If you shop online, book flights or hotels, or pay at certain stores, ShopBack is a platform that can put money back in your pocket — literally. Think of it as a rewards system that lets you earn cashback whenever you spend, without extra hassle.

What is ShopBack?

ShopBack is a cashback and rewards platform that pays you back a percentage of what you spend when you shop via its app, website, or browser extension.

- Works with thousands of partner merchants across shopping, travel, and food delivery.

- Includes ShopBack Pay, which lets you earn cashback when paying online or in-store at supported merchants.

How ShopBack Works

Online Shopping & Bookings

Start on ShopBack (app, website, or extension), click through to the merchant, and shop as usual. Cashback tracks automatically.

E-Vouchers & Store Credits

Buy gift cards or store credits via ShopBack and earn cashback upfront.

ShopBack Pay

ShopBack’s built-in payment feature lets you pay with linked cards or wallets (Visa, Mastercard, Apple Pay, Google Pay).

At participating merchants, you’ll earn instant cashback—sometimes via scratch cards—on top of your normal card rewards, allowing you to stack benefits beyond using your credit card alone.

New to ShopBack?

Sign up via this link and use code VUIsVg to get S$10 cashback with a min. S$20 spend (excludes ShopBack Play & Surveys)

What type of cards would be best for ShopBack Pay?

When you pay using ShopBack Pay, the Merchant Category Code (MCC) is inconsistent and unpredictable. It does not follow a fixed pattern, and the MCC can also differ depending on whether you use a Visa or Mastercard.

For example, a Nike purchase may be coded as 5812 (Eating Places and Restaurants) on a Visa card, but 5311 (Department Stores) on a Mastercard.

That said, here’s the important upside:

Even when the MCC is inaccurate, ShopBack Pay transactions are generally processed as online payments.

Why this matters:

- Many credit cards award higher rewards for online spend, allowing you to earn bonus miles or cashback even when paying in-store via ShopBack Pay.

- Some banks treat ShopBack Pay as an e-commerce transaction, which can help you qualify for online-spend milestones or promotional bonuses.

Bottom line:

Because the MCC is unreliable, the safest strategy is to use cards that earn miles or cashback on a broad definition of online transactions, rather than relying on specific MCCs.

Guide to link your cards correctly:

If you’re using a card that earns miles or cashback on online transactions, make sure it’s linked properly in ShopBack.

To have ShopBack Pay treated as online spend, link your credit or debit card directly instead of using Apple Pay.

Steps:

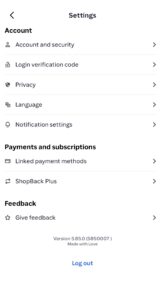

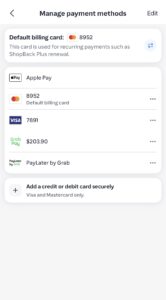

- Tap the gear icon (top left)

- Go to Payments & Subscriptions

- Select Linked Payment Methods

- Add your credit or debit card securely

Once added, your card (e.g. cards ending in 8952 or 7891) will be recognised as an online card payment, allowing you to earn miles or cashback where applicable.

Important:

If you’re using a card that earns rewards on Apple Pay / mobile contactless transactions, you can skip this setup and simply pay via Apple Pay. The transaction will be processed as mobile contactless instead.

Best Cards for Shopback

Below are cards you can consider for use with ShopBack. Be sure to check the Card Summary and full review to see which one best fits your spending pattern.

I also keep the latest sign-up deals updated under the “Sign-Up Deal” section. If you choose to apply, you can do so via the Apply Here buttons in this post — using these links helps support this site and allows me to continue publishing independent, unbiased reviews like this.

Cashback Cards:

Cards | Earn Rate | Minimum Spend and Cap | Notes |

OCBC Frank | 8% cashback | minimum spend S$800; capped at S$25 per month | both online or apple pay works |

UOB Evol | 6.36% effective cashback | minimum spend S$800; capped at S$30 per statement month | both online or apple pay works |

Citi SMRT | 5% savings on supermarkets & groceries, online spending, taxi rides (including private hire operators) and SimplyGo | minimum spend S$500 per statement month | only online works |

UOB One | 3.33% cashback | minimum spend of S$600, S$1,000, or S$2,000 depending on the tier; capped at S$60, S$100, or S$200 per quarter | must spend on 10 eligible transactions both online or apple pay works |

DCS Flex | 6% cash rebates | minimum spend of S$600; capped at S$25 per category | both online or apple pay works |

UOB Evol Card

Earn max possible 6.36% cashback on all online and mobile contactless spend and gym, telco, and streaming services

Citi SMRT Card

Earn 5% cashback on supermarkets, online shopping, taxi rides, and SimplyGo

UOB One Card

Earn at least up to 10% cashback on most local spend

DCS Flex Card

Earn up to 8% cash rebates (best value), 2.4 miles per dollar, or 8% investment credits

Miles Cards:

Cards | Earn Rate | Minimum Spend and Cap | Notes |

Citi Rewards | 4 miles per dollar | No minimum spend; capped at S$1,000 per statement month | only online works |

DBS Woman’s World Mastercard | 4 miles per dollar | No minimum spend; capped at S$1,000 per calendar month | only online works |

Citi Rewards Card

Earn 4 miles per dollar on online spend and selected retail

Conclusion:

ShopBack isn’t about changing how you spend — it’s about getting rewarded for spending you were already going to do anyway. Whether you’re shopping online, booking travel, or paying at participating stores, it adds an extra layer of cashback with very little effort.