Paying your bills doesn’t have to feel like a chore anymore! With AXS Rewards, you can earn exciting perks, discounts, and exclusive treats every time you settle a bill on the AXS app. From utilities and telecom bills to insurance premiums and government payments, AXS is turning routine expenses into opportunities to earn perks and save on bills, making everyday bills more rewarding than ever.

For a limited time until 28 February 2026, AXS is also offering Sure-Win Mystery Boxes, giving users the chance to score up to S$88 off their bills.

What is the AXS Rewards Promotion?

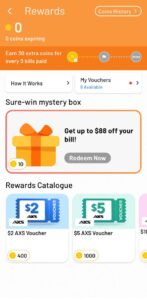

AXS has introduced AXS Rewards, a programme that lets users earn AXS Coins whenever they pay eligible bills through the AXS app. These coins can later be redeemed for bill offsets, vouchers, and limited-time promotional rewards.

As part of the launch, AXS is also running a special campaign titled “Your Bills Just Got More Rewarding”, where users can enjoy additional perks and promotional redemptions for a limited period.

How it Works:

- Download or Update the AXS m-Station Mobile App

- Sign up with code URF2RKZZ (for new users) to earn 50 bonus AXS coins on your first bill payment.

- Login with your account

- Pay Your Bills via the AXS App

- Use the AXS mobile app to pay supported bills, such as:

- Utilities

- Telco services

- Insurance premiums

- Credit card bills

- Town council charges

- Government and statutory payments

- Use the AXS mobile app to pay supported bills, such as:

- Earn AXS CoinsActionRewardSingle bill payment10 coinsRecurring bill payment15 coinsEvery 3 bills paid in one calendar monthBonus 30 coins

- Coins accumulate in your My Rewards wallet in the app, where you can track and redeem them.

- Coins are valid for 3 years from the month they are issued.

- Redeem Your Rewards

- Your accumulated AXS Coins can be used to:

- Offset future bills (coming soon)

- Redeem vouchers

- 400 coins = S$2 AXS voucher

- 1000 coins = S$5 AXS voucher

- 2000 coins = S$10 AXS voucher

- Unlock limited-time rewards and promotional redemptions (like the Mystery Box Redemption below)

- Your accumulated AXS Coins can be used to:

📢 Limited Time Rewards: Sure-win Mystery Box Redemption

Between 28 January 2026 and 28 February 2026, users can redeem coins for AXS Rewards Mystery Boxes — each offering a guaranteed e-voucher reward.

- How the Sure-Win Mystery Boxes Work:

- Each Sure-Win Mystery Box costs 10 coins to redeem.

- At max hack level, you can make 3 different recurring bills paid in a calendar month to receive 15 coins x 3 + 30 coins = 75 coins. This allows you to get 7 Sure-Win Mystery Boxes ( redeemed using 70 AXS Coins with 5 coins leftover.

Mystery Box rewards include:

- AXS e-vouchers worth S$0.18 to S$88

- Ya Kun e-voucher worth S$2.20 (redeemable via the Ya Kun Cherish App)

Read the terms and conditions here

Eligibility

- Must be an AXS app user on version 9.0 or above.

- Logged in via account login

Voucher Rules

- AXS e-vouchers must be redeemed by 31 July 2026 and can be used to pay bills on the AXS app (minimum final payment of S$1).

- E-vouchers are valid once and cannot be exchanged for cash or combined with other promo codes.

- If you request a refund/stop payment on a bill where an e-voucher was used, the voucher is not refunded.

General Conditions

- AXS may cancel, change, or suspend the promotion at any time without notice.

- Participation in Mystery Box redemption means you accept the full T&Cs

What Credit Cards Can You Use for Cashback When Paying Bills?

While paying bills using AXS doesn’t always earn rewards on every card, there is only one credit card in Singapore that offers some level of cashback.

- Maybank Family & Friends Card

Offers cashback on AXS bill payments at 0.3% when you pay via the AXS app or kiosk, no minimum amount required (cashback capped at S$50 per transaction).

You can also choose up to 5 preferred cashback categories (up to 8%) on everyday expenses, such as transport, dining, and groceries. Read my review here for more.

💡 Best for: users who want cashback on AXS bill payments and flexible category rebates.

Maybank Family & Friends Card

Earn 6% or 8% cashback for five of your chosen categories.

My Personal Experience Using AXS Rewards

Even if you just got S$0.18 vouchers with 400 coins, it still gives you at least S$7.20 worth of vouchers, which is more value than the S$2 voucher you can exchange for. So it is a no brainer to use your coins for the Sure-win Mystery Box.

To better understand how the programme works in practice, I tried it myself.

I started by using a referral code, which earned me 50 AXS Coins upon successful sign-up. I then paid a bill to my town council through the AXS app and received an additional 10 coins, bringing my total to 60 AXS Coins.

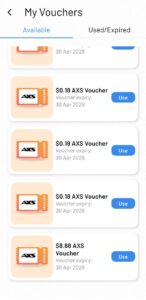

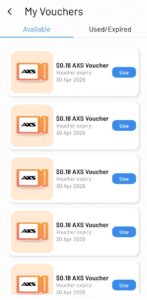

With those 60 coins, I redeemed 6 Sure-Win Mystery Box consecutively. The rewards I received were:

- S$0.18 × 5 AXS e-vouchers

- S$8.88 × 1 AXS e-voucher

All vouchers were credited instantly in the app and can be used to offset future bill payments until 30 April 2026, based on the redemption details listed on each voucher. Yay for me!

(Note: Rewards vary by user and redemption. Voucher values are not guaranteed and depend on chance.)

Final Takeaway

AXS Rewards turns a routine task into something more rewarding. For a limited time, the Sure-Win Mystery Box promotion offers a fun and tangible way to earn bill discounts, with the benefit of scoring higher-value vouchers.

If you already pay your bills through AXS, this promotion lets you get more value out of what you’re already doing. And if you’re new, the current Mystery Box pricing makes it a good time to start.