Maybank XL Rewards/Cashback Card

Earn 4 miles per dollar (Rewards Card) or 5% cashback (Cashback Card) on bonus categories

Maybank XL Rewards/Cashback Card Overview:

- The Maybank XL Rewards and XL Cashback Cards are basically the rebranded version of the old Maybank DUO Platinum Mastercard—same solid perks, for the 21 to 39 y/o age-range, these cards give you up to 4 miles per dollar or 5% cashback on bonus categories like dining, shopping, travel, and play—perfect if your lifestyle’s a little bit of everything.

- If you want miles, you can choose Maybank XL Rewards and if you want cashback, choose Maybank XL Cashback.

Eligibility & Fees:

- Minimum Age: 21 to 39 years old

- Minimum Annual Income: S$30,000 (Singaporeans/PRs), S$45,000 (Malaysian), S$60,000 (Foreigners)

- Annual Fee: S$87.20 (waived for the first 2 years), can be waived when you perform an annual spend of S$6,000

Key Benefits:

-

Maybank XL Rewards:

-

Earn 4 miles per dollar on bonus categories such as

-

Local currency spend: dining, travel, shopping, play

-

All foreign currency spending

-

-

Earn 0.4 miles per dollar on other spends

-

Minimum spend of S$500 and a spending cap of S$1,000 per calendar month

-

-

Maybank XL Cashback:

-

Earn 5% cashback on bonus categories such as

-

Local currency spend: dining, travel, shopping, play

-

All foreign currency spending

-

-

Earn 0.2% cashback on other spends

-

Minimum spend of S$500, spending capped at S$1,600; cashback capped at S$80 per calendar month. Yes, the spending cap is higher than the miles version.

-

Only for Maybank XL Cashback card— Cardmembers who hold a Maybank DUO Platinum Mastercard before 1 August 2025 will receive 5% cashback on petrol transactions in Singapore and Malaysia, with no minimum spend required, as long as their card account is in good standing.

-

Eligible petrol transactions include those made at petrol stations classified under MCC 5541 and 5542, as well as fuel purchases charged to a Diamond Sky Fuel Card (linked to the Mastercard) under MCC 8699.

-

-

How to Best Optimise it:

Best Used for Bonus Category Spend Only

- Use for local currency spend under bonus categories: Dine, Shop, Travel, and Play

- Use for all foreign currency spend, including hospital bills, education fees, and utilities (excluding insurance—see “What To Avoid”)

- You’ll earn either 4 mpd (miles per dollar) up to S$1,000/month, or 5% cashback up to S$1,600/month. Once you exceed the cap or spend outside bonus categories, switch to another card.

Category | MCC | Description |

Dine | 5811, 5812, 5814 and 5462 | Caterers, Restaurant Dining, Fast Food Eateries, Bakeries, Food Deliveries locally |

Shop | 5262, 5310, 5311, 5331, 5399, 5621, 5631, 5651, 5655, 5661, 5691, 5699 and 5941 | Apparels, Departmental Store, Sports/Riding Apparels Stores, Sporting Goods Stores, Paid Television, Cable and Radio Services locally |

Travel | 3000 – 3299, 3300 – 3308, 4511, 4722, 7011 | Airlines, Lodging, Travel Agencies locally |

Play | 4899, 5813, 5815, 7832, 7993 and 7994 | Bars, Drinking Places, Cable Television Service, Cinemas, Motion Picture Theatres, Theatrical Producers, Ticketing Agencies, Video Amusement Game, Video Game Arcade locally |

Foreign Spend (subject to 3.25% fx fee) Read “Any Hacks/Promo” for available hack | All foreign spends except those in the exclusion list | Transactions spent overseas in store and online (including e-commerce transactions) as long as it’s spent in foreign currency |

Can be Used on Etiqa Insurance Payments

- You can also earn 0.4 miles per dollar or 0.2% cashback when you charge your Etiqa insurance transactions on your card, coded under MCC 6300 with merchant description “ETIQA”

Best for Months with High Bonus Category Spend

- You don’t need to hit the S$500 minimum spend every month. Use the card when you know you’ll be spending more on bonus categories—like travel, dining, shopping, or entertainment. It’s most effective when your spending lines up with what earns rewards like months when you have those upcoming large travel spending

Can Be Used on HeyMax to Hit Minimum Spend

- If you’re short of the S$500 monthly eligible spend, regular supermarket or off-category purchases won’t count unless they’re tagged under the qualifying MCCs: SHOP, DINE, TRAVEL, PLAY, or all foreign currency transactions. One workaround is using HeyMax to buy vouchers for places like NTUC or Sheng Shiong. HeyMax is classified under MCC 5311 (Department Stores), so purchases made there qualify under SHOP. You’ll hit the spend threshold and earn Max Miles at the same time.

- New user? Signing up with HeyMax first here gives you 200 Max Miles to start.

Any Hacks/Promos:

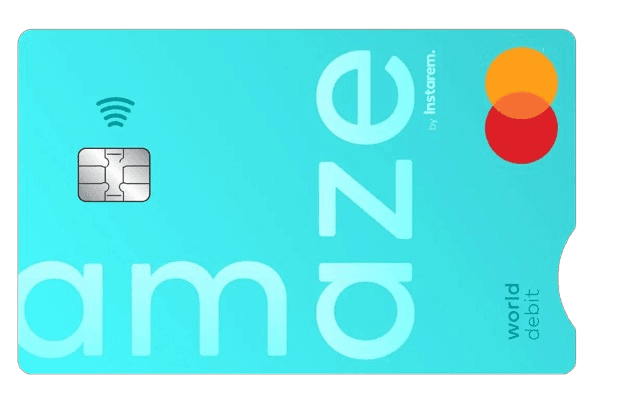

- For overseas spend in bonus categories (Dine, Shop, Travel, Play), link your card to an Instarem amaze card. This bypasses the usual 3.25% foreign exchange fee, bringing it down to a 2–2.1% fx spread.

- Just note: avoid using amaze for foreign currency transactions outside those categories, or you won’t earn bonus rates.

Instarem Amaze

Use Code: Ac6aso

Instarem Amaze card is a payment processor in the form of a physical card that helps you consolidate multiple cards

What to Avoid:

Exclusion List:

- NETS and eNETS transactions;

- Payments made to government or government institutions, agencies or companies or for government institutions or statutory boards or for government or government-related services (e.g. court cases, fees, fines, bail and bonds, tax payments, postal services, parking lots and garages, intra-government purchases or any other government services not classified here);

- Betting or gambling transactions;

- Brokerage/securities transactions;

- Charitable, Religious and Political Organisations;

- Payment to insurance companies or for insurance premiums, excluding Etiqa Insurance;

- Transactions classified under the following Merchant Category Codes (“MCC”):

- MCC 6012 – Financial Institutions – Merchandise, Services, and Debt Repayment

- MCC 6051 – Non-Financial Institutions – Foreign Currency, Non-Fiat Currency (including but not limited to Cryptocurrency), Money Orders, Account Funding (not Stored Value Load), Travelers Cheques, and Debt Repayment

- MCC 6540 – Non-Financial Institutions (Stored Value Card Purchase/Load (including but not limited to Grab mobile wallet topups));

- Transactions made via AXS or SAM;

- FlexiCash, FlexiPay, 0% Interest Instalment Plans, funds transfers, cash advances, finance charges, late payment charges, annual fees, reversals, interest charges, or any other miscellaneous charges charged to the cardmember

- Payment of funds to prepaid accounts such as those listed below (the following list is not exhaustive and Maybank reserves the right to amend the list from time to time without giving prior notice or reason to any party):

- EZ LINK PTE LTD (FEVO)

- EZ Link

- EZ-LINK*

- EZLINK

- EZ-Link

- EzLink

- EZLINKS.COM

- EZ Link transport

- EZ-LINK (IMAGINE CARD)

- EZ-Link EZ-Reload (ATU)

- BANC DE BINARY

- BANCDEBINARY.COM

- Flashpay ATU

- MB * MONEYBOOKERS.COM

- NETS VCASHCARD

- OANDA ASIA PAC*

- PAYPAL* BIZCONSULTA

- PAYPAL* CAPITALROYA

- SNACK BY INCOME

- SKRSkrill.com

- SKRxglobalmarkets.com*

- SKYFX.COM*

- TRANSIT*

- TRANSITLINK*

- TRANSIT LINK*

- WWW.IGMARKETS.COM.SG

- WWW.PLUS500.CO.UK

- WWW.MYEZLINK.COM.SG

- YOUTRIP*

Is it Worth it:

Advantages:

- One of the few that gives high cashback/miles on travel-related spends

- Wide category options that covers most spending

Disadvantages:

- Has age restrictions, only below 40 years old can avail of this card

Transfer Partners:

Here is the list of their current transfer partners:

Transfer Partners | Conversion Ratio |

Krisflyer | 25,000:10,000 |

Cathay Pacific Asia Miles | 12,500:5,000 |

Malaysia Airlines Enrich | 12,500:5,000 |

AirAsia a rewards | 4,000:2,000 |

Frequently Asked Questions:

- When will my miles/cashback be credited:

- Miles – Miles will be credited in the form of TREATS points and will be credited by the end of the next calendar month. TREATS Points will be awarded for every block of S$5 spent per transaction, rounded down.

- Cashback – Cashback will be credited by the end of the next calendar month

- Do TREATS point pool with other cards?

- Yes, as long as it’s a Maybank miles-earning card

- If I already own a Maybank DUO Platinum card, can I bypass the age limit requirement?

- Yes, if you own a Maybank DUO Platinum card, it will automatically be replaced with the Maybank XL Cashback card regardless of your age.

Additional Resources:

Read Terms & Conditions:

How to Maximise Your Sign-Up Rewards as a New-to-Bank Credit Cardholder

If you’re eyeing the XL series from Maybank, timing and card sequencing are everything. Here’s how to make your application count:

Step 1: Choose the Right “First” Card

- If you’re planning to apply for the XL Cashback Card: Start with the Maybank Family & Friends Card.

- If you’re going for the XL Rewards Card: Begin with the Maybank World Mastercard.

Starting with either of these opens the door to better sign-up rewards and sets you up for complementary benefits down the line.

Step 2: Qualify for the Samsonite Luggage Gift

- After your first card is approved, spend at least S$1,300 on eligible transactions within two months to receive: 1 Samsonite ENOW Spinner 69/25 (worth S$570)

Pro tip for lower spend:

- Apply for CreditAble – Personal Line of Credit alongside your card (you don’t need to use it). This reduces the minimum qualifying spend to S$1,200.

Step 3: Apply for the XL Card

- Once you’ve unlocked the Samsonite reward, apply for the XL card of your choice. This gives you: 12 months of Complimentary Etiqa Trip XpLorer Protect Travel Insurance for first 12,000 card applicants.

Step 4: Fill Up Google Form

- I have encountered times where the banks have not paid out the sign up bonuses to those who signed up. This form is only for the purpose of tracking for Maybank credit card promotion. As this is a referral program, filling up this form HERE after your application can help track!

Why You Shouldn’t Apply for the XL Card First

If you lead with the XL card instead:

- You only get S$60 cashback—and that’s if you’re among the first 2,000 sign-ups (there’s no way to confirm).

- After that? Just S$10 cashback.

Starting with Family & Friends not only boosts your rewards, but it pairs beautifully with your XL Cashback Card for everyday spending.

And starting with World Mastercard gives you the Rewards Infinite membership—which means your miles never expire.

Final Thoughts:

- The newly-launched Maybank XL Rewards and Cashback Cards can be a solid option if your spending aligns with their bonus categories like dining, shopping, travel, entertainment, and all foreign currency with the minimum spending requirement. It’s also notable for being one of the few cards that still offer miles or cashback on travel-related expenses, which adds real value. That said, the age restriction of 21 to 39 years old may seem overly limiting, especially for those beyond the age requirement who might also benefit from its perks. Still, it remains a well-rounded card with strong benefits overall.

💳 Credit cards change their T&Cs every so often and it is difficult to stay updated. That’s why I created a Telegram Broadcast where you can receive timely bite-sized updates to get the most out of your spending.

💡 We believe in always paying our credit card bills on time and in full. It is only by doing that, can we fully maximise our credit card benefits.