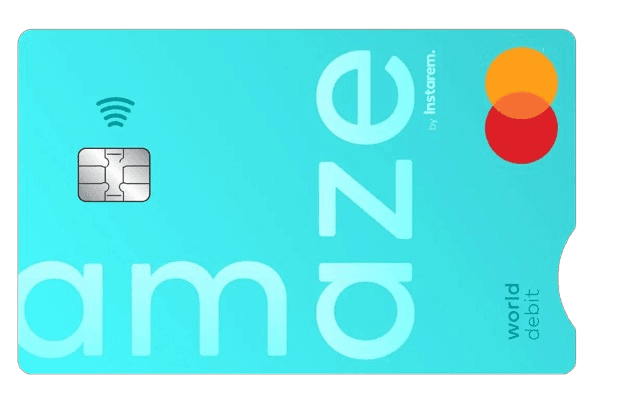

- The Amaze card allows you to link up to 5 mastercards— a way for you to eliminate the hassle of carrying multiple cards. This can help you pay and save locally or overseas, use it to earn rewards, and lastly, you can convert your offline to online transactions using the credit card of your choice without incurring foreign exchange fees + gaining the rewards (miles/cashback) on the credit card used

- When using overseas, there is a 2% spread on FX rate with amaze but you get the miles

- Instarem Amaze will impose a 1% fee (minimum S$0.50) for any local spendings

above S$1,000 per monthfrom the first dollar spent when amaze is linked to a card. This fee will only affect Citi Rewards with some inconveniences.

March 20, 2024

Comments: 1

What is Instarem Amaze Card? Instead of carrying multiple credit cards, the Instarem Amaze card is a...

No posts found

Overview of Best Cards to Pair with Amaze:

Cards | Cards | Rate | Why use with Amaze? | Why use with Amaze? | General Exclusions Apply | |

Rate | Save on Foreign Currency Fee for Overseas Spending | Convert Offline to Online for Local Spending | Type of Transaction | Spending Cap | ||

Citi Rewards | Citi Rewards | 4 miles per dollar | Yes | Yes | Offline almost all spending | S$1k |

OCBC Rewards | OCBC Rewards | 4 miles per dollar | Yes | Offline retail spending | S$1.1k | |

Maybank Family & Friends | Maybank Family & Friends | 8% cashback | Yes | Any 5 of your chosen categories | S$312.5 per category | |

No limits for overseas spending | Above S$1k local spending monthly will incur 1% fee (minimum S$0.50) Update: There will be 1% fee (minimum S$0.50) for all local spendings from the first dollar spend | |||||

Citi Rewards Card

- This is my top favourite card to pair with amaze.

- The Citi Rewards card offers 4 miles per dollar, but only up to S$1,000 per month (statement period). The Amaze card, however, charges a 1% fee for

exceeding S$1,000 in local spending each calendar monthALL local spends. - If you’re spending local online spending – Use Citi Rewards without Amaze

- After the update, this can be paired with Citi Rewards for overseas spending. For local offline spends, I would not recommend using Citi Rewards and Amaze combo anymore as it will incur a 1% fee even on the first dollar spent, but if you wish to, I suggest to do it when the transaction amount is above S$50 so you can still get a pretty cheaper cost per mile. You can check out more details of the updates below:

February 28, 2025

Comments: 2

https://youtu.be/VS6GjQDTYVY&list=PLDFEQWdI9twYZz73WFvtk_aL1Xq6E81Ad Effective 10 March 2025, Instarem...

No posts found

OCBC Rewards Card

- with the decent bonus earn rate of 4 miles per dollar, you can earn by spending in these categories:

Alibaba | Guardian | *Shopee (exclude Shopee Pay) |

AliExpress | Lazada | Taobao |

**Amazon | **Mustafa Centre | TikTok Shop |

Daigou | NTUC Unity | Watsons |

Ezbuy | Qoo10 | |

*Shopee Pay transactions under MCC 5262 are not eligible to earn any OCBC$ **Transactions under MCC 5411 (Groceries, Supermarket) is not eligible to earn any Bonus OCBC$ | **Transactions under MCC 5411 (Groceries, Supermarket) is not eligible to earn any Bonus OCBC$ | |

OCBC Rewards Card

Earn 6 miles per dollar on Watsons, Lazada, Shopee, Tiktok Shop, and Taobao (until 31 December 2025) and 4 miles per dollar on Eligible Online and Offline Spends

Maybank Family & Friends Card

- Earn 8% cashback for 5 of your chosen spend categories across 10 options:

- You can change the categories every quarter. Default categories are chosen for you when you first receive your card. Then you can change it afterward.

- Each category is capped at S$25 per month; which would max out at S$312.50 of spending per category

- Monthly minimum spend of S$800 required

- Pair with Amaze Card to convert offline overseas spending under your chosen categories to online to earn 8% cashback

- Rule of thumb: use AMAZE when spending overseas for chosen categories

Maybank Family & Friends Card

Earn 8% cashback for five of your chosen categories.

Frequently Asked Questions about Amaze:

Q: Can i use amaze with DBS Women’s World Mastercard?

A: No. It’s excluded.

Q: Can i use it with a Visa card?

A: No. Only mastercard.

💳 Credit cards change their T&Cs every so often and it is difficult to stay updated. That’s why I created a Telegram Broadcast where you can receive timely bite-sized updates to get the most out of your spending.

💡 We believe in always paying our credit card bills on time and in full. It is only by doing that, can we fully maximise our credit card benefits.

2 Responses