CFDs (Contracts for Difference) are widely marketed as an easy way to trade global markets with small capital. In Singapore, they’re legal, accessible but not widely understood by retail investors. Before you place your first trade, here’s what you need to know. This is not a sponsored post or an endorsement to buy/sell/hold CFDs.

What Is a CFD (Contract for Difference)?

A Contract for Difference (CFD) is a financial derivative where you:

- Do not own the underlying asset

- Trade based on price movement only

- Profit if the price moves in your favour, lose if it doesn’t

Example:

- If you trade a CFD on NVDIA, you don’t own the shares

- You’re simply betting on whether the price goes up or down

CFDs are short-term tools and require careful planning.

What Can You Trade as CFDs in Singapore?

Most CFD platforms in Singapore offer access to:

- SGX-listed shares (e.g. DBS, OCBC)

- US stocks and indices (S&P 500, Nasdaq)

- Forex (USD/SGD, EUR/USD)

- Commodities (Gold, Oil)

- Crypto CFDs (depending on broker)

This global access is a major reason CFDs appeal to local retail traders.

How Leverage Works in CFD Trading

CFDs are leveraged products, meaning:

- You can control a large position with a small amount of capital

- Leverage amplifies both gains and losses

- A small price move can result in a large profit or loss

Example:

- With 1:10 or 10x leverage, a 1% market move becomes a 10% gain or loss

- With 1:5 or 5x leverage, a 1% market move becomes a 5% gain or loss

If losses increase:

- You may receive a margin call (when your broker tells you to add more money or they will sell your investments because your losses fell below the minimum requirement)

- Your broker may close your position automatically if you do not top up in time and you may lose your entire capital (which is also known as liquidation)

This is why CFDs are considered high risk.

Morever, risk is not just about leverage. Things like market volatility, liquidity (how easily you can exit a trade), and broker solvency (counterparty risk) can all impact your results.

Costs You Must Understand Before Trading CFDs

CFD trading involves costs beyond profits and losses:

- Spread – the difference between buy and sell price (This is similar to what your money changers earn)

- Overnight financing fees for holding positions (This refers to interest charged to you by a broker for holding a leveraged trading position (like CFDs or Forex) open past the end of the trading day.)

- FX conversion costs for SGD-based accounts

- Commissions, depending on the broker

Note: “Zero commission” does not mean zero cost, these fees can eat into profits.

How CFD Trading Is Regulated in Singapore

CFD trading falls under the oversight of the Monetary Authority of Singapore (MAS).

This means:

- Risk disclosures are mandatory

- Leverage limits apply to retail traders

- Brokers must meet regulatory standards

Not all platforms available in Singapore are MAS-regulated. Always check a broker’s licence before trading.

Who Should (and Should NOT) Trade CFDs

CFDs may be suitable for:

- Experienced traders

- Short-term trading strategies

- Traders who understand leverage and risk

CFDs are generally not suitable for:

- Long-term investors

- Beginners learning market basics

- Anyone who cannot afford to lose capital

Most retail CFD traders lose money, often because they underestimate costs, overuse leverage, or fail to set realistic expectations. Beginners should understand that consistent profitability takes time, discipline, and practice; CFDs are not a guaranteed income source.

Common CFD Mistakes Singapore Beginners Make

CFD trading can be quite challenging for beginners. The most frequent beginner mistakes are:

- Using excessive leverage because it is available

- Holding CFD trades longer than intended

- Ignoring overnight fees and FX costs

- Trading without a clear plan

- Following Telegram or social media “signals”

Take note that even small mistakes can compound quickly due to the nature of leveraged trading.

Tax Considerations for CFD Traders in Singapore

- Singapore has no capital gains tax

- CFD profits may be taxable as income if trading is frequent

- Tax treatment depends on behaviour, not the product

- Keeping records of trades is important

Before You Place Your First CFD Trade

Ask yourself:

- Do I fully understand leverage, margin, and risk?

- Can I afford to lose this money?

- Do I know all the costs involved, including spreads and overnight fees?

- Is my broker properly regulated?

- Am I trading price movements or trying to invest?

- Do I have realistic expectations about profit and loss?

Which CFD Platforms Are MAS Regulated?

There are many CFD Platforms in the market, but Plus500 and eToro are the recent CFD platforms that I’ve shared on my platforms recently.

Plus500 is a specialized, commission-free, and CFD-only broker, offering leveraged derivatives on shares, forex, commodities, cryptocurrencies, and indices while eToro is a brokerage that includes stocks, ETFs as well as CFDs.

Here’s My Buy and Sell Test on Plus500:

(This MUST not be taken as an endorsement/indicator to buy/sell/hold crypto like BTC. I used it to test out purely due to the lower amount of leverage. Capital at risk. Crypto CFDs are high-risk speculative products and are not suitable for most retail investors.)

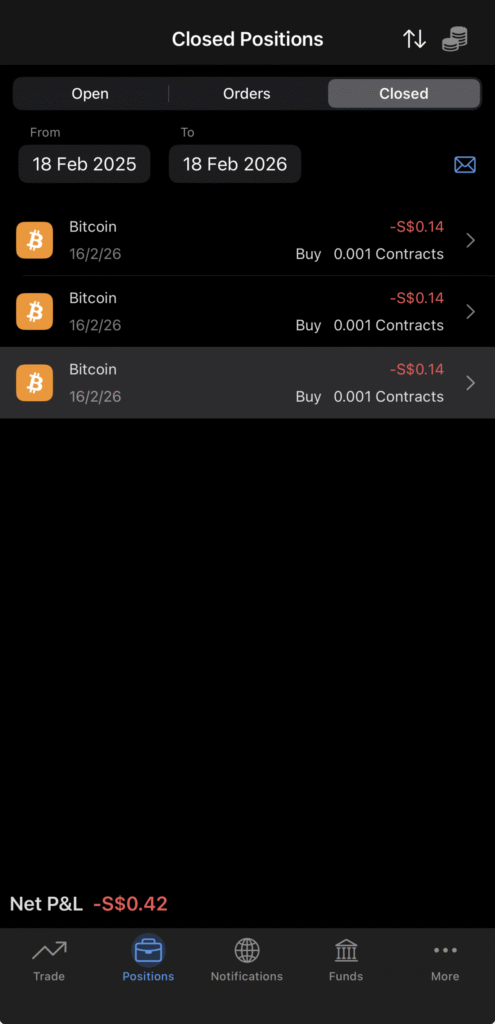

Below are three buy and sell trades I did with BTCUSD:

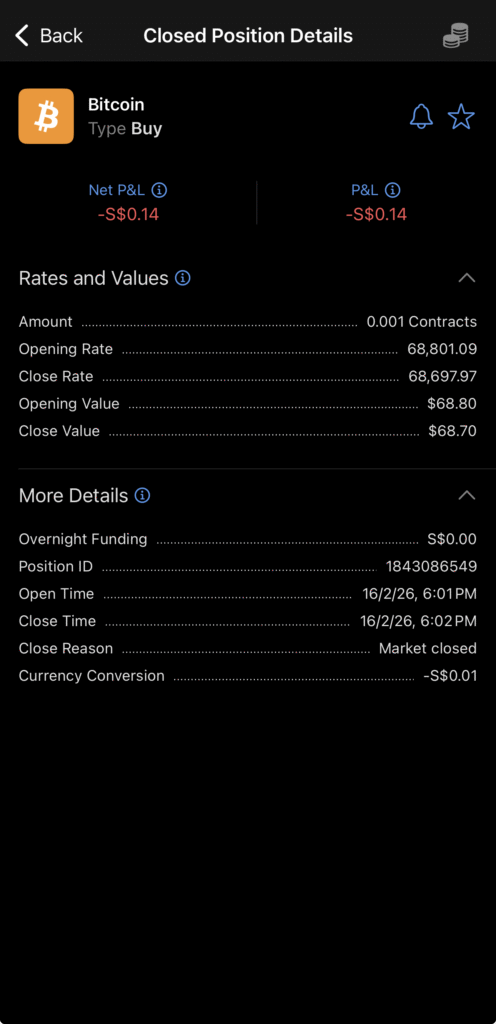

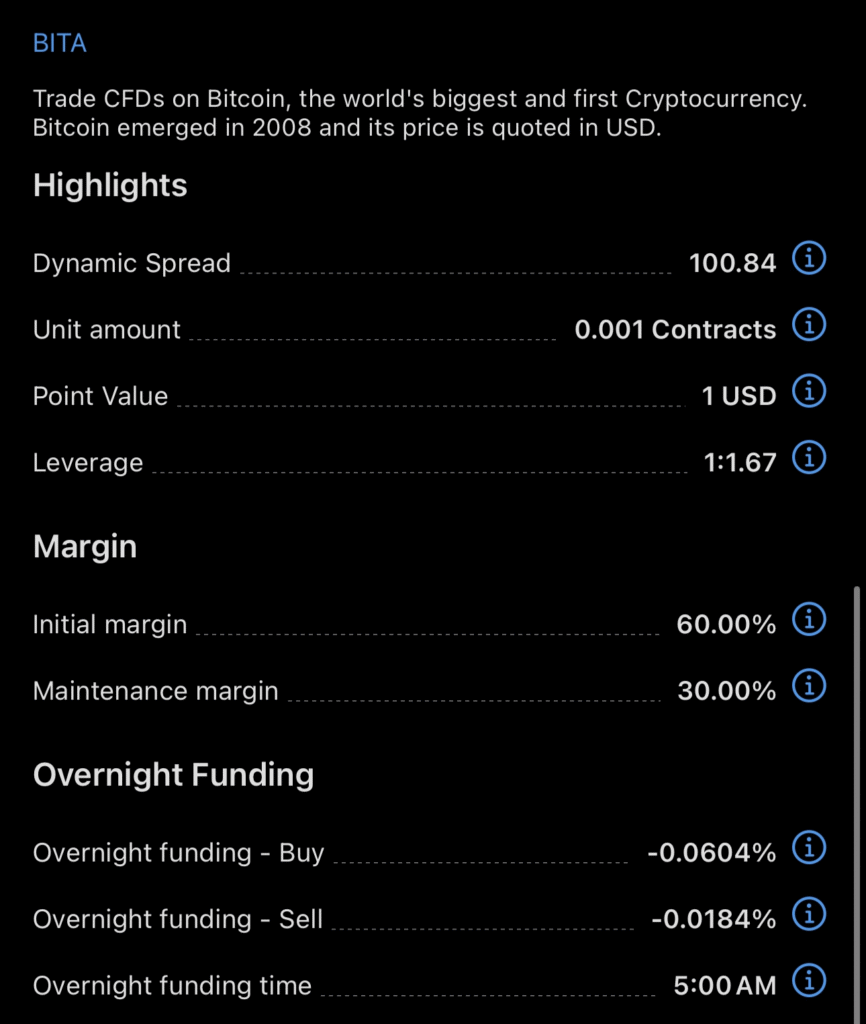

- I was only using it to test it out with the lowest amount of leverage (1:1.67). For every $1 of my own money, I control $1.67 worth of Bitcoin exposure.

- I picked a day and time where almost all the major markets were closed for least volatility.

- I opened and closed within seconds apart at the smallest possible order at 0.001 contracts.

- The lowest amount i can buy is 0.001 contracts of BTC, which is equivalent to $68.80. Since the leverage is 1:1.67, this means that I am using $41 of my own money to control $68.80 worth of BTC.

- In one of the trades, the price was open at the buy price of $68,801.09. After factoring in the spread and a slight movement in price to 68,697.97, the difference is -103.12 (which is a 0.1498% loss). This is equivalent to 103.12 × 0.001 contracts = $0.10312.

- So i lost $0.10312 but my capital used was $41, not $68. Therefore, my % loss on capital is 0.25% (due to leverage).

In conclusion,

- the buy and sell price had a -0.15% difference (for BTC). With 1:1.67 leverage, my loss became -0.25%.

That is exactly how leverage magnifies % profits or losses, with a smaller capital.

- You might be wondering, the net loss is $0.14, not $0.10312. Where is the $0.04 from? The additional $0.04 loss is likely due to currency conversion fee during the buy and sell trade. However, I’ve asked their 24/7 support team to verify this for my own curiosity. I will update here upon verification.

Final Thoughts

While CFDs offer flexibility and access to global markets, the use of leverage means all movements are amplified. So do take time to understand risk and cost.