From 23 January (12pm) to 27 January 2025, don’t miss your chance to bag an extra S$38 bonus cash reward, stacking up to an incredible S$408 cash reward in total! That’s right—on top of the usual S$370, you’re getting a little extra to sweeten the deal!

This exclusive offer is limited to the first 500 new-to-bank applicants daily, so act fast! Don’t worry if you miss the daily cap—the remaining applicants will still get S$370 cash.

But wait, there’s more! Take part in the Sure Win, Sure Huat promotion for a shot at winning up to S$8,888! This is on top of the Singsaver reward you chose.

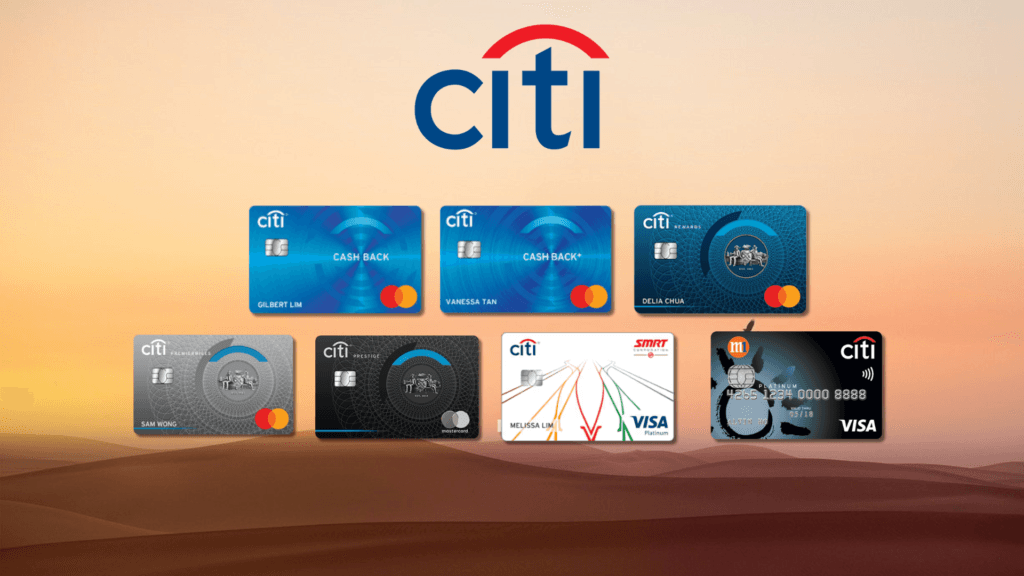

What Citibank defines as New Cardholder?

Customers who does not currently hold a Citibank credit card, has not had a Citibank credit card (as the main cardholder) closed within the past 12 months, and does not have a pending Citibank credit card application at the time of applying.

To be Eligible for this Reward:

- Must spend a minimum of S$500 on qualifying spends within 30 days of card approval

- Must be a new-to-Citibank credit cardholder at the time of application

- Submit the Rewards Redemption Form (by SingSaver), which will be sent to your registered email, within 14 days of applying for the card

Apply Below:

Tips to be first 500 applicants daily:

- This is based on the fastest fingers first! The first 500 applications resets each day at 12pm.

- Set an alarm and Click on the apply button below at 12pm sharp. Do not click before the time!

Here’s the Rewards:

1. Singsaver Sign Up Offer for New-to-Citibank Cardholders:

Read Terms and Conditions here

2. Sure Win, Sure Huat Promotion

- You can get 1x Red Packet worth up to S$8,888 when you apply for a Citibank credit card

- Valid for New-to-Bank Citibank Cardholders only

- This reward will be received on top of existing SingSaver rewards

- Read Terms and Conditions here

- Valid until 26 January 2025

Top Recommended Card: Citi Rewards Card

- I choose the Citi Rewards Card because it’s the best card for earning miles. I can rack up 4 miles per dollar on eligible spends making it easy to maximize my miles. Plus, you can pair it with the Amaze card to earn 4 miles per dollar on almost everywhere as it converts everything from offline to online! From my personal experience, I earn 4 miles per dollar on many purchases that other cards typically exclude, such as Google Ads, TCM, and doctor’s visits. This advantage really makes the Citi Rewards Card stand out as the top choice above all others. Watch my tiktok video for more details!

Apply Below:

Promo Details:

-

Get up to S$288 worth of gifts

-

50 units of SPDR Straits Times Index ETF (SGX:ES3) worth S$198 + S$60 cashback.

- Additional S$30 when you apply through my exclusive link

-

-

How to qualify:

-

Apply for a Bonus$aver Account and Bonus$aver World Mastercard Credit Card (as main account/principal cardholder).

-

Deposit S$50,000 fresh funds.

-

Keep the deposit until the end of the calendar month after account opening.

- You must also open or have a valid Standard Chartered Online Trading account. This is necessary since this is where the ETF shares will be credited.

-

-

Who can apply:

-

New Bonus$aver accountholders, or existing Standard Chartered customers who don’t have a Bonus$aver account yet.

-

-

Valid from 28 July – 31 August 2025.

- Read Terms and Conditions here

Additional Tips to Maximise Sign Up Gifts:

-

Apply for a Standard Chartered credit card first (with sign-up bonus) before joining this promo. I personally recommend these two:

Final Thoughts:

Don’t let this amazing opportunity slip away! With a total of S$408 cash rewards up for grabs + you have the option to choose from other exciting gifts to suit your preference—this is definitely the perfect time to start your year right! Plus, take advantage of the Sure Win, Sure Huat promotion to earn up to S$8,888 on top of your chosen Singsaver reward!

Remember, this exclusive offer runs only from 23 January (12pm) to 27 January 2025 and is limited to the first 500 new-to-bank applicants daily. So apply now!

💳 Credit cards change their T&Cs every so often and it is difficult to stay updated. That’s why I created a Telegram Broadcast where you can receive timely bite-sized updates to get the most out of your spending.

💡 We believe in always paying our credit card bills on time and in full. It is only by doing that, can we fully maximise our credit card benefits.