HSBC bank is now offering Sure-Win Spins with amazing gifts, on top of SingSaver’s sign up offers of IPad, Dyson Hairdryer or Sony earphones or Sony Vlog Camera. There is also a Sure Win red packet promotion happening if you apply before 26 Jan. With relatively easy criterias to hit and the ability to stack three promotions, this is one of the better offers that I’ve seen coming from HSBC.

If you are a new to HSBC Cardholder, you can qualify for all gifts by following my 3 best optimisation strategies.

If you are an existing HSBC Cardholder, you can apply for a card and qualify for the HSBC Rewards if all the conditions are met.

What HSBC defines as New and Existing Cardholder?

- New HSBC cardholder as:

- Someone who have not held an HSBC credit card in the last 12 months.

- Existing HSBC cardholder as:

- Someone who currently holds an HSBC credit card issued more than 12 months ago, and have not cancelled an HSBC credit card in the last 12 months.

Apply Below:

Here are the Rewards:

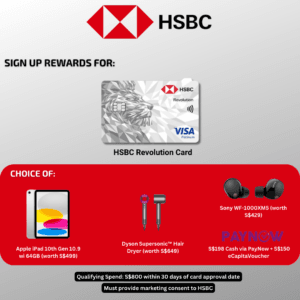

1. Singsaver Sign Up Offer for New-to-HSBC Cardholders:

- Valid till 2 February 2025

2. Sure Win, Sure Huat Promotion

- You can get 1x Red Packet worth up to S$8,888 when you apply for an HSBC credit card

- Valid for New-to-Bank HSBC Cardholders only

- This reward will be received on top of existing SingSaver rewards

- Read Terms and Conditions here

- Valid until 26 January 2025

3. HSBC Direct Bank Rewards for New and Existing Cardholders:

Receive 1x sure-win spin when you apply and activate an HSBC credit card as a principal cardholder and make a minimum 10 transactions within 30 days from card account opening.

- Valid for new and existing cardholders

- No Minimum Spend Required

- Account must be of good standing throughout the promotional period and at fulfillment

- Valid from 13 January to 13 April 2025

Sure-Win Gifts include:

- 226,500 miles for 1x Business Class return ticket to London

- 54,000 miles for 1x Economy Class return ticket to Tokyo

- 17,000 miles for 1x Economy Class return ticket to Bali

- Apple Watch Series 9

- Samsonite Luggage (worth S$320)

- Vouchers from Grab, Klook, Marriott, Shopee and Starbucks

You can also get up to 2 additional spins and a grab voucher when you register through this link using the code: SPIN:

- Up to 2x spin – 1x spin per eligible S$1,800 spend (another 1x spin for the next S$1,800 spend)

- S$200 GrabGifts Voucher – if you are among the 1,875 customers to make S$5,000 qualifying spend within the promo period

Summary of Spins:

| Task | Spins |

|---|---|

| Apply for a credit card and make 10 transactions within 30 days | 1x |

| Register with the code: SPIN | 1x (S$1,800 spend) |

| 1x (next S$1,800 spend) | |

| S$200 GrabGifts Voucher (S$5,000 spend) Limited to 1,875 redemptions |

Each qualified customer can earn up to three (3) spins. If a customer meets multiple criteria, they will get spins for each one, but the total number of spins cannot exceed the cap.

3 Best Optimisation Strategies:

- For New-to-HSBC Cardholders:

- Fulfilling any of the below scenarios will automatically fulfill SingSaver’s qualifying spend of S$800 within 30 days of card approval if you are new Cardholder.

- Remember to fill up the SingSaver form + provide marketing consent to HSBC and maintain it till gift fulfilment.

- For Existing Cardholders:

- Just fulfill the below scenarios.

| Scenario | Gifts for New Cardholders | Gifts for Existing Cardholders |

|---|---|---|

| Apply a credit card and make 10 transactions within 30 days that amounts to a total of S$1,800 spend + register with the code: SPIN | Choice of Singsaver Gift + 2x Sure-Win Spins | 2x Sure-Win Spins |

| Apply a credit card and make 10 transactions within 30 days that amounts to a total of S$3,600 spend + register with the code: SPIN | Choice of SingSaver Gift + 3x Sure-Win Spins | 3x Sure-Win Spins |

| Apply a credit card and make 10 transactions within 30 days that amounts to a total of S$5,000 spend + register with the code: SPIN | Choice of SingSaver Gift + 3x Sure-Win Spins + S$200 GrabGift Voucher | 3x Sure-Win Spins + S$200 GrabGift Voucher |

Note: During fulfillment, eligible cardholders will receive an SMS with a unique spin code by 29 May 2025.

Apply Below:

Final Thoughts:

This is a rare deal for HSBC where they offer rewards for both new and existing cardholders. With the ability to triple dip before 26 Jan, this is a great time for those who are new to HSBC to take advantage of the offer.

💳 Credit cards change their T&Cs every so often and it is difficult to stay updated. That’s why I created a Telegram Broadcast where you can receive timely bite-sized updates to get the most out of your spending.

💡 We believe in always paying our credit card bills on time and in full. It is only by doing that, can we fully maximise our credit card benefits.