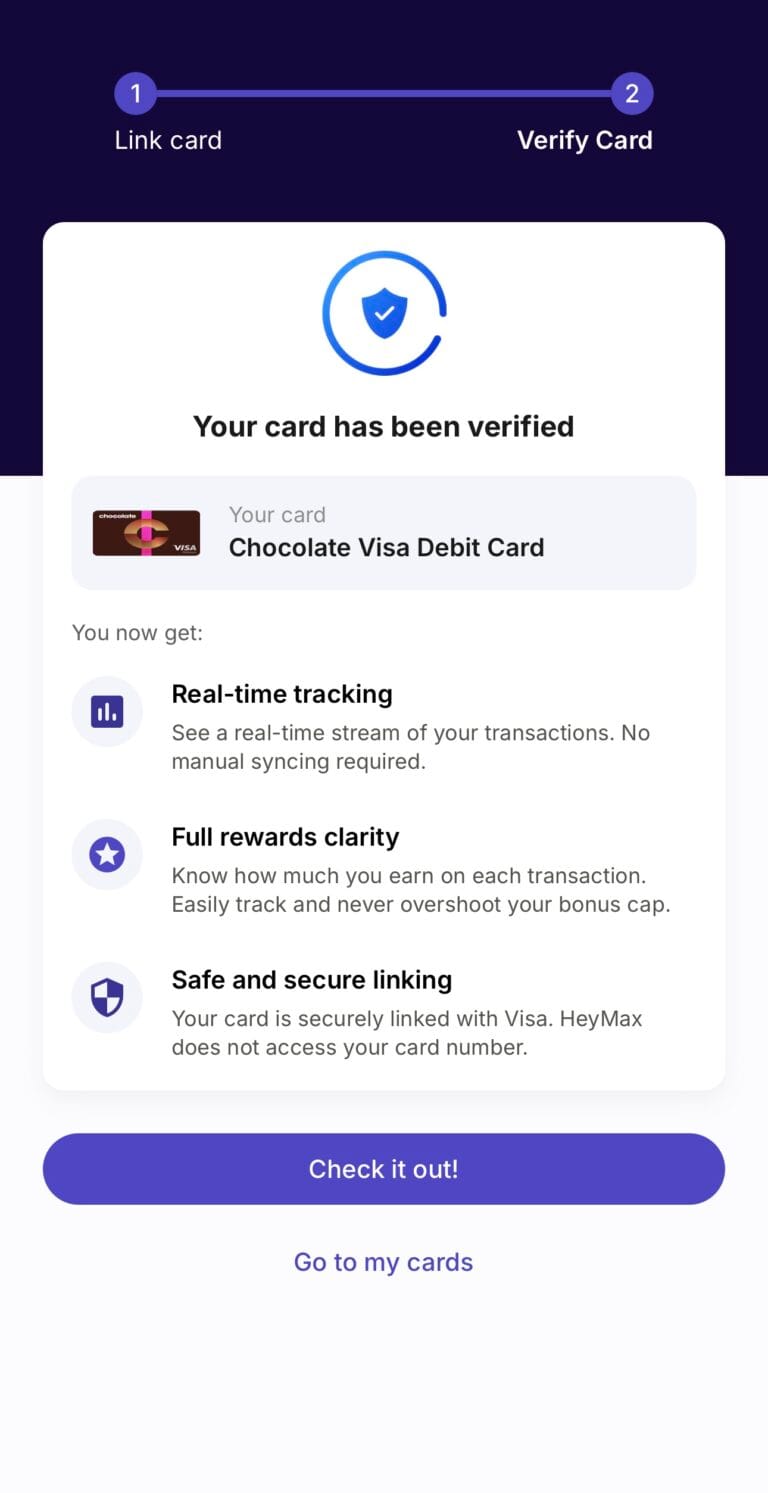

The Chocolate Visa Debit Card is a virtual debit card issued by Chocolate Finance. While it functions like a typical debit card, it becomes more powerful when linked to HeyMax.

When you add the Chocolate card to HeyMax and spend with your Chocolate Card, you earn Max Miles that can be used to offset your flight purchases or transfer to frequent flyer/hotel loyalty programs. 1 Max mile = 1 mile. The miles do not expire.

How They Work Together to Earn Miles

Here’s how the Chocolate Visa Debit + HeyMax combo works:

- The Chocolate card serves as your funding source.

- HeyMax tracks your eligible spend and rewards you with Max Miles.

- Use the linked Chocolate Visa card on platforms or merchants supported by HeyMax.

- Earn Max Miles automatically with every eligible transaction.

- Once you reach the minimum threshold, you can transfer your Max Miles to frequent flyer programs or offset your flight cost via FlyAnywhere function.

Is Chocolate Finance Safe?

They are MAS-regulated. You do not have to use them to put your funds in if you don’t want to. Since it’s a debit card, you can transfer in the amount that you want to spend then spend using the card. Remember, the goal is just to earn miles.

How to Get Started with Chocolate Visa Debit Card and HeyMax:

- Sign up for a HeyMax account here

- Get 200 Max Miles when you sign up and verify your phone number, plus an additional 50 Max Miles when you complete onboarding.

- Sign up for Chocolate Finance here

- Sign up and add funds to your Chocolate Finance Account. I recommend topping up just S$1 to test how it works before withdrawing.

- Link your Chocolate Visa Debit Card to your HeyMax account:

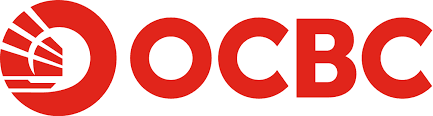

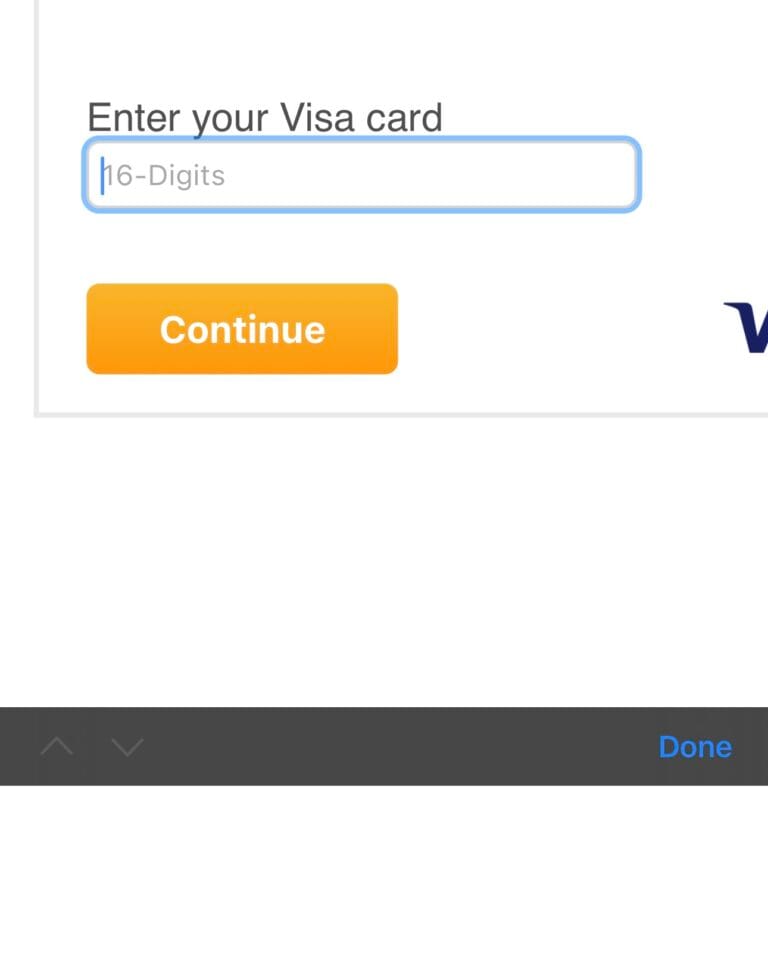

a. Open your HeyMax account on your mobile app (the desktop version may not show the Chocolate Visa Card).

b. Go to Cards and click Add Card.

c. Search for Chocolate Visa Debit Card.

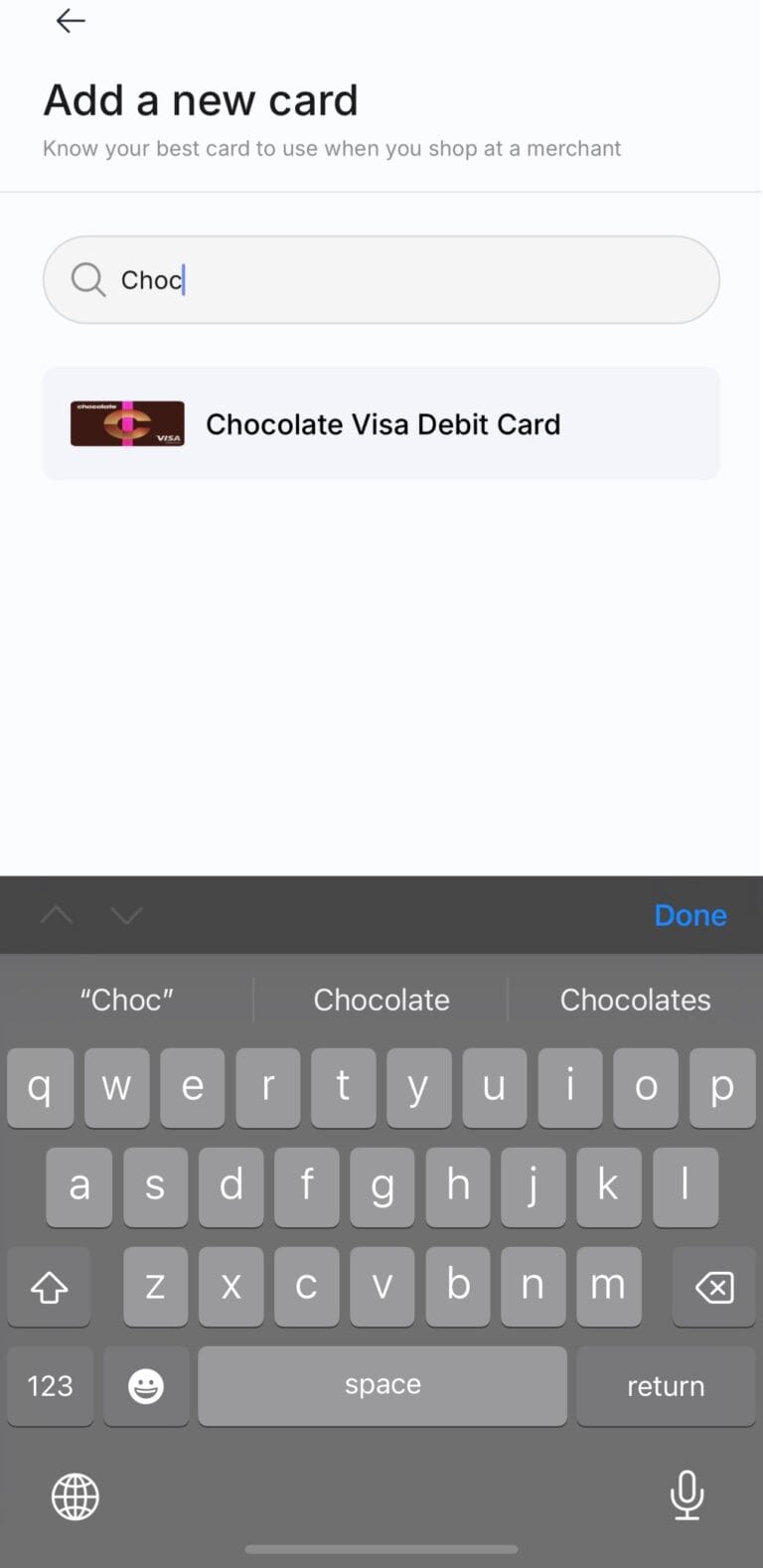

d. Select Continue

e. then click Link Card;

f. then enter your card details from the Chocolate Finance app.

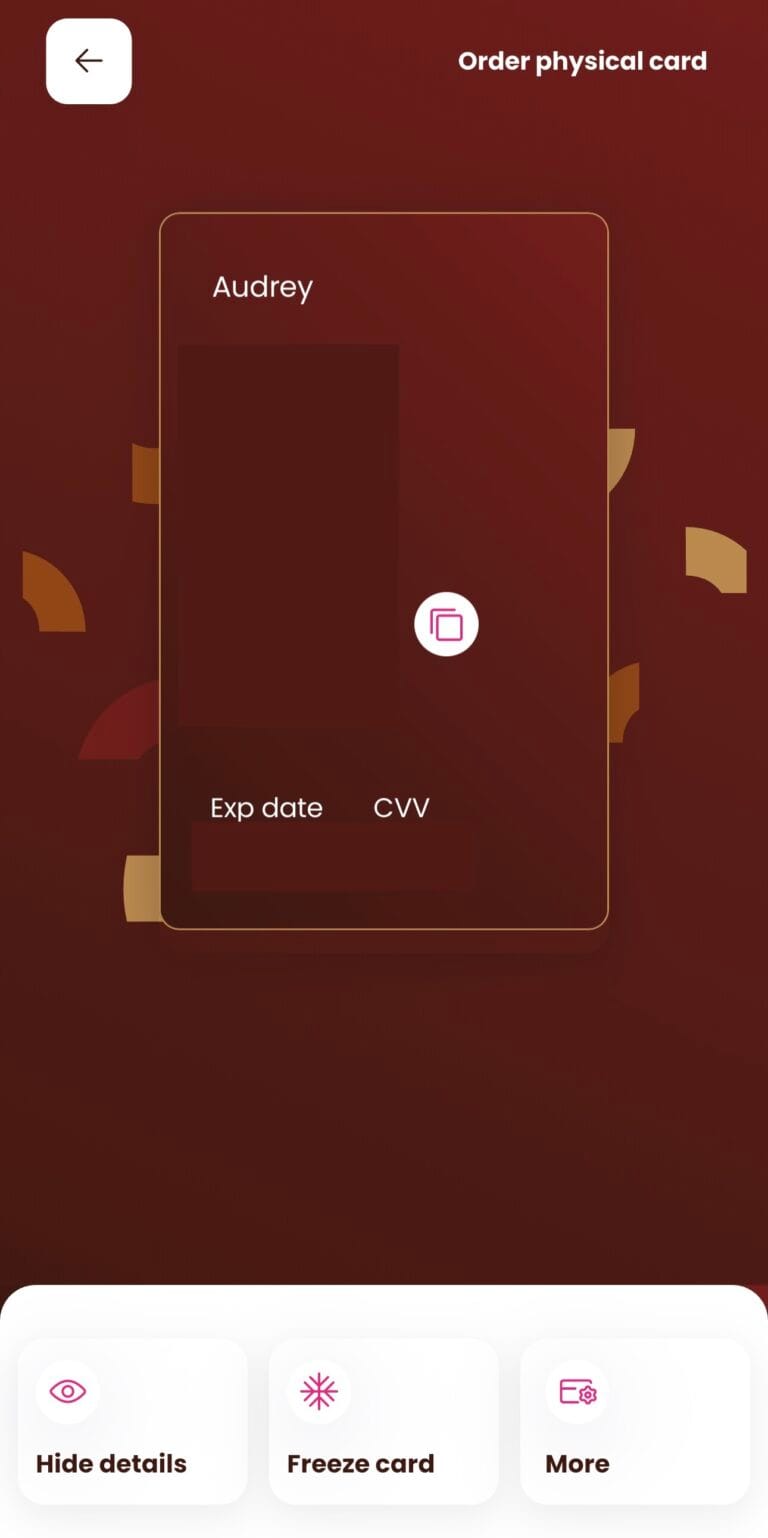

- You can find the card details here from the Chocolate Finance app:

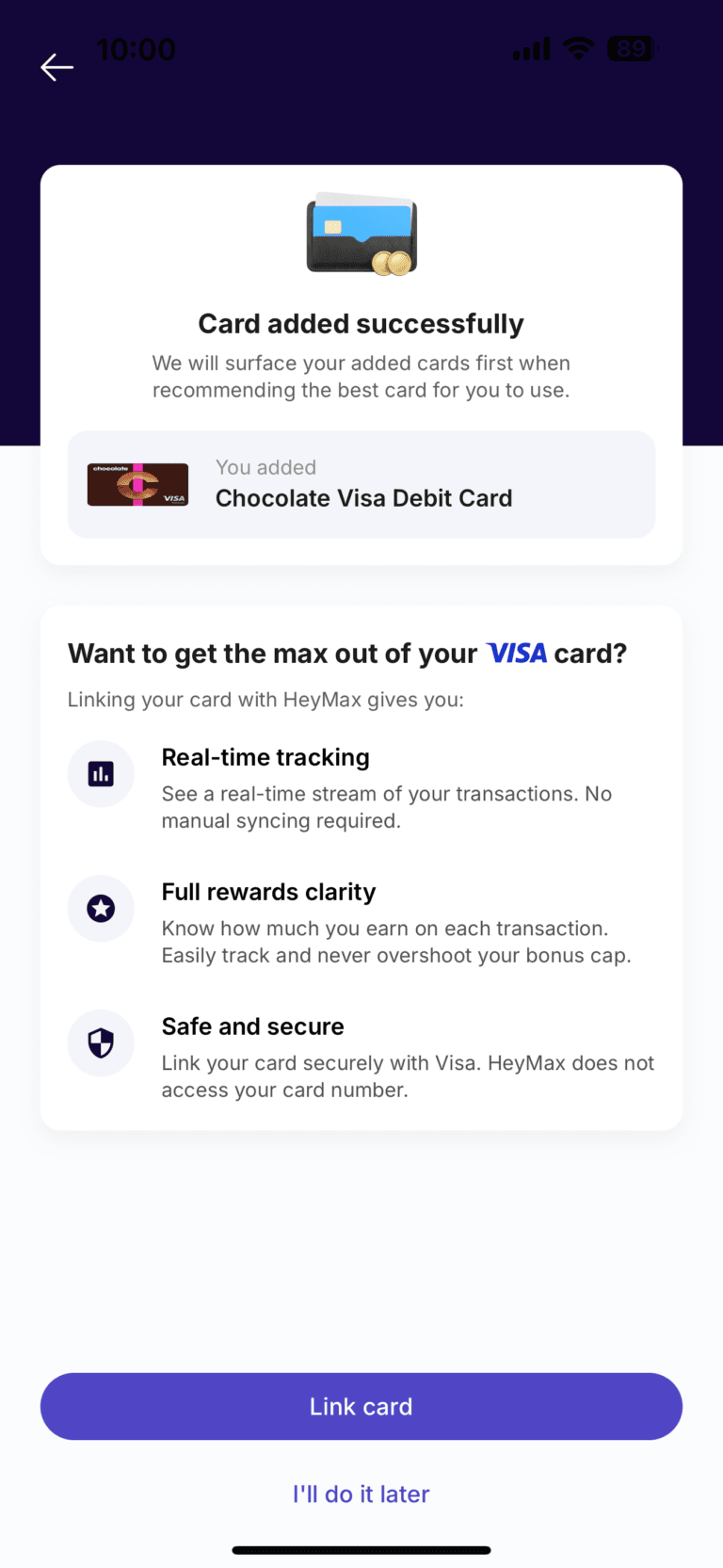

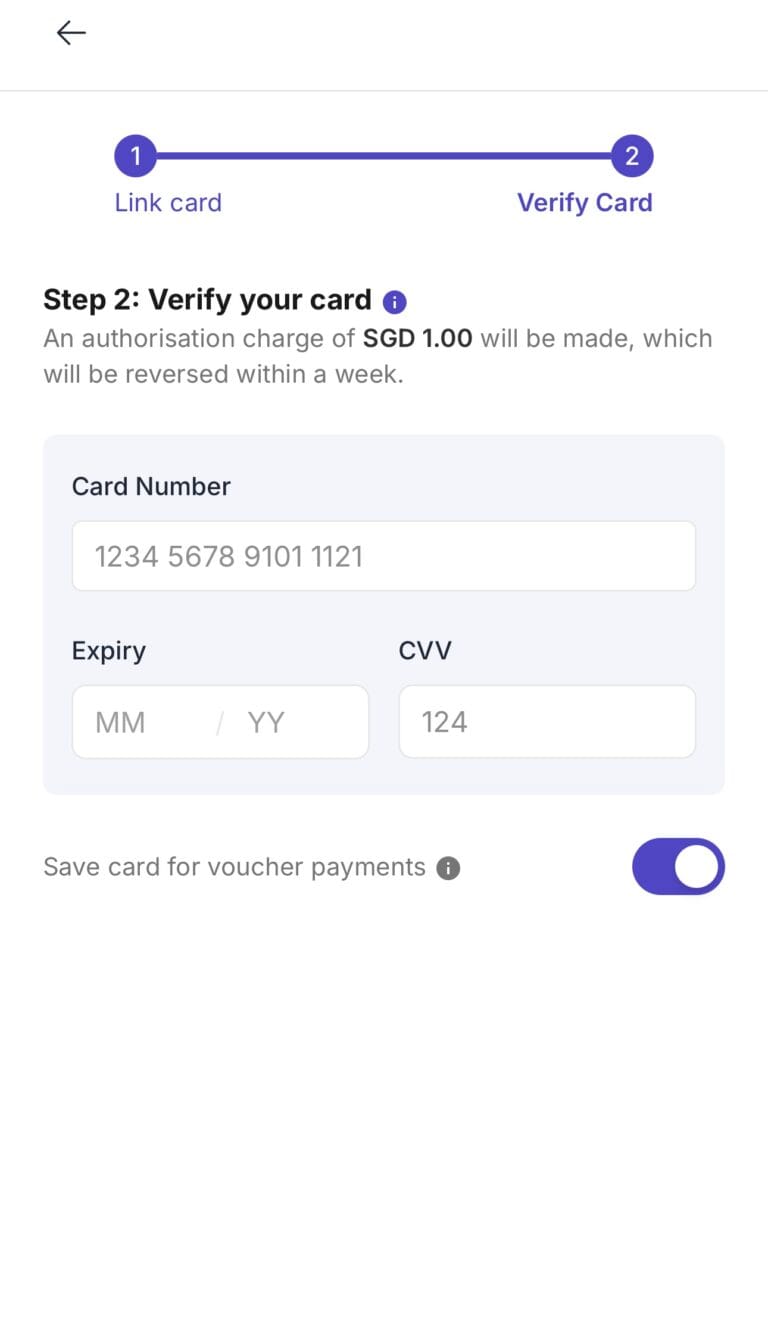

g. key in your card details again, then have your card verified;

h. Once verified, you’ll be ready to start earning miles!

You can read my previous post on the latest earn rate for Chocolate Visa Debit Card:

💳 Credit cards change their T&Cs every so often and it is difficult to stay updated. That’s why I created a Telegram Broadcast where you can receive timely bite-sized updates to get the most out of your spending.

💡 We believe in always paying our credit card bills on time and in full. It is only by doing that, can we fully maximise our credit card benefits.