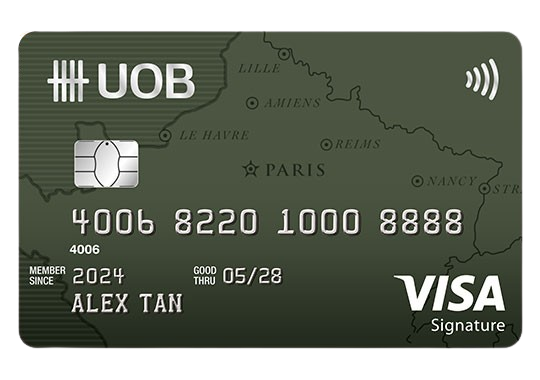

This card doesn’t offer any sign-up promotions. To make the most of your sign-up rewards, consider applying for the DBS Altitude card first. This is because you can combine points from both DBS cards, and the DBS Altitude card also includes two complimentary airport lounge passes.