From 12 February to 2 April 2025, YouTrip is offering S$100 OFF and up to 17% upsized cashback (with no cap) every Travel Wednesday. Mark your calendars for these dates:

- 12 Feb, 19 Feb, 26 Feb, 5 Mar, 12 Mar, 19 Mar, 26 Mar, 2 Apr 2025

What is YouTrip Travel Wednesdays?

YouTrip Travel Wednesdays is a limited-time promotion that lets YouTrip users enjoy exclusive savings on their travel bookings. Whether you’re booking hotels, flights, or activities, you can get instant discounts and cashback when making your payment via YouTrip.

This works similarly to cashback platforms like Azgo or ShopBack, but now it’s all within the YouTrip app!

Don’t have Youtrip?

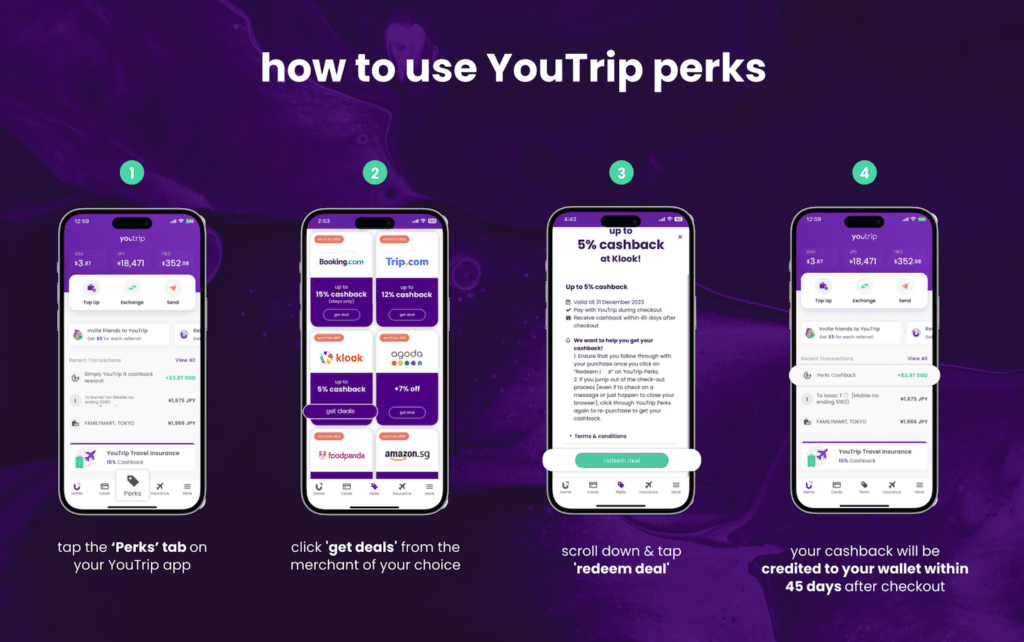

How to Redeem YouTrip Perks

Unlocking these exclusive deals is super simple!

- Open Your YouTrip App and go to the ‘Perks’ tab.

- Click ‘Get Deals’ and select your preferred travel brand.

- Click ‘Redeem Deal’ and complete your booking immediately after clicking.

- Pay with Your YouTrip Card! Cashback will be credited to your wallet within 45 days. (I don’t see a way to verify this and so you just have to cross your finger and trust?)

Important: If you leave checkout for any reason (like replying to a message), you must re-click through YouTrip Perks before making payment to ensure cashback is tracked.

Participation will be voided if the Participant exits the Merchant page after accessing it from YouTrip Perks or Perks (from the YouTrip app) or clicks on any external link or widget from the Merchant’s site

Purchase must be completed within the same window on the same day for successful participation.

Here’s the visual guide:

Can Your Cashback Be Tracked? Not Really…

Youtrip says that your cashback will be credited within 45 days of checkout. Please approach YouTrip if you do not see your cashback, but honestly, it’s all based on their system & the merchant’s tracking so you won’t really know for sure. The T&Cs are a bit thin and vague.

If you prefer a more sure way of earning your cashback, you can follow my Youtube guide to use Azgo instead.

Best Travel Platforms for this Deal (In Order Of My Preference)

But please be sure to check the prices quoted on a desktop version to ensure that you are getting the best rates:

As usual, I think Trip.com or Klook will possibly have better pricing than Agoda, Booking.com or Expedia. You can also verify the pricing you can get on Google flights or Google hotels to see if the prices are inflated when you use the app.

- Trip.com (My fav: I did a Tiktok Video on this)

- Klook

- Agoda

- Booking.com

- Expedia

Note: Vouchers are available in limited quantities on a first-come, first-served basis—act fast!

Extra Lobang Sis Strategy:

I usually book hotels with free cancellation because better deals often pop up later. This way, I have the flexibility to cancel my existing booking and switch to a better offer if it saves me more money! I will share these deals on my Telegram. Do subscribe!

1. Trip.com

Rewards:

- Upsized uncapped cashback of 17% on Hotels

- Upsized uncapped cashback of 11% on Flights

This is stackable with Vouchers:

One-time use per account during the promo.

Promo Code | Discount | Minimum Spend |

YTWEDH15 | S$15 OFF (HOTELS) | S$200 |

YTWEDH30 | S$30 OFF (HOTELS) | S$400 |

YTWEDF30 | S$30 OFF (FLIGHTS) | S$600 |

YTWEDF100 | S$100 OFF (FLIGHTS) | S$1,200 |

Steps to maximise your rewards:

1.Sign up for a Trip.com account here first to get Trip coins:

2. Access YouTrip perks via Youtrip App

3. Apply stackable code above.

4. Make payment with Youtrip card (yes, you will not be able to use your credit cards)

2. Klook

Rewards:

- Upsized uncapped cashback of 10% on Hotels

- Upsized uncapped cashback of 5% on Shinkansen Bookings

Get extra 5% using IJUSTTRYLAHKLOOK by adding it into your payment promo code

Note: Every Wednesday during the promotion period, Youtrip will also release 2 new promo codes are released at 12:00 AM at the “Perks” tab and remain valid until 11:59 PM on the same day.

Other T&Cs:

- Valid for Klook website & app bookings (excludes Agoda, Booking.com, Hotels.com).

- Not valid for Stay+ bundles, Pay at Pickup car rentals, travel insurance, and select activities.

- Not applicable for Apple Pay, Google Pay, or Samsung Pay.

Steps to maximise your rewards:

1.Sign up for a KLOOK account here first

2. Access YouTrip perks via Youtrip App

3. Apply stackable code above

4. Make payment with Youtrip card (yes, you will not be able to use your credit card

3. AGODA

- 7% off on Hotels

Meh, i’d skip cos I always find the prices inflated. But don’t take my word for it. You can go verify this.

4. BOOKING.COM

- Up to 15% Cashback on Hotels

Meh, i’d skip cos I always find the prices inflated. But don’t take my word for it. You can go verify thi

5. EXPEDIA

Promo Code | Discount | Cap | Travel Period |

YOUTRIP10 | 10% | S$45 | 1 Feb 2024 – 30 Jun 2025 |

YOUTRIP16 | 16% OFF (HOTELS) | S$50 | 5 Feb - 30 Jun 2025 |

For more information, make sure to read the Travel Wednesdays Terms and Conditions here

Conclusion:

This is a great time to book your flights and hotels and definitely an irresistible deal as compared to any 4 miles per dollar card. YouTrip’s Travel Wednesdays S$100 OFF and up to 17% upsized cashback on top travel platforms from 12 February to 2 April 2025! With limited stackable vouchers available on a first-come, first-served basis, I don’t see why anyone should sign up a YouTrip card and take advantage of this offer. However, these promotions come and go. Do join my telegram channel for the latest updates.

💳 Credit cards change their T&Cs every so often and it is difficult to stay updated. That’s why I created a Telegram Broadcast where you can receive timely bite-sized updates to get the most out of your spending.

💡 We believe in always paying our credit card bills on time and in full. It is only by doing that, can we fully maximise our credit card benefits.