If you’re planning a trip this year, here’s a simple win: DBS & POSB cardholders can get S$50 off a round-trip Singapore Airlines ticket with no minimum spend. The promo is limited-time and works across all cabin classes.

Promo Details:

- Promo Code: DBS50OFF

- Discount: S$50 off per booking

- Eligible Cards: DBS & POSB credit/debit cards

- Minimum Spend: None

Important Dates

- Booking window: 13 Jan (10AM) – 19 Jan 2026

- Travel period: Anytime from 13 Jan – 31 Oct 2026

Where to Book

- Book directly via the Singapore Airlines official website: www.singaporeair.com

Who Can Use It

- This offer is available to customers paying with DBS or POSB credit or debit cards — covering most card products issued by the bank.

- ✔️ DBS & POSB Credit Cards

- ✔️ DBS & POSB Debit Cards

- ❌ DBS UnionPay Platinum Debit Card not eligible

Which Flights Are Eligible

To apply the discount, your booking must meet these conditions:

- Round-trip flights only (no one-way or open-jaw itineraries).

- The first flight must depart from Singapore on Singapore Airlines.

- Applicable to all cabin classes — Economy, Premium Economy, Business, First, and Suites.

- Only flights operated by Singapore Airlines qualify (codeshare flights aren’t eligible).

- Up to two passengers per booking can benefit from the S$50 discount.

Note: The discount applies to the fare component of your ticket only — not to government taxes, fees, seat selection, baggage charges, or insurance.

Important Rules & Conditions

- Limited redemption: The promo code can run out early — it’s issued on a first-come, first-served basis and may sell out before the end date.

- No refunds on the code: If you book using the code and later cancel or change your booking, you won’t get the promo code refunded or reinstated.

- Availability not guaranteed: Even during the promo period, the exact flights or seats that accept the discount aren’t guaranteed — popular dates and routes may fill up fast.

Singapore Airlines Terms and Conditions

DBS Terms and Conditions

Best DBS Card Strategy for This SQ Promo:

If you already have an existing DBS/POSB Card, the best card would be the DBS Woman’s World Mastercard. If you do not have an existing DBS/POSB Card, then the best card to apply for would be the DBS Altitude Card under the promotion below that you can easily stack this promotion with.

Don’t Have A DBS/POSB Card Yet?

From 26 December 2025 to 02 February 2026, DBS is rolling out one of its most attractive sign-up promos yet for new credit card customers. What makes this round stand out is the ultra-low S$100 minimum spend. Apply for an eligible card such as the DBS Live Fresh Card, DBS yuu Card, DBS Altitude Card or POSB Everyday Card, and score premium gifts worth up to S$600 with minimal effort. If you’ve been waiting for an easy entry point to a DBS or POSB Credit Card, this limited-time promotion is hard to beat.

Choice of Gifts:

Shokz OpenRun Bone Conduction Open-Ear Headphones (worth S$249)

Samsonite STRAREN SPINNER 67/24 (worth S$600)

S$200 eCapitaVoucher

Stryv AirFlex 2.0 (worth S$369)

Xiaomi Truclean W20 Wet Dry Vacuum (worth S$259)

New-To-DBS/POSB Credit Cardholders are defined as:

- do not currently hold a principal DBS or POSB Credit Card currently, and

- have not cancelled any principal DBS or POSB Credit Cards in the last 12 months

How to Qualify in 3 Simple Steps:

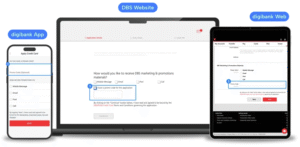

1. Apply for your preferred DBS/POSB Credit Card via the links below, and be sure to enter the promo code SINGSAVER during the application!

- Keep an eye out for the promo code field!

2. Spend a minimum of S$100 within 30 days of your card approval.

- Once your card is approved, make sure to make at least S$100 qualifying spend within the first 30 days from card approval date to unlock your gift!

3. Have a valid DBS PayLah! Account by the end of the spend period

Which Card To Apply For:

If you’re thinking about which card to apply, there’s a clear first move: get the DBS Altitude Card first. Why? Because it actually offers a welcome bonus—unlike the DBS Woman’s World Card (WWMC), which almost never run a sign-up offer.

Apply Here:

DBS Altitude Card

Earn 1.3 miles per dollar on local spend and 2.2 miles per dollar on foreign currency spend

2 Priority Pass visits per membership year (Visa version only)

DBS yuu Card

Earn up to 18% cash rebate or 10 miles per dollar at yuu merchants

POSB Everyday Card

Earn up to 10% cash rebates on selected categories on local spend

Conclusion

This DBS–Singapore Airlines S$50 promo is a solid deal for travelers who are planning a trip from Singapore before the end of October 2026. If you already hold a DBS or POSB card, this is an easy way to squeeze extra value out of it with minimal effort. While S$50 might seem modest on long-haul flights, it can make a noticeable difference on short-haul and regional routes — especially if you’re flexible with your travel dates.

Where this promo really shines is when stacked with the current DBS/POSB sign-up deal. If you’re applying for a new DBS or POSB card during the ongoing campaign, you’re effectively getting:

- A sign-up gift worth up to S$600 with just S$100 minimum spend, plus

- An additional S$50 off your Singapore Airlines flight when you use the new card to book within 30 days.

That makes this a strong double-dip opportunity for those who are planning an upcoming trip!