If you’re looking for a high-interest savings account with no salary crediting or spending hoops, the GXS Savings Account offers up to 2.88% p.a. with daily interest. Pair it with the GXS FlexiCard, a S$500-limit credit card with no foreign transaction fees, and you’ve got a simple setup for earning interest and managing small expenses. Most importantly—it’s SDIC insured of up to S$100,000!

Here’s how it works:

GXS Savings Account: Up to 2.88% p.a. Interest

Unlike many high-interest accounts, GXS doesn’t require salary crediting or minimum spending. Instead, you get daily interest and flexibility to organise your savings into different pockets:

Boost Pockets (Up to 2.88% p.a.) – it’s a bit like a flexible Fixed Deposit

- 2.08% p.a. base interest (credited daily)

- Bonus interest upon maturity:

- 1 month: +0.6% p.a. (total 2.68% p.a.) *rates are subjected to change

- 3 months: +0.8% p.a. (total 2.88% p.a.)*rates are subjected to change

- Withdraw anytime

- Open up to 2 Boost Pockets

Saving Pockets (2.38% p.a.)

- Interest credited daily

- Open up to 8 Saving Pockets

- No fees, no lock-in period

Main Account (2.08% p.a.)

- Interest credited daily

- Unlimited randomised cashback with min. S$10 spend on the GXS Debit Card

- Link to Grab/Dash for quick payments

It is possibly a better idea to just keep funds in Boost or Saving Pocket.

How to Apply For GXS Savings Account:

- Download the GXS App (Apple/Google Play)

- Use code AUDR190 when applying for the GXS Savings Account

GXS FlexiCard: A Simple, No-FX Credit Card

The GXS FlexiCard is a fee-based, interest-free credit card with a fixed S$500 limit, designed for those who may not meet traditional income requirements.

Key Features:

- Instant Cashback – Earn randomized cashback up to S$3 when you spend S$10 or more on eligible transactions.

- No Foreign Transaction Fees – Useful for small overseas purchases.

- Fixed S$500 Credit Limit – Helps manage spending while building credit history.

- Annual fee: S$54.50 (waived for the first year)

Like all credit cards, paying in full and on time is key to avoiding unnecessary fees. And you should always request for annual fee waiver!

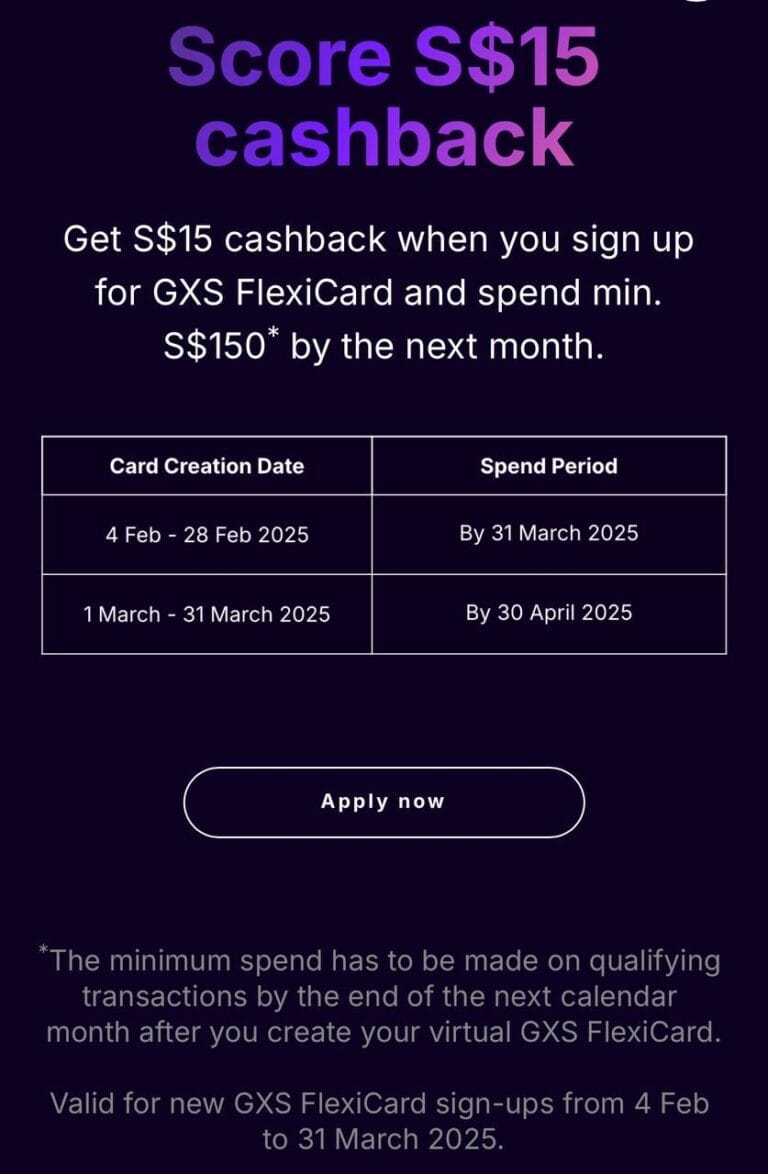

Limited-Time Promotions:

From 17 Feb – 30 June 2025, apply for a GXS FlexiCard or FlexiLoan with the code AUDR190 to get S$10 bonus (limited to 10,000 applicants).

From 4 Feb – 31 Mar 2025, spend S$150 on the GXS FlexiCard by the end of the next calendar month and get S$15 cashback.

How to Apply & Claim Your Bonus for GXS FlexiCard:

- Download the GXS App (Apple/Google Play)

- Use code AUDR190 when applying

- Spend S$150 within the qualifying period for S$15 cashback

Final Thoughts:

After the Chocolate Finance fiasco, things still feel a bit jittery in the personal finance space. At the same time, many are looking for safer places to park their money. If you are looking for a sort of fixed deposit with the flexibility to withdraw, GXS Savings Boost Pocket (up to 2.88% p.a., SDIC insured) is worth considering for extra funds.