I created this step by step guide for Singaporeans to help you figure out which credit card best fits your situation.

This is just a guide, not financial advice.

Watch Video:

How To Use This Guide:

Step 1: What Is Your Annual Income?

Your annual income determines the range of credit cards available to you. Cards with income requirements between S$30,000 and S$80,000 are generally accessible and often suitable for fresh graduates.

In contrast, cards with a S$120,000 annual income requirement have a strict eligibility rule—you must meet this income level to qualify. For cards with lower income thresholds, approval is typically more straightforward.

Step 2: What Is Your Monthly Spending?

Monthly spending refers to the regular expenses that can be charged to a credit card to earn rewards. This typically includes everyday purchases such as groceries, dining, shopping, and transport.

Certain payments—such as cash transactions, insurance premiums, AXS bills, e-wallet top-ups, or housing loan repayments—are generally not eligible for rewards and should not be included when assessing your spending.

If you occasionally pay on behalf of your company or friends, those charges can also be placed on your card, provided you are reimbursed afterwards.

Step 3: Choose Your Focus: Cashback or Miles?

The choice between cashback and miles shapes the type of rewards you will prioritise. Once you have a preference, review details such as sign-up promotions and the card’s key features to determine whether it aligns with your spending habits and financial goals.

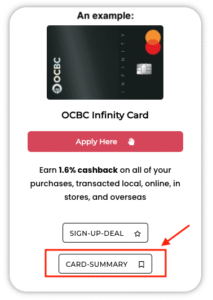

Step 4: Check the Card Summary

Each card comes with a “card summary” outlining its key features and benefits. Within the card summary, you can also refer to the accompanying review for a more detailed explanation and analysis.

Step 5: Check the current “Sign Up Deal”

Sign-up promotions can add significant value when choosing a credit card. Be sure to review the latest offers, which are regularly updated to reflect the best available deals.

Step 6: Apply for the Card

Once you have decided on a card, use the “Apply Here” link to submit your application. Make sure to meet the requirements stated in the sign-up deal, such as completing the minimum spend within the specified time frame, and remember to fill out any rewards redemption form (as shown in my guide to claiming your rewards) to ensure you receive the benefits. You can always ask a question in my telegram channel on the sign up process.

Now that the steps are clear, you can navigate through the stages by clicking on them, which will take you directly to the relevant section.

Step 1 & 2: What’s Your Annual Income & Monthly Spending?

Income Level A: S$30,000 – S$80,000

What’s your monthly spending?

Income Level B: S$80,000 – below S$120,000

What’s your monthly spending?

S$800+ per month (willing to hold cards with minimum monthly spend required) → Go to STAGE 2

No, prefer no minimum spend requirement → Stay in STAGE 1B

Income Level C: above S$120,000+

What’s your monthly spending?

S$800+ per month (willing to hold cards with minimum monthly spend required) → Go to STAGE 2

No, prefer no minimum spend requirements → Stay in STAGE 1B

Next Question: Are you willing to pay annual fees for premium perks?

STAGE 1A: Low Spending (Under S$800/month)

Recommended Priority: No minimum spend + Non-expiring rewards

Choose Your Focus:

Cashback Cards To Consider:

Recommended Card Strategy: Able to use one card spend to earn cashback + earn high interest on savings account

1. OCBC Infinity Cashback + OCBC 360 Account

(Great if you’re just starting out or unsure of your spending habits)

Reasons why this is my top pick:

OCBC Infinity Card

Earn 1.6% cashback on all of your purchases, transacted local, online, in stores, and overseas

OCBC 360 Account

Use Code: VHW8FDOS

Get competitive interest rates by crediting your salary, saving, or spending at least S$500 monthly.

2. UOB One Card + UOB One Account

(Best if you consistently spend ≥ S$500 monthly and hold ≥ S$150K in UOB One)

Reasons why this is my top pick:

✅ Same as OCBC. It rewards both spending + saving

⚠️ Requires minimum S$500 spend per month to unlock cashback.

💡 Similar to OCBC, insurance or utilities charged directly to the card (not via AXS) count toward the minimum spend requirement. If you are unsure whether you can hit min spend, go with OCBC infinity.

UOB One Card

Earn at least up to 10% cashback on most local spend

Aud’s note: I know I mentioned that, ideally at this stage, you’d want cashback cards with no minimum spend. But if you’re chasing the highest rewards with minimal requirements, the above two are still the best.

That said, if you prefer a pure no-minimum-spend cashback option, here’s one to consider:

DCS Ultimate Platinum Mastercard

(Perfect if you’re not pairing with any high-yield savings account)

DCS Ultimate Platinum Card

Earn 2% cashback on almost everything

Miles Cards To Consider:

Recommended Card Strategy: No min. spend with miles that don’t expire (crucial for low spenders)

Reasons why these are my top picks:

- 2 free lounge visits annually

- Easily waivable annual fee

DBS Altitude Card

Earn 1.3 miles per dollar on local spend and 2.2 miles per dollar on foreign currency spend

2 Priority Pass visits per membership year (Visa version only)

Citi PremierMiles Card

Earn 1.2 miles per dollar on local spend and 2.2 miles per dollar on foreign currency spend

2 Priority Pass visits per calendar year

✅ Action Steps if you are fresh graduate:

- Apply with your first payslip as income proof when they ask you to upload supporting documents (Don’t be afraid even if they ask for NOA or 3 months pay slip)

- Set up GIRO auto-payment immediately

- Track spending for awareness (not optimization)

- If you do cancel the card one day, remember to transfer the points out before cancelling

STAGE 1B: Higher Spending (S$800+/month)

Choose Your Focus:

Cashback Cards To Consider:

Recommended Card Strategy: Able to use one card spend to earn cashback + earn high interest on savings account

Same recommendations as Stage 1A, but you can also consider the below cards with S$800 minimum spends if the rewards justify increased effort on your part.

1. OCBC 365 Cashback + OCBC 360 Account

OCBC 365 Card

Earn 6% cashback on Petrol, 5% cashback on Dining, 3% cashback on Groceries, Land Transport, Streaming, Electric Vehicle Charging, Watsons, Utilities

OCBC 360 Account

Use Code: VHW8FDOS

Get competitive interest rates by crediting your salary, saving, or spending at least S$500 monthly.

2. UOB Evol + UOB One Account

UOB Evol Card

Earn max possible 6.36% cashback on all online and mobile contactless spend and gym, telco, and streaming services

Miles Cards To Consider:

Recommended Card Strategy: Willing to change spending patterns or go out of your way to maximise rewards

Same as Stage 1A cards, plus you can start considering:

DBS yuu Card (if you shop at yuu merchants) with min spend required of S$800

DBS yuu Card

Earn up to 18% cash rebate or 10 miles per dollar at yuu merchants

STAGE 2: Higher Spending of more than S$800-4000/month + Need Multiple Cards To Optimise

Choose Your Focus:

Cashback Cards To Consider:

Recommended Card Strategy: Use one card spend to earn cashback + earn high interest on savings account from Stage 1A or Stage 1B then switch to these cards below once you have hit the minimum spend required for those cards. Alternatively, if you are not pairing with a bank account, here are cards to consider.

High Cashback Cards (with Min. Spend Required Of S$600-800)

DCS Flex Card

Earn up to 8% cash rebates (best value), 2.4 miles per dollar, or 8% investment credits

Maybank Family & Friends Card

Earn 6% or 8% cashback for five of your chosen categories.

Miles Cards To Consider:

Recommended Card Strategy: Use cards from Stage 1A or Stage 1B then switch to these cards below once you have hit the minimum spend required (if any) for those cards. Alternatively, if you are not pairing with a bank account, here are cards to consider.

High Miles Cards (With Specialised Spending Category Or Requirement):

DBS yuu Card

Earn up to 18% cash rebate or 10 miles per dollar at yuu merchants

Maybank XL Rewards/Cashback Card

Earn 4 miles per dollar (Rewards Card) or 5% cashback (Cashback Card) on bonus categories

UOB Preferred Platinum Visa Card

Earn 4 miles per dollar on mobile contactless payments, online shopping, and entertainment

Citi Rewards Card

Earn 4 miles per dollar on online spend and selected retail

Action Steps:

Action Steps:

- Get annual fee waivers for all.

- 2-3 cards should be enough. Personally, I think Maybank XL Card (miles or cashback version) and Citi Rewards are must haves.

- Don’t spread across too many cards (you may not earn enough miles to transfer them out before they expire)

- Focus on your top 80% spending

STAGE 3: High Income Earners of more than S$120K annual income per year + willing to pay annual fee for benefits

Choose Your Focus:

Cashback Cards To Consider:

At this level, there are not much cashback cards to consider. You will have to combine all the cards that I have mentioned above (from Stage 1a to Stage 2) if you want optimisation.

Miles Cards To Consider:

DBS Vantage Card

Earn 1.5 miles per dollar (or 1.5% cashback) on local spend, 2.2 miles per dollar (or 2.2% cashback) on foreign currency spend

10 Priority Pass visits per membership year

Citi Prestige Card

Earn 1.3 miles per dollar on local spend and 2 miles per dollar on foreign currency spend

12 Priority Pass visits per calendar year

QUICK REFERENCE GUIDE

🚫 What to AVOID at Each Stage:

Stage 1: High annual fees, minimum spend requirements, specialty category cards

Stage 2: Too many cards (3+ creates tracking chaos), cards that don’t match your spending

Stage 3: Cards with benefits you won’t use, paying fees without justification

✅ Universal Best Practices:

- Always set up GIRO auto-payment (never miss payments)

- Track your spending to understand your 80% categories

- Start simple, add complexity gradually

- Annual fee waiver strategy: Most cards with S$197 annual fees are waivable – just ask

- Review annually or when income/spending changes significantly