Planning for your next trip? Until 30 April 2025, you can get up to S$100 Shopee Vouchers when you purchase any of the participating travel insurance!

Guidelines to take note:

- This is a great opportunity to purchase a plan for your upcoming trip.

- You are able to combine purchase for you and your travel buddies in a single transaction to hit the minimum spend criteria per basket.

- Remember to “Secure your Rewards” after you have applied to lock in your rewards. No form = No rewards.

- If you refund after you have purchased your plan, you will not be eligible for the rewards.

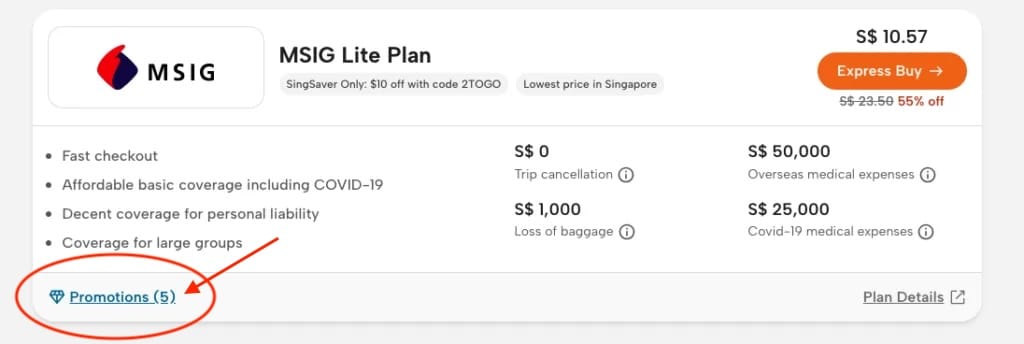

How to Verify the Promotions:

You can verify the promotions under “Promotions” on the bottom left corner of each insurance as well as read the policy on the bottom right corner to ensure promotion validity at time of application.

Ready to purchase some travel insurance?

Best Offer Based On Reward Value:

Single Trip Travel Insurance

-

Income Travel Insurance: Offers good coverage with the lowest minimum spend required of S$40 for a S$10 Shopee voucher.

-

FWD Travel Insurance: Provides adequate coverage with a hassle-free claims process and one of the cheapest premiums. However, a minimum spend of S$100 is required for a S$10 Shopee voucher.

Annual Travel Insurance

-

Singlife: Offers the largest Shopee voucher value of S$100 with a minimum spend of S$400, but limited to the first 50 customers.

-

Allianz: Has the same Shopee voucher value and minimum spend as Singlife, but only for the first 10 customers.

1. Income Insurance

- Best for High Altitude Trips up to 4,000 metres (Read Blog Here)

What You Can Receive:

Plan | Free Shopee Voucher Value | Min. spend (S$) | First X customers |

Single Trip | S$10 | 40 | 200 |

Promotion Period: 31 March (5:31PM) – 30 April (5:30PM) 2025

2. FWD:

- Best for trip disruption due to sudden onset of Pre-Existing Conditions (Read Blog Here)

- Best for straightforward and minimal coverage for Sports Equipment (Read Blog Here)

- Best for high altitude up to 3,000 metres (Read Blog Here)

What You Can Receive:

Free Shopee Voucher Value | Min. spend (S$) | First X customers |

S$10 | 100 | 100 |

S$20 | 150 | 80 |

S$40 | 200 | 50 |

Promotion Period: 31 March (05:31PM) – 30 April (5:30PM) 2025

3. Starr Insurance

What You Can Receive:

Plan | Free Shopee Voucher Value | Min. spend (S$) | First X customers |

Single Trip | S$10 | 80 | 160 |

Promotion Period: 1 – 30 April (5:30PM) 2025

4. Allianz Travel:

- Best for Pregnancy coverage within first 20 weeks (Read Blog Here)

What You Can Receive:

Plan | Free Shopee Voucher Value | Min. spend (S$) | First X customers |

Single Trip | S$10 | 100 | 100 |

Annual Trip | 10 x S$10 | 400 | 10 |

Promotion Period: 1 – 30 April (5:30PM) 2025

5. MSIG Insurance

- Best for Overseas Wedding Shoot (Read Blog Here)

- Best for Pregnancy Coverage with Pre-Ex Plan (Read Blog Here)

- Best for Higher Coverage for Golfing Equipment (Read Blog Here)

- Best for Adventurous Activities with Pre-Existing Condition Coverage (Read Blog Here)

What You Can Receive:

Free Shopee Voucher Value | Min. spend (S$) | First X customers |

S$10 | 100 | 200 |

2 x S$10 | 150 | 100 |

3x S$10 | 200 | 50 |

Promotion Period: 1 – 30 April (5:30PM) 2025

6. Singlife Insurance

- Best for Golf coverage as optional cover (Read Blog Here)

- Best for Wedding Shoot and Wedding Banquet (Read Blog Here)

- Best for emergency medical treatment for Pregnancy 12 weeks before the return date (Read Blog Here)

- Best for reimbursement of the full retail price of frequent flyer points (Read Blog Here)

What You Can Receive:

Plan | Free Shopee Voucher Value | Min. spend (S$) | First X customers |

Single Trip | 2 x S$10 | 150 | 150 |

Annual Trip | 10 x S$10 | 400 | 50 |

Promotion Period: 31 March (05:31PM) – 30 April (5:30PM) 2025

Conclusion:

These offers are available for a limited time only and are on a first-come, first-served basis! Promo may end early. The earlier you purchase according to the promotion period, the better your chances of getting the rewards.