From 3 March (5PM) until 31 March 2025, for every product you apply for, you’ll score a spin on the Madness Wheel – Yes, you’ll get this on top of the Singsaver exclusive deals!

Eligible Participants Must:

- Be a Resident of Singapore (including Singaporeans, PRs, & Foreigners with Employment Passes, S Passes, or work permit) aged 21 or above.

- Be a new-to-bank cardholder (for credit card application)

- Consent to receive direct marketing messages from Singsaver

- Have the application approved by the product provider with final and unconditional approval

How It Works:

- Apply for an eligible product from 3 March (5PM) until 31 March 2025 (11:59PM)

- Make sure to meet the spend requirements – some rewards may require you to hit a minimum spend, as per the participating banks’ terms.

- Secure your Rewards by submitting the Singsaver Reward Redemption form within 14 days after completing the application

- Once you submit the reward form, you’ll be eligible for a 1x wheel spin — your prize is randomly selected when you spin.

- Eligible participants can spin the Madness Wheel only between 3 March and 7 April 2025.

What You Can Potentially Win From The Madness Wheel:

- 50% of monthly salary; capped at S$2,500 (to be distributed via PayNow);

- 1x SK Jewellery Roly Poly God of Wealth Figurine (Gold Bar);

- 1x SK Jewellery Smooth Sailing 999 Pure Gold Bar Figurine (Gold Bar);

- 1x SK Jewellery Fortune Bag 999 Pure Gold Coin Angpow (Gold Bar);

- 2D/1N Stay with Compass Hospitality Hotels;

- Amara Sanctuary Hotel Dining, Cartimes Autorent, Chrysalis Spa, SK Jewellery or Under Amour Voucher

- 388 HeyMax Max Miles; or

- S$5 off discount code for purchasing Travel Insurance products—only applicable for Starr, MSIG, Allianz and HLAS (Single Trip & Annual Trip) and Zurich (Single Trip) from SingSaver Insurance Brokers, with a minimum premium of at least S$33.

Participating Credit Cards

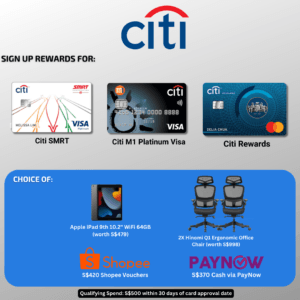

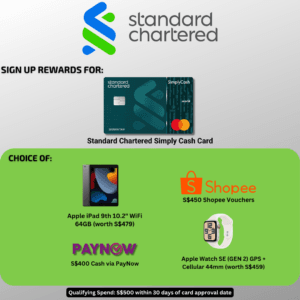

Although you have the opportunity to win prizes from the spin, some of the prizes are not really prizes but baits to get you to spend at the merchants. So it is better to just base your decision on the actual sign-up gifts that you can choose from. Note that the promo may end early when gifts run out. So you should always check the gifts available to you at time of sign up at the red box section (as shown in the example below)

Singsaver Rewards:

- All Gifts are valid for New-to-bank Credit Cardholders only.

Citibank:

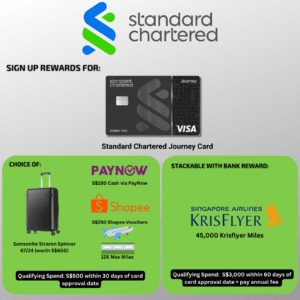

Standard Chartered:

HSBC:

CIMB:

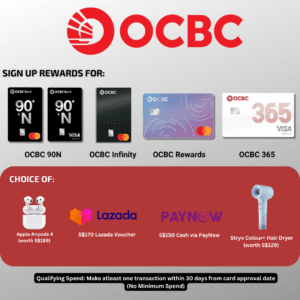

OCBC:

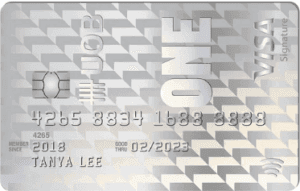

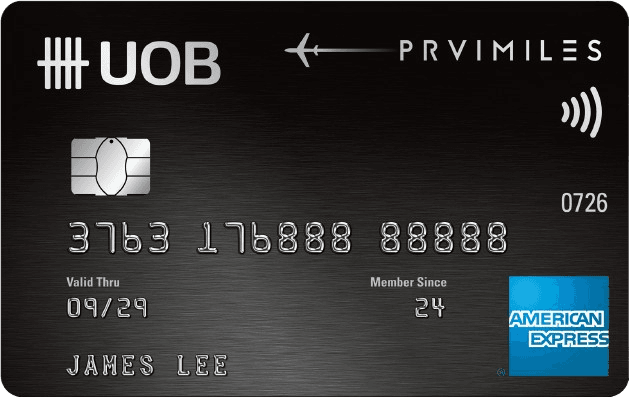

UOB:

UOB Cards | Direct Bank Rewards |

S$350 Cashback (only for first 200 customers) Minimum Spend: S$1,000 per month for 2 consecutive months from card approval date | |

Receive up to 58,000 Miles which consists of: (1) 20,000 Miles: SMS PMAF‹space›last 4 alphanumeric of NRIC/passport registered with UOB to 77862 to register by 28th February 2025 (2) 26,000 Miles: Min. S$2,000 spend per month for 2 consecutive months from card approval date + first year annual fee payment of S$261.60 (inclusive of 9% GST) (3) 5,600 to 12,000 miles: Min. spend of S$2,000 per month for 2 consecutive months based on *local or overseas earn rate *Local Spends: 1.4 miles per dollar; Overseas Spends: 3 miles per dollar | |

Participating Travel Insurance:

- Be a Resident of Singapore (including Singaporeans, PRs, & Foreigners with Employment Passes, S Passes, or work permit) aged 21 or above.

- Must start and submit an application to an eligible product during promotion period

- Consent to receive direct marketing messages from Singsaver

- Secure your Rewards by submitting the Singsaver Reward Redemption form within 14 days after completing the application (except Starr, MSIG and Allianz where this is not required)

- Have the application approved by the product provider with final and unconditional approval

- Please click on the promo and apply after the date and time stated.

- This is a great opportunity to purchase a plan for your upcoming trip.

- You are able to combine purchase for you and your travel buddies in a single transaction to hit the minimum spend criteria per basket.

- If you refund after you have purchased your plan, you will not be eligible for the rewards.

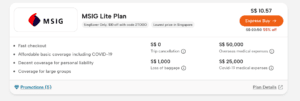

You can verify the promotions under “Promotions” on the bottom left corner of each insurance as well as read the policy on the bottom right corner to ensure promotion validity at time of application.

Be among the first 10 at 7PM daily to purchase the eligible travel insurance below & score an extra 5xS$10 Shopee voucher. There is no min. spend required, but you do need to enter your email address here and click send at 7pm SHARP to increase your chances of winning & quickly check out. Ideally, you should already decide which policy you want, such that you can just go ahead to proceed with the purchase at 7pm.

- Flash Deal only applies to Eligible Single & Annual Travel Insurance from:

- Starr

- Singlife

- MSIG

- Allianz

- Income

- Direct Asia

Terms And Conditions

Conclusion:

From 3 March to 31 March 2025, every eligible application gets you 1x spin on the Madness Wheel on top of exclusive credit card rewards & travel insurance! The more you apply, the more spins you earn—maximizing your chances of scoring amazing prizes!