 1:1 ratio with no transfer fees. This means 1 Max Mile = 1 mile.

Please note, Singapore Airlines KrisFlyer is not currently a transfer partner. However, I plan to explore and share insights on other transfer partners in the future, so make sure to subscribe for updates!

What is Chocolate Finance?

Chocolate Finance is a managed account by Choc Fin Pte Ltd, licensed by the Monetary Authority of Singapore. The Chocolate Visa Debit Card is linked to your Chocolate Finance account. As it is not a bank, it is not SDIC insured.

I covered about it previously, however, the rates have reduced ever since.

the current rates right now are:

- 3.3% p.a. (drop to 3% effective 1 June 2025) on the first S$20,000 (*guaranteed)

- 3% p.a. (drop to 2.7% effective 1 June 2025) on the next S$30,000 (*guaranteed)

- A target 3% p.a. (drop to 2.7%) on any amount above that

The above guarantee rate is covered by their Top-up programme, where they invest your money into short-dated fixed income funds and money market funds. If they are unable to generate the target returns on 3.3% p.a on the first S$20,000 and 3% p.a on the next S$30,000, the difference will be topped up by them. That’s why it’s guaranteed, in a way. However, the target 3% p.a is not guaranteed.

Note: At the time of writing, I have no funds in the Chocolate Finance account, and I don’t intend to deposit money at the moment.

Take note of the debit card risk!

Since this is a debit card, typically, it is more difficult to get a dispute on a debit card transaction than a credit card transaction as debit card transactions are processed immediately and directly debited from your account.

Even though there is a proper report process that Choc Fin has to get such transactions reversed from your account, but I’m not sure if you will get back your money and if so, how fast this can be done. This is not unique to Choc Fin as such is the nature of a debit card.

So you can either put no money inside your choc fin account to be safe, or lock the card via the Chocolate app when it’s not in use.

That being said, I’m fully committed to maximizing my miles accumulation with the Chocolate Visa Debit Card, as the reward structure is too good to ignore.

My Plan to Maximize Miles:

To make the most of my miles, I plan to use the Chocolate Visa Debit Card for payments that typically aren’t eligible for rewards, such as insurance premiums, charity donations, education fees, and AXS bills. I had a peek at the list of exclusions, and it appears only e-wallet top-ups, debt payments, and payments to financial institutions are excluded.

Here’s my process:

- Transfer the required amount to cover a bill.

- Pay with my Chocolate Visa Debit Card.

You can definitely earn miles on the above-mentioned commonly excluded transactions, however, there are still several restrictions to keep in mind:

MCC | MCC Name |

4829 | Money Transfer |

6010 | Financial Institutions - Manual Cash Disbursements |

6011 | Financial Institutions - Automated Cash Disbursements |

6012 | Financial Institutions - Merchandise, Services, and Debt Repayment |

6050 | Quasi Cash - Financial Institutions, Merchandise, Services |

6051 | Non-Financial Institutions – Foreign Currency, Money Orders (Not Wire Transfer), Stored Value Card/Load, Travelers Cheques, and Debt Repayment |

6529 | Quasi Cash – Remote Stored Value Load – Financial |

6530 | Quasi Cash – Remote Stored Value Load – Merchant |

6540 | Non-Financial Institutions – Stored Value Card |

How to Get Started with Chocolate Visa Debit Card and HeyMax:

- Sign up for a HeyMax account here

-

Receive 200 Max Miles when you sign up, complete phone verification and make 1 confirmed transaction via HeyMax (within 180 days since account creation)

-

- Sign up for Chocolate Finance here

- Receive S$5 when you sign up and add funds to your Chocolate Finance Account. I recommend topping up just S$5 to test how it works before withdrawing.

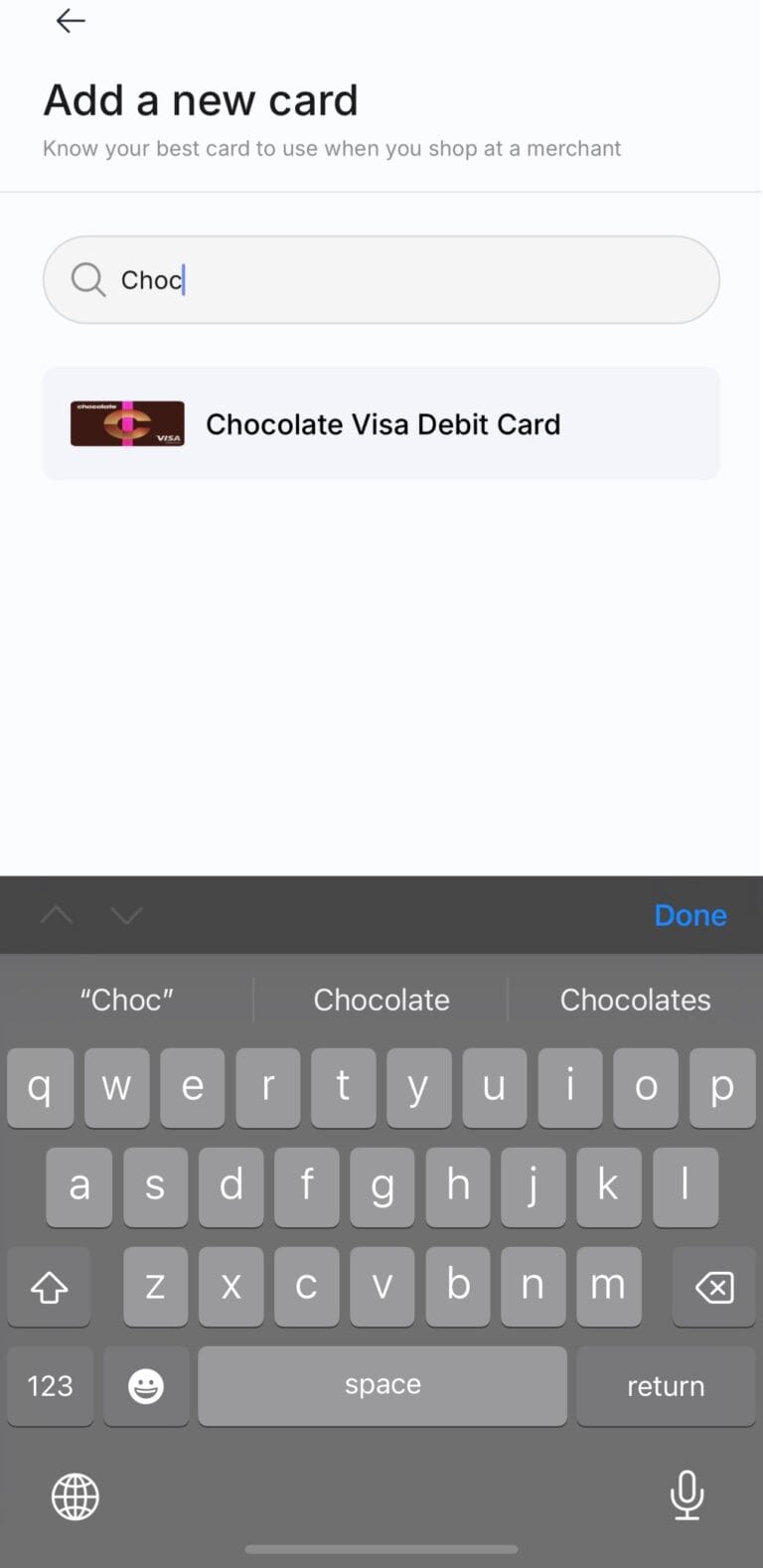

- Link your Chocolate Visa Debit Card to your HeyMax account:

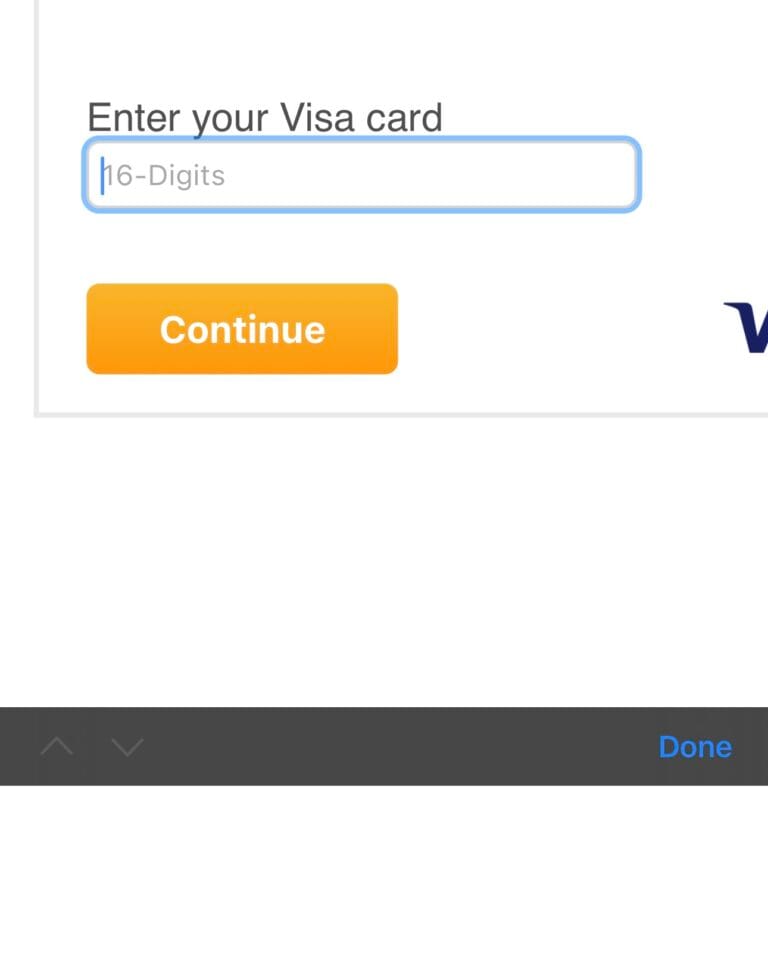

a. Open your HeyMax account on your mobile app (the desktop version may not show the Chocolate Visa Card).

b. Go to Cards and click Add Card.

c. Search for Chocolate Visa Debit Card.

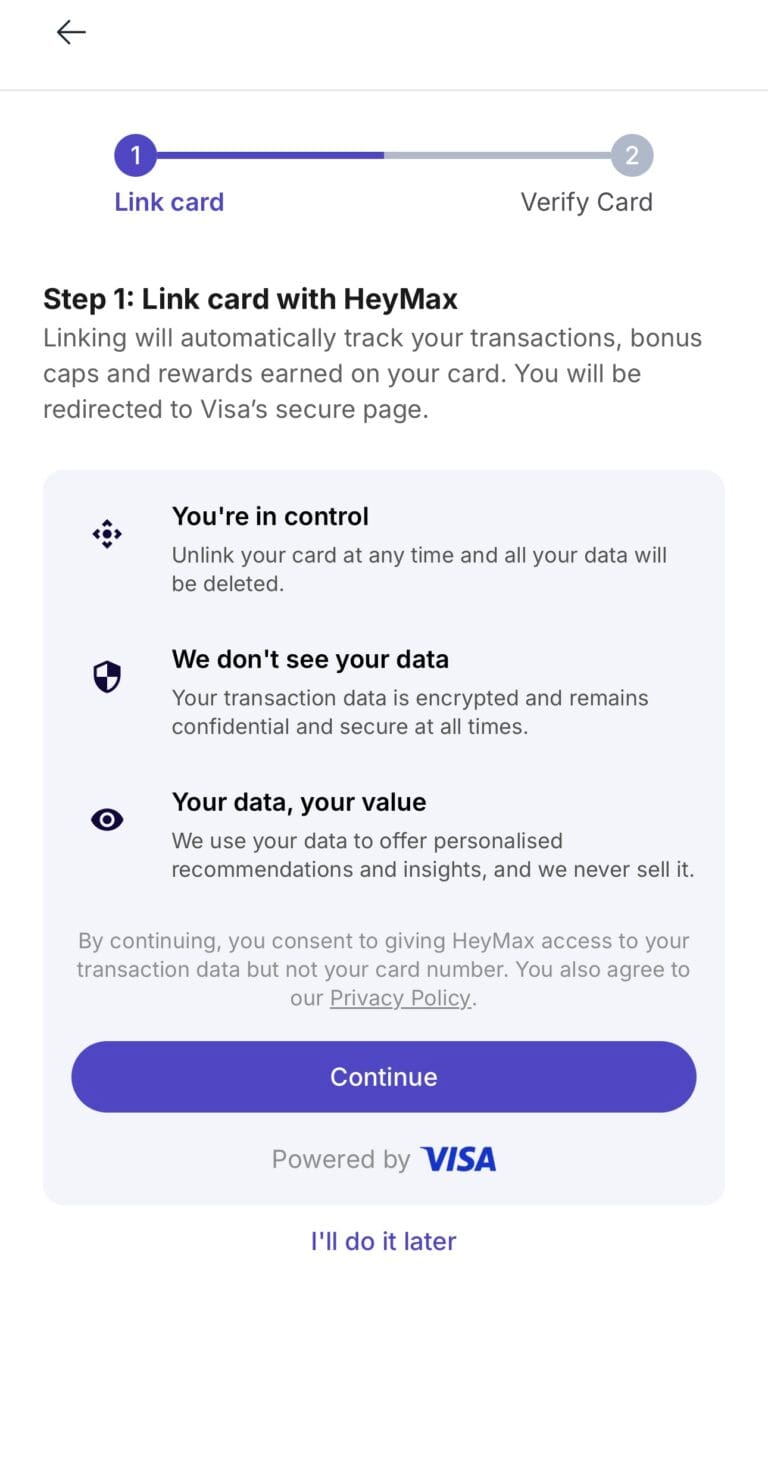

d. Select Continue

e. then click Link Card;

f. then enter your card details from the Choc Fin app.

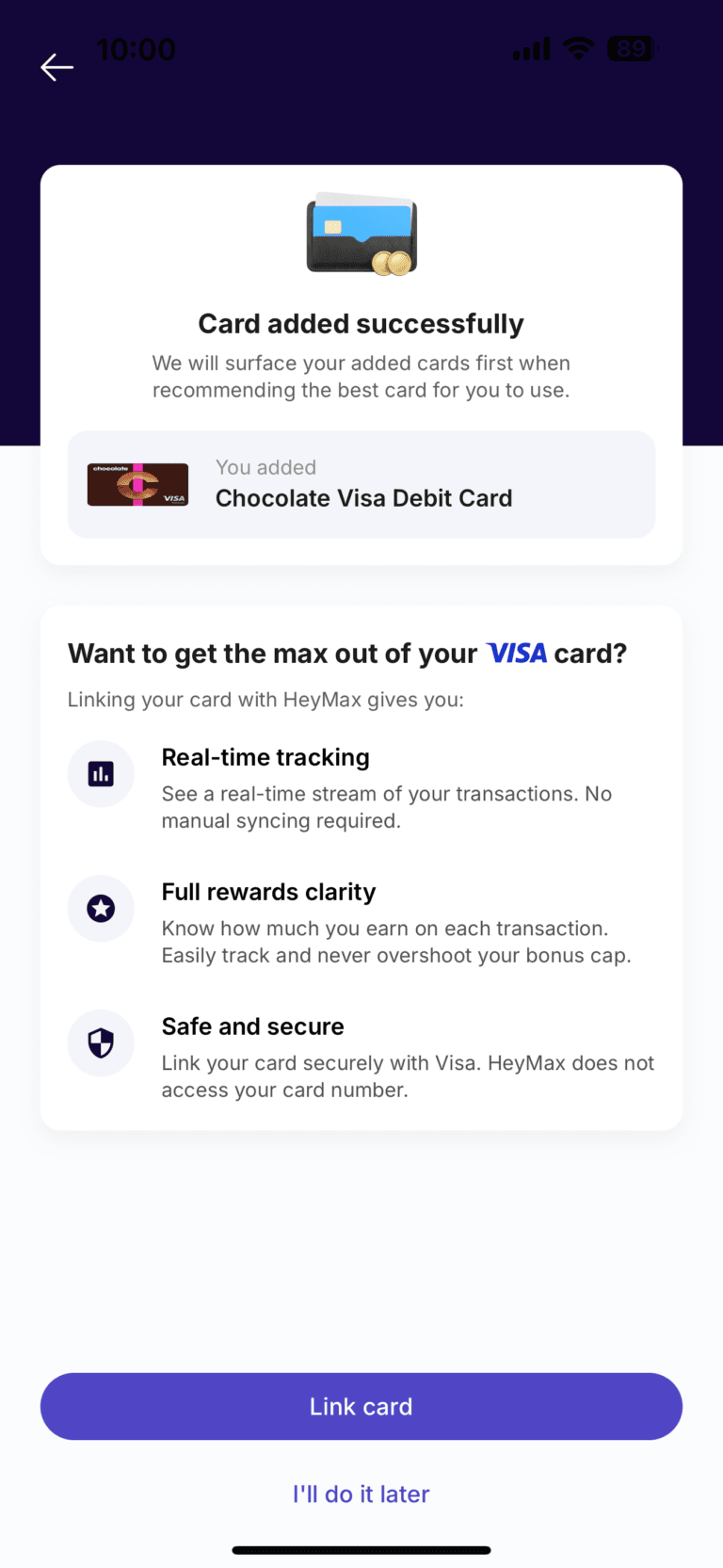

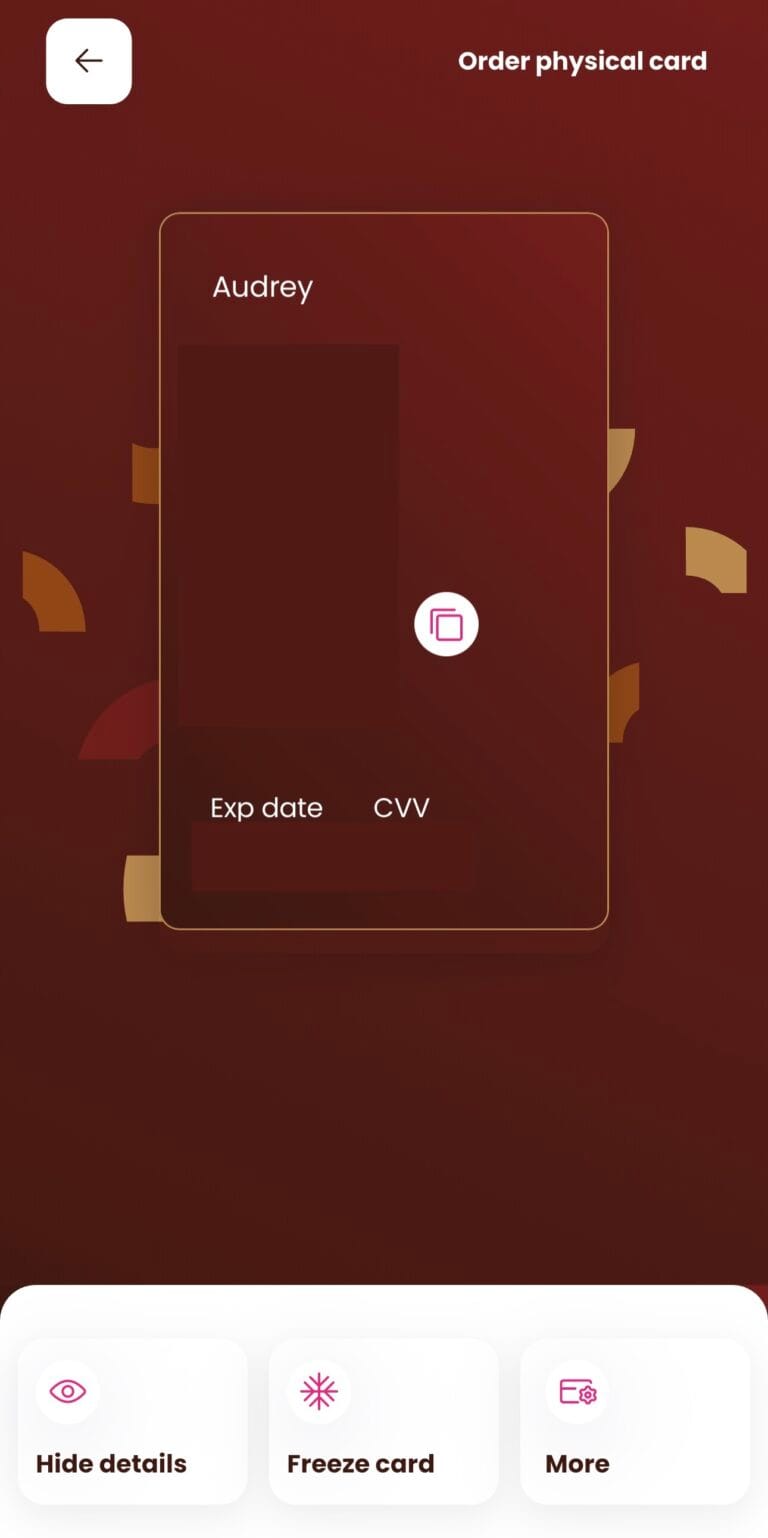

- You can find the card details here from the choc fin app:

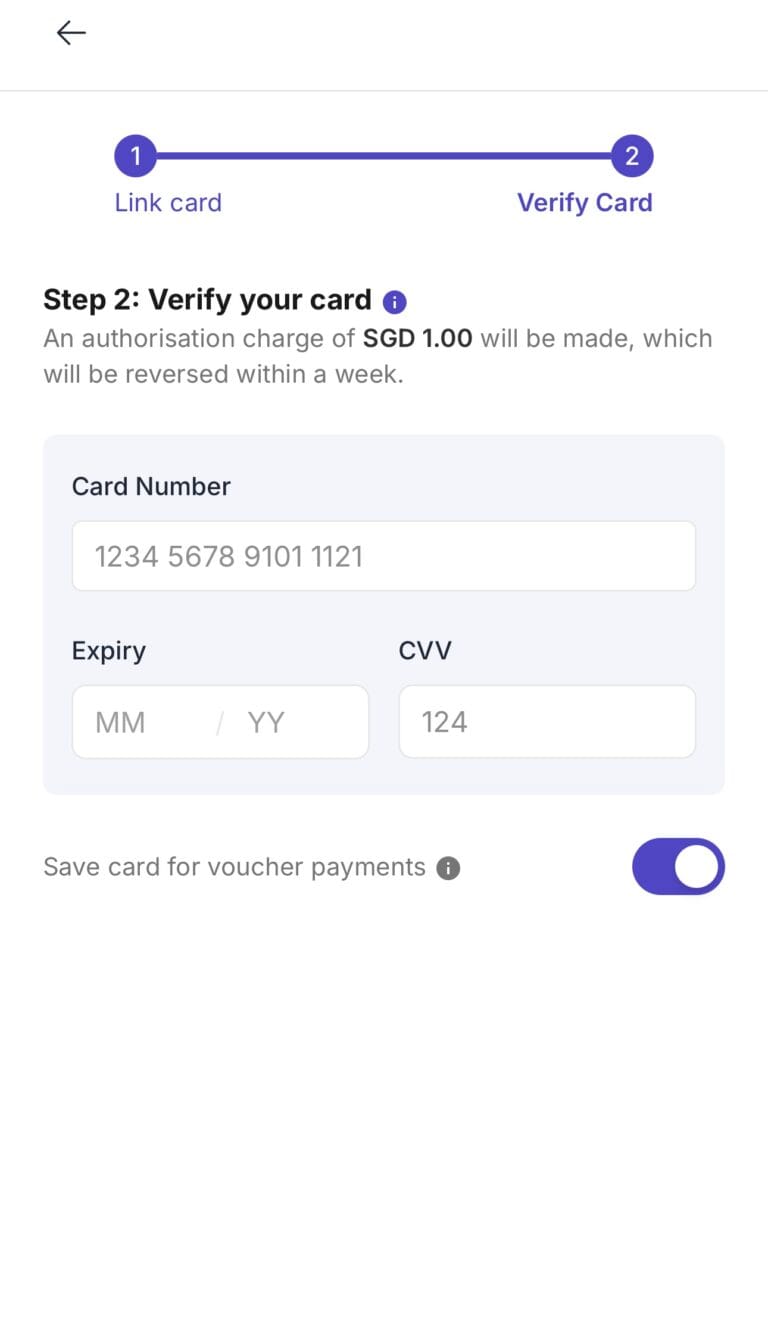

g. key in your card details again, then have your card verified;

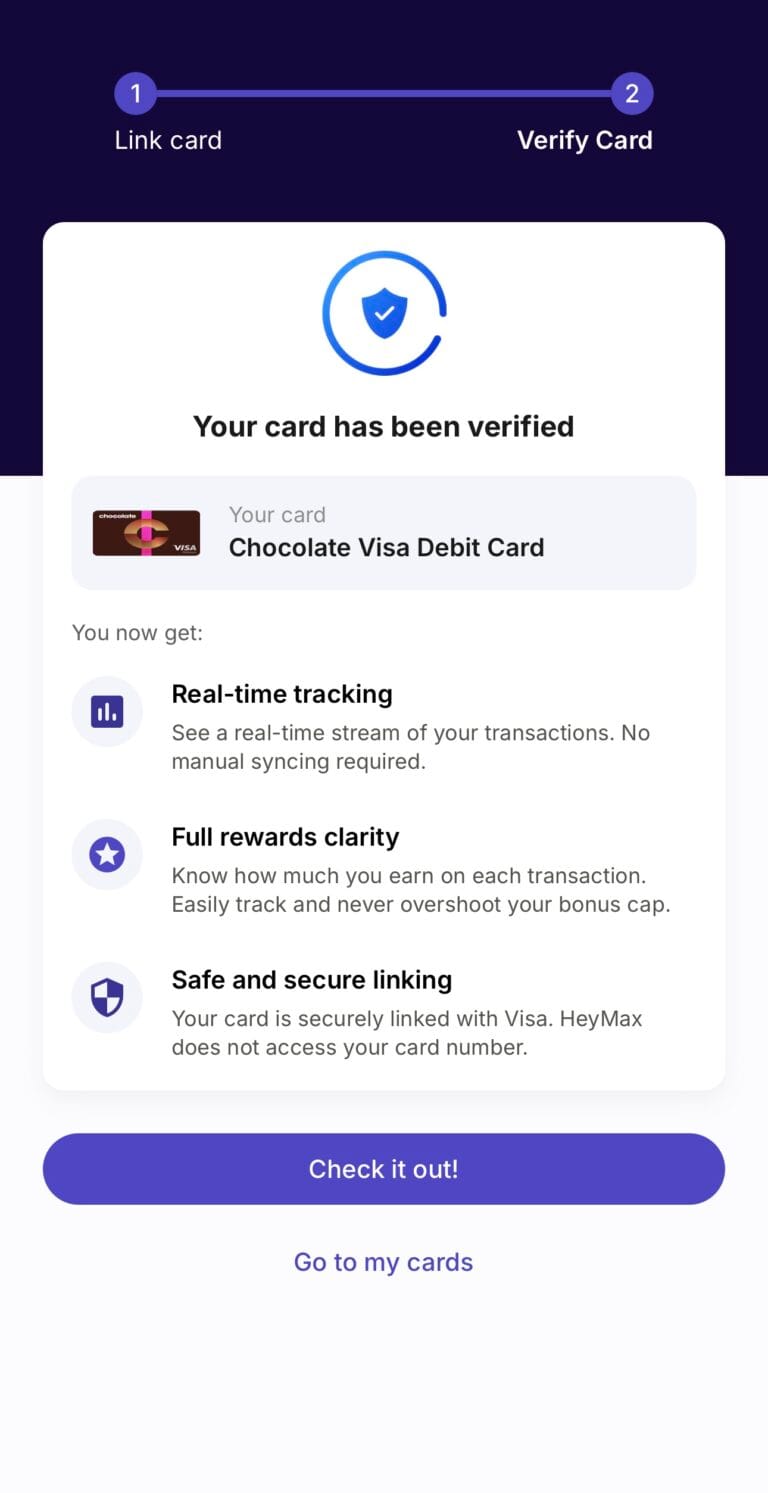

h. Once verified, you’ll be ready to start earning miles!

Conclusion:

By using the Chocolate Visa Debit Card with HeyMax, you can earn miles on a wide range of everyday expenses, including those that usually don’t qualify for rewards. With no hidden fees, no foreign exchange charges, and the chance to earn 5 miles per dollar on your bus and MRT rides for a limited time, it’s a win-win. Make sure to sign up today and start collecting your miles!

💳 Credit cards change their T&Cs every so often and it is difficult to stay updated. That’s why I created a Telegram Broadcast where you can receive timely bite-sized updates to get the most out of your spending.

💡 We believe in always paying our credit card bills on time and in full. It is only by doing that, can we fully maximise our credit card benefits.